Top Family Budget Tips to Save Money in 2025

Share

Unlocking Financial Freedom: Simple Budgeting for Families

Managing a family budget effectively is key to financial stability and achieving your goals. This listicle provides eight practical family budget tips to help you save more and gain control of your finances. Learn how to track expenses, utilize the 50/30/20 rule, build an emergency fund, implement zero-based budgeting, automate savings, use the envelope method, conduct regular budget reviews, and prioritize paying yourself first. These family budget tips will empower you to build a stronger financial future, whether you're saving for a down payment or simply seeking peace of mind.

1. Track Every Expense

One of the most fundamental, yet powerful, family budget tips is to track every single expense. This practice, the cornerstone of effective budgeting, provides complete visibility into your family's spending patterns, revealing where your money actually goes versus where you think it's going. By documenting every financial transaction, no matter how small – from that daily coffee to the monthly mortgage payment – you gain invaluable insights into your financial habits and identify areas for potential savings. This empowers you to make informed decisions about your family's finances and work towards achieving your financial goals. This is especially important for families, where multiple individuals may be contributing to and drawing from shared resources. Accurate expense tracking allows everyone to understand how their spending impacts the overall family budget.

Tracking every expense involves diligently recording all income and expenditures. This can be achieved through various methods, offering flexibility for different preferences and tech savviness. You can leverage digital tools like budgeting apps such as Mint or YNAB, which automatically categorize bank transactions, or maintain a manual system using a spreadsheet or notebook. Regardless of the chosen method, the key is consistent and comprehensive recording. Categorizing expenses—housing, groceries, transportation, entertainment, etc.—provides a structured view of spending allocation. Regular monitoring and review, ideally weekly or monthly, allow you to analyze trends and identify areas needing adjustment. This consistent process cultivates financial awareness and accountability within the family, leading to more conscious spending decisions.

There are numerous benefits to tracking every expense. It illuminates hidden spending patterns, such as recurring subscription fees or frequent impulse purchases, that might otherwise go unnoticed. This increased financial awareness helps identify unnecessary expenses and opportunities to cut back, freeing up funds for savings or debt reduction. The process also creates a sense of accountability for spending decisions, encouraging more thoughtful and responsible financial behavior. For example, the Johnson family, after diligently tracking their expenses for 30 days, discovered they were spending nearly $300 each month on coffee and takeout, a surprising amount that prompted them to adjust their habits and allocate those funds towards their vacation savings.

However, tracking every expense does come with its challenges. It can be time-consuming, especially in the initial stages of establishing the habit. It can also feel overwhelming for beginners, requiring a consistent level of discipline to maintain accurate records. For some, meticulously tracking expenses can induce anxiety about spending, highlighting areas of overspending and creating a sense of pressure. However, the long-term benefits of financial clarity and control far outweigh these initial hurdles.

To make the process easier, start with just one week of tracking to build the habit. Leverage technology by using smartphone apps for real-time expense logging, minimizing the effort required. When reviewing your spending, focus on weekly patterns rather than daily fluctuations to get a clearer picture of your habits. And to avoid losing those pesky paper receipts, take photos of them immediately after purchase.

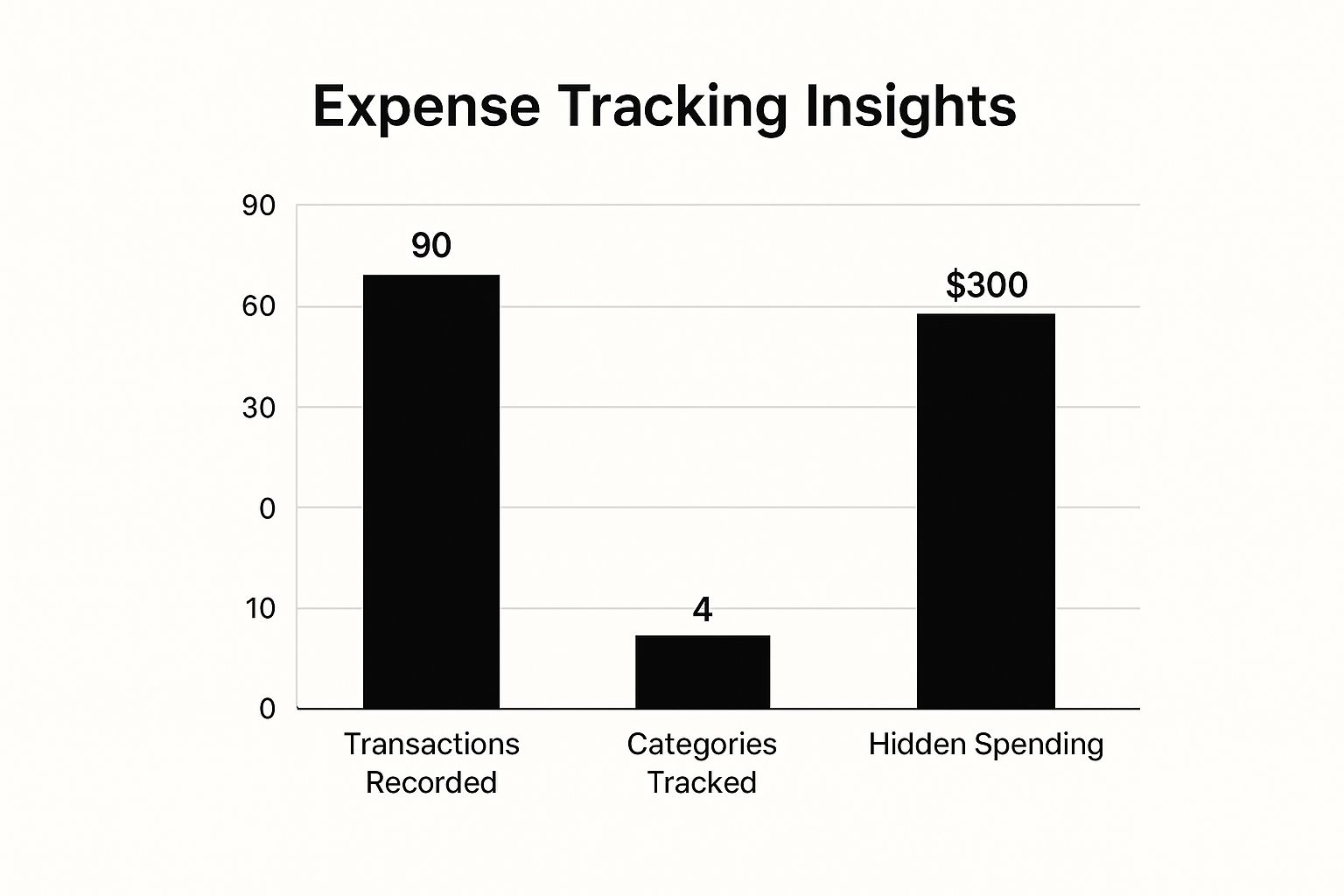

The infographic below visualizes some key data points highlighting the effectiveness of expense tracking. It shows the number of transactions recorded, the number of categories tracked, and the amount of hidden spending discovered.

As the 'Expense Tracking Insights' bar chart clearly demonstrates, by recording 90 transactions across 4 main categories, a surprising $300 in hidden spending was uncovered. This illustrates the potential for significant savings by simply becoming more aware of where your money is going.

Learn more about Track Every Expense

By embracing the practice of tracking every expense, families can gain a significant advantage in managing their finances effectively. It provides the foundation for creating a realistic budget, identifying areas for improvement, and achieving long-term financial stability. This essential family budget tip empowers you to take control of your money and work towards a more secure financial future.

2. Use the 50/30/20 Rule

Effectively managing a family budget can feel like a daunting task, but a simple framework like the 50/30/20 rule can provide much-needed structure and clarity. This budgeting method, popularized by Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi, offers a balanced approach to allocating your after-tax income without resorting to overly restrictive rules. It’s a powerful tool among the arsenal of family budget tips available, helping you prioritize spending and ensure your financial goals are within reach.

The 50/30/20 rule divides your after-tax income into three straightforward categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Let's break down each category:

-

50% for Needs: This encompasses your essential expenses, the non-negotiable costs required for daily living. This includes housing (rent or mortgage), groceries, utilities, transportation, health insurance, and childcare. Notice that this category is focused on needs, not necessarily everything you currently spend money on. A large cable package, for instance, might be a regular expense, but it falls under "wants," not "needs."

-

30% for Wants: This category covers discretionary spending, the things you enjoy but aren't essential for survival. This includes dining out, entertainment (movies, concerts, streaming subscriptions), hobbies, shopping, and vacations. This is where you have flexibility to personalize your budget and enjoy the fruits of your labor. The key is to stay within the allocated 30%.

-

20% for Savings and Debt Repayment: This portion is dedicated to building your financial future. This includes saving for emergencies, retirement, a down payment on a house, or paying down debt such as student loans, credit card balances, or car loans. Prioritizing this category helps you achieve long-term financial stability and security.

The 50/30/20 rule is incredibly scalable, working for a variety of income levels and family structures. Consider these examples:

- Family of Four Earning $6,000/month: Using the 50/30/20 rule, they would allocate $3,000 for needs, $1,800 for wants, and $1,200 for savings and debt repayment.

- Single Professional Saving for a Down Payment: By diligently following the rule and maximizing the 20% savings category, a single professional can accelerate their progress towards homeownership.

- Young Couple Paying off Debt: A young couple might choose to modify the rule to 60/20/20, allocating a larger portion of their income (60%) to needs while aggressively tackling their debt with the 20% allocated for savings and debt repayment.

While the 50/30/20 rule offers a helpful framework, it's important to acknowledge its limitations. It may not be feasible for very low incomes where essential expenses consume a significantly larger portion of the budget. The fixed percentages might also need adjusting based on individual circumstances and financial goals. Furthermore, it doesn't explicitly account for irregular expenses like car repairs or medical bills. In high cost-of-living areas, adhering to the 50% for needs might be particularly challenging.

To successfully implement the 50/30/20 rule as one of your key family budget tips, consider these actionable strategies:

- Calculate percentages based on your after-tax income: This ensures accuracy and reflects your true disposable income.

- Adjust percentages during different life phases: You might prioritize debt repayment during one phase and then shift focus to saving for a down payment later.

- Automate the 20% savings transfer: Set up automatic transfers to a separate savings or debt repayment account to prevent accidentally spending the funds allocated for this crucial category.

- Review and rebalance categories quarterly: Track your spending, assess if you're staying within the allocated percentages, and make adjustments as needed. Life changes, and your budget should reflect those changes.

The 50/30/20 rule's simplicity and adaptability make it a valuable tool for families seeking to gain control of their finances. By providing a clear framework for prioritizing spending, saving, and debt repayment, this budgeting method empowers you to make informed financial decisions and work towards your family's financial goals. While not a one-size-fits-all solution, it offers a solid foundation for building a healthy and sustainable family budget.

3. Create an Emergency Fund

One of the most crucial family budget tips is creating an emergency fund. This dedicated savings account acts as a financial safety net, providing a buffer against unexpected expenses. It allows you to handle emergencies, like a sudden job loss, medical bills, or major home repairs, without derailing your regular budget or resorting to high-interest debt like credit cards. Building this fund is a fundamental step towards financial security and peace of mind. It prevents emergencies from escalating into financial disasters and allows you to navigate challenging times with greater confidence. This strategy is particularly important for families, as unexpected expenses can have a more significant impact on their overall financial stability.

A properly structured emergency fund should cover 3-6 months of essential living expenses. This includes necessities like mortgage or rent payments, groceries, utilities, transportation, and insurance. The exact amount will vary depending on your family’s individual circumstances, such as income stability, number of dependents, and health conditions. For example, a family with a single income earner may aim for a larger emergency fund than a dual-income family.

This emergency fund should be kept in a separate savings account, distinct from your regular checking account. While it should be easily accessible, it shouldn’t be so convenient that you’re tempted to dip into it for non-emergencies. Think high-yield savings accounts or money market accounts – these offer relatively easy access while also earning a modest amount of interest. Crucially, any withdrawals from the emergency fund must be replenished as soon as possible to maintain its protective function. Learn more about Create an Emergency Fund offers further insights into maximizing savings.

Consider the example of a family diligently saving $500 per month. Over 30 months, they successfully build a $15,000 emergency fund. This fund could provide significant relief if the primary earner experienced a job loss, giving them time to find new employment without accumulating debt. Another example could be a couple who faced a sudden $2,000 car repair bill. Because they had a well-funded emergency account, they were able to cover the expense without resorting to high-interest credit cards, avoiding the burden of additional debt and interest payments.

While creating an emergency fund is a highly recommended family budget tip, it’s important to be aware of the potential drawbacks. The money held in an emergency fund typically earns lower returns compared to investments in the stock market. There's also the opportunity cost of not investing that money for potentially higher gains. Additionally, building a substantial emergency fund takes time and requires discipline. It can be tempting to use the funds for non-emergencies, especially if progress feels slow. This is why it’s crucial to clearly define what constitutes a true emergency beforehand.

To effectively implement this strategy, consider the following tips: start small by aiming for a $1,000 “mini-emergency fund” before building towards the full 3-6 month goal. This initial milestone provides a sense of accomplishment and motivates further saving. Automate regular transfers to your emergency fund each payday, making saving effortless. Keep the fund in a high-yield savings account to maximize interest earnings, and clearly define what constitutes a true emergency to avoid unnecessary withdrawals. Popular personal finance experts like Dave Ramsey and Suze Orman, along with many certified financial planners, strongly advocate for prioritizing emergency funds. They emphasize the importance of having a financial cushion to weather unexpected storms and protect long-term financial goals. This is a cornerstone of sound financial planning and a critical component of any successful family budget.

4. Implement Zero-Based Budgeting

Zero-based budgeting (ZBB) is a powerful family budget tip that can revolutionize how you manage your finances. It's a method where every single dollar of your income is assigned a specific purpose before the month begins. This ensures that your income minus all allocated expenses equals zero, leaving no room for unaccounted-for spending. This approach fosters intentional decision-making about every dollar and prevents money from slipping through the cracks without a designated purpose, making it a valuable strategy for any family looking to gain control of their finances.

This proactive approach to budgeting stands in stark contrast to more traditional methods that often focus on tracking spending after it occurs. ZBB flips the script, requiring you to plan where your money will go in advance, effectively transforming your budget from a reactive tool to a proactive instrument for achieving your financial goals. Implementing ZBB can significantly improve your family’s financial health and contribute to long-term stability. It deserves a place on this list because it provides a structured framework for families to gain complete control over their money, regardless of income level.

How Zero-Based Budgeting Works:

The core principle of ZBB is assigning every dollar a job. This means categorizing all anticipated expenses, including necessities like housing, food, and transportation, as well as savings, debt repayments, and entertainment. Even smaller, seemingly insignificant expenses need a designated allocation within the budget. By accounting for every dollar earned, you gain a comprehensive understanding of where your money is going and can make informed decisions about your spending habits.

Features and Benefits of ZBB:

- Every Dollar Has a Purpose: Nothing is left to chance. Every dollar is earmarked for a specific category, ensuring mindful spending. This eliminates the "mystery money" syndrome where you're unsure where your funds have gone.

- Income Minus Expenses Equals Zero: This fundamental equation ensures that all income is accounted for, leaving no room for unintentional overspending. This balance helps you stay within your budget and avoid accruing unnecessary debt.

- Monthly Budget Planning in Advance: The proactive nature of ZBB requires you to plan your spending before the month begins. This allows you to anticipate potential financial challenges and adjust your spending accordingly.

- Includes Savings and Debt Payments as ‘Expenses': ZBB prioritizes saving and debt reduction by treating them as essential expenses rather than afterthoughts. This helps build a strong financial foundation and reduces reliance on credit.

Real-World Examples:

- A family with a $4,000 monthly income might allocate their budget as follows: $1,800 for housing, $600 for food, $400 for transportation, $500 for savings, $300 for entertainment, and $400 for utilities and miscellaneous expenses. This ensures every dollar has a defined purpose and contributes to their overall financial goals.

- Popular budgeting software like YNAB (You Need A Budget) facilitates ZBB by providing tools to assign every dollar before it's spent. This software and others like it simplify the process of implementing ZBB and provide a visual representation of your budget.

- Families have successfully used zero-based budgeting to achieve significant financial milestones, such as paying off large debts, buying homes, and building substantial savings. Stories abound of families who have paid off tens of thousands of dollars in debt within a few years using this method.

Pros and Cons of Zero-Based Budgeting:

- Pros: Maximizes the efficiency of every dollar earned, prevents mindless or impulse spending, forces prioritization of financial goals, and creates a detailed spending plan.

- Cons: Requires significant time for monthly planning, can be too restrictive for some personalities, poses challenges with irregular income, and may cause stress if applied too rigidly.

Actionable Tips for Implementing ZBB:

- Start Early: Begin your budgeting process 2-3 days before the new month starts to give yourself ample time to plan and allocate your funds effectively.

- Include a "Miscellaneous" Category: Incorporate a small category for unexpected expenses to provide flexibility within your budget and prevent it from feeling too restrictive.

- Regular Review and Adjustments: Review your budget weekly and adjust as needed based on your actual spending. This allows you to stay on track and make informed decisions throughout the month.

- Utilize Budgeting Apps: Explore and use budgeting apps that support zero-based methodology to simplify the process and enhance your budgeting experience. These apps often offer features such as automatic categorization, spending alerts, and progress tracking.

Who Popularized Zero-Based Budgeting:

Zero-based budgeting has been popularized by financial experts like Dave Ramsey, the YNAB (You Need A Budget) methodology, and adapted from corporate budgeting practices for personal use. These resources offer valuable insights and guidance for implementing ZBB effectively.

By implementing zero-based budgeting as a family budget tip, you can gain a comprehensive understanding of your finances, eliminate wasteful spending, and make significant progress towards your financial goals. While it requires discipline and commitment, the benefits of ZBB can be transformative for your family’s financial well-being.

5. Automate Your Savings

One of the most effective family budget tips is to automate your savings. This “pay yourself first” strategy involves setting up automatic transfers from your checking account to your savings account immediately after payday, effectively treating savings as a non-negotiable expense. This powerful method removes the temptation to spend money that should be earmarked for savings and builds wealth through consistent, systematic contributions. For families juggling multiple financial priorities, automating savings can be the key to reaching long-term financial goals.

This approach works by leveraging the power of technology and consistent habits. Instead of relying on willpower to manually transfer money to savings, you set up a recurring, automatic transfer with your bank. This transfer typically occurs shortly after your paycheck is deposited. By having the money moved automatically, you avoid the mental debate about whether or not you can afford to save this month. The money is saved before you even have a chance to miss it.

There are several features that make automated savings a powerful tool in managing a family budget:

- Automatic bank transfers on payday: This core feature ensures consistent savings without requiring manual intervention.

- Multiple savings goals with separate accounts: You can establish separate automatic transfers for different financial goals, such as a vacation fund, emergency fund, down payment on a house, or college savings. This compartmentalized approach helps you visualize progress toward each goal.

- Scheduled transfers for different timeframes: You can customize the frequency and timing of your automatic transfers – weekly, bi-weekly, or monthly – depending on your pay schedule and financial goals.

- Integration with direct deposit splitting: Some employers offer direct deposit splitting, allowing a portion of your paycheck to be automatically deposited into your savings account. This streamlines the process even further.

Successfully implementing automated savings can take many forms. For example, a family could set up an automatic $300 transfer to savings every payday, accumulating $7,800 annually. Alternatively, they could establish separate automated transfers for specific goals: $100 for a vacation fund, $200 for an emergency fund, and $400 for retirement. Another example is using your employer’s 401k automatic deduction to save $500 monthly pre-tax, taking advantage of potential tax benefits.

Automating savings provides several advantages:

- Removes human error and temptation from saving: By automating the process, you eliminate the risk of forgetting to save or succumbing to the temptation to spend the money elsewhere.

- Builds wealth consistently over time: Regular, automated contributions, no matter how small, add up significantly over time, thanks to the power of compound interest.

- Reduces decision fatigue about saving: Automating removes the mental burden of deciding how much to save each month, freeing up mental energy for other important decisions.

- Takes advantage of compound interest: The earlier you start saving and the more consistently you contribute, the more you benefit from the snowball effect of compound interest.

However, it’s crucial to be aware of the potential drawbacks:

- May cause cash flow issues if poorly timed: If the automated transfer is scheduled too soon after payday and before other essential bills are paid, it could lead to overdraft fees.

- Less flexibility for irregular expenses: Having a fixed automated transfer might make it harder to handle unexpected expenses that arise.

- Can overdraw accounts if not monitored: It's essential to monitor your account balances regularly to ensure that automated transfers don’t cause overdrafts, especially if your income fluctuates.

- May miss opportunities for higher-yield investments: While convenient, basic savings accounts typically offer lower interest rates compared to other investment vehicles.

To maximize the benefits of automated savings, consider these tips:

- Start with small amounts and increase gradually: Begin with a manageable amount that doesn't strain your budget, and gradually increase the amount as your income grows.

- Time transfers for 1-2 days after payday: This ensures that your paycheck has cleared and other essential bills have been paid before the savings transfer occurs.

- Use separate accounts for different savings goals: This helps you track progress toward each goal and avoids dipping into funds earmarked for specific purposes.

- Monitor account balances to prevent overdrafts: Regularly review your account activity to ensure sufficient funds and avoid overdraft fees.

This approach has been popularized by financial experts like David Bach (author of "The Automatic Millionaire") and Ramit Sethi (author of "I Will Teach You To Be Rich"), and has been further facilitated by modern banking apps and fintech companies. Automating your savings is a crucial component of a successful family budget, allowing you to build wealth consistently and achieve your financial goals. Learn more about Automate Your Savings By incorporating this strategy into your financial plan, you can take control of your finances and secure a brighter financial future for your family.

6. Practice the Envelope Method

Effectively managing a family budget requires discipline and a clear understanding of where your money goes. One powerful strategy, particularly for those prone to overspending in certain areas, is the envelope method. This time-tested budgeting technique offers a tangible, visual, and surprisingly effective way to control spending and achieve your financial goals. This method deserves a place on any list of family budget tips because of its simplicity and its ability to directly address overspending habits.

The envelope method, a cash-based budgeting system, involves allocating specific amounts of cash for different spending categories. These predetermined amounts are then placed in physical envelopes, each clearly labeled with its corresponding category (e.g., groceries, entertainment, dining out). When you need to make a purchase within a particular category, you use the cash from that designated envelope. Crucially, when the money in an envelope is gone, spending in that category stops until the next budgeting period. This creates a hard limit, preventing you from overspending and accumulating unnecessary debt.

The strength of this system lies in its tactile and visual nature. Physically handling cash creates a stronger connection to your spending than swiping a credit card. Seeing the money dwindle in each envelope provides a constant visual reminder of your spending limits, fostering mindful spending habits. This tangible connection to money is a key advantage of the envelope system and a primary reason why it's so effective in curbing overspending.

Consider these examples of how families have successfully implemented the envelope method:

- The Grocery Guru: A family consistently overspent on groceries, often tempted by impulse buys. They allocated $400 per month to their "Groceries" envelope. This forced them to plan meals carefully, stick to their shopping list, and become more conscious of grocery prices, ultimately saving them a significant amount each month.

- Entertainment on a Budget: Another family, struggling to control entertainment spending, designated $200 to their "Entertainment" envelope. This encouraged them to prioritize free or low-cost activities like parks, libraries, and family game nights, reducing their reliance on expensive outings.

- Dining Out Discipline: A couple frequently overspent on restaurant meals. They implemented a cash-only "Dining Out" envelope, limiting themselves to a set amount each month. This forced them to be more selective about where and how often they dined out, leading to substantial savings.

While undeniably effective, the envelope system has its drawbacks. It's less practical in our increasingly cashless society and can be inconvenient for online purchases. Carrying large amounts of cash also presents a security risk. Additionally, managing bill payments and automated expenses can be difficult with this method.

Here are some tips to make the envelope system work for your family:

- Start Small: Begin with just 2-3 categories where you tend to overspend. This will help you adjust to the system without feeling overwhelmed.

- Hybrid Approach: Combine the envelope method with digital budgeting tools for fixed expenses and bill payments. This allows you to enjoy the benefits of both systems.

- Digital Envelopes: Consider using digital envelope budgeting apps like Goodbudget (formerly EEBA - Easy Envelope Budget Aid) or You Need A Budget (YNAB). These apps provide the convenience and security of digital transactions while maintaining the core principles of the envelope method.

- Track Spending: Keep receipts in your envelopes to monitor your spending patterns and identify areas for improvement. This allows you to refine your budget over time.

The envelope method, popularized by financial expert Dave Ramsey and rooted in traditional budgeting practices from the pre-credit card era, provides a powerful tool for families seeking greater control over their finances. By promoting mindful spending and setting clear boundaries, this system can effectively curb overspending, prevent debt accumulation, and contribute to a healthier family budget. It’s a valuable approach for families wanting to implement effective family budget tips. While not without its limitations, the envelope method, particularly when adapted to incorporate digital tools, can be a highly effective strategy for achieving your family's financial goals.

7. Conduct Regular Budget Reviews

One of the most crucial yet often overlooked aspects of successful family budgeting is the regular review. Just like a ship needs course correction to reach its destination, your family budget needs regular adjustments to stay on track with your financial goals. Conducting regular budget reviews – whether monthly or quarterly – is essential to ensuring your family's financial health. This practice allows you to analyze your budget's performance, compare your actual spending to your planned amounts, and make necessary adjustments based on your family's evolving needs and circumstances. This makes it a vital component of any comprehensive family budget tips strategy.

But why is this step so important? A static budget created months ago may no longer reflect your current reality. Unexpected expenses, changes in income, or shifts in priorities can all impact your spending habits. Regular budget reviews provide the opportunity to identify these changes and adjust your budget accordingly, keeping it a relevant and effective tool for managing your finances. This dynamic approach helps you stay proactive rather than reactive, giving you more control over your family's financial future.

How Budget Reviews Work:

The process is straightforward. First, choose a review frequency – monthly is ideal for catching issues early, while quarterly might be sufficient for families with stable incomes and spending habits. Mark this review on your calendar as an important appointment – treat it with the same seriousness you would a doctor’s visit. During the review, gather all relevant financial documents, such as bank statements, credit card bills, and receipts. Then, compare your actual spending in each category to your planned budget. This comparison will highlight areas where you’ve overspent or underspent.

Next, analyze the reasons behind any discrepancies. Was the overspending due to a one-time expense, or a recurring pattern? Did you underspend because of conscious effort or a change in circumstances? Understanding these “whys” is key to making informed adjustments to your future budget allocations. For example, if you consistently overspend on groceries, you might explore meal planning or using coupons more effectively. If you're consistently underspending on entertainment, you might consider reallocating those funds towards a higher priority, like saving for a down payment.

Examples of Successful Implementation:

- Monthly Family Meetings: Many families find it beneficial to hold monthly budget meetings, perhaps on the last Sunday of each month. These meetings become a dedicated time to review the previous month's spending, plan for the upcoming month, and align family members on financial goals.

- Quarterly Reviews and Savings: A family conducting a quarterly review discovered they were spending $200 more per month on subscriptions than they realized. This led them to cancel unused subscriptions and consolidate others, resulting in significant savings.

- Major Purchase Alignment: Couples often use budget reviews to discuss and align on major purchase decisions, ensuring they’re making financially sound choices that align with their shared goals, like buying a new car or renovating their home.

Tips for Effective Budget Reviews:

- Schedule and Prioritize: Treat budget reviews like important appointments. Block off time in your calendar and avoid rescheduling.

- Focus on Trends, Not Fluctuations: Don’t get bogged down in daily spending fluctuations. Look for larger trends and patterns that indicate areas needing attention.

- Celebrate Successes: Acknowledge and celebrate areas where you've successfully managed your spending. This positive reinforcement helps build motivation and encourages continued adherence to the budget.

- Keep it Concise: Aim to keep your reviews to 30-45 minutes to maintain focus and avoid analysis paralysis.

- Be Flexible: Your budget should be a living document. Don’t be afraid to adjust it based on your changing needs and circumstances.

Pros and Cons of Regular Budget Reviews:

Pros:

- Keeps your budget aligned with your current financial reality.

- Identifies potential problems before they become serious.

- Celebrates progress and builds motivation.

- Allows for course corrections and improvements.

Cons:

- Requires dedicated time and effort.

- Can be discouraging if consistently over budget.

- May lead to analysis paralysis if overdone.

- Can be difficult to maintain consistency over time.

Despite the potential downsides, the benefits of conducting regular budget reviews far outweigh the challenges. By incorporating this practice into your family's financial routine, you can gain greater control over your spending, make informed decisions about your money, and work towards achieving your financial goals. Regular budget reviews are not about restriction; they are about empowerment and aligning your spending with your values and aspirations, making them an invaluable part of any family budget tips arsenal.

8. Use the Pay Yourself First Principle

One of the most effective family budget tips is the “Pay Yourself First” principle. This powerful strategy prioritizes saving and debt repayment above all other expenditures. Instead of treating savings as an afterthought – whatever is left over after all the bills and discretionary spending – "paying yourself first" flips the script. It treats savings and debt reduction as your most important “bills,” ensuring your long-term financial goals are funded before you allocate funds towards wants. This mindset shift is crucial for building wealth and achieving financial security. By consistently prioritizing your future self, you lay the foundation for a stronger financial future for your entire family. This principle deserves its place on this list because it fosters financial discipline, encourages consistent savings, and helps families prioritize long-term financial well-being over immediate gratification.

How it Works:

The Pay Yourself First principle is simple in concept but profound in impact. It involves setting aside a predetermined portion of your income for savings and debt repayment before you consider any other expenses. This can be achieved through various methods, but automation is often the most effective. Setting up automatic transfers from your checking account to your savings or debt repayment accounts ensures consistency and removes the temptation to spend the money elsewhere. Think of it as automating good financial habits.

Features and Benefits:

- Savings Treated as a Non-Negotiable Expense: Just like your rent or mortgage, savings becomes a mandatory outflow, ensuring you consistently contribute to your financial goals.

- Automatic Deductions Before Discretionary Spending: Automating the process removes emotion from the equation and makes saving effortless.

- Priority Given to Long-Term Financial Goals: Whether it’s retirement, a down payment on a house, or your children’s education, “paying yourself first” ensures these goals are consistently funded.

- Integration with Automated Systems: Utilizing online banking tools and automated transfer features simplifies the process and reinforces consistent saving habits. This makes sticking to your family budget tips that much easier.

Examples of Successful Implementation:

- A young professional automates 20% of their paycheck to be transferred to their retirement account and a separate savings account for a down payment on a house. By age 30, they’ve accumulated $100,000 in savings and are well on their way to achieving their financial goals.

- A family committed to paying down their debt decides to allocate an extra $300 per month towards their highest-interest loan before considering any restaurant dining or entertainment expenses. This accelerated debt repayment strategy helps them become debt-free faster.

- A couple diligently saves 15% of their income for retirement before budgeting for entertainment, travel, or other discretionary expenses. They understand that prioritizing their future financial security allows them to enjoy those other expenses guilt-free later on.

Pros and Cons:

Pros:

- Ensures consistent progress toward financial goals

- Builds wealth through compound growth over time

- Reduces lifestyle inflation

- Creates financial discipline and good habits

Cons:

- May feel restrictive initially, especially if you're used to a different spending pattern.

- Requires adjustment of lifestyle expectations. You might need to reassess spending habits and find areas where you can cut back.

- Can be challenging with tight budgets. However, even small amounts saved consistently can make a difference.

- May need modification during financial emergencies. Flexibility is key, and you might need to adjust your savings rate temporarily during unexpected financial hardships.

Actionable Tips for Implementing “Pay Yourself First”:

- Start Small and Gradually Increase: Begin with a small percentage of your income (e.g., 1-5%) and gradually increase it over time as your income grows or your expenses decrease.

- Combine with Automatic Transfers: Set up automatic transfers from your checking account to your savings and debt repayment accounts to make saving effortless and consistent.

- Calculate Based on Gross Income for Retirement Contributions: When contributing to retirement accounts, base your contribution percentage on your gross income (before taxes) to maximize tax benefits.

- Adjust Lifestyle Spending to Accommodate Savings Priority: Review your spending habits and identify areas where you can cut back to accommodate your increased savings rate.

When and Why to Use This Approach:

The “Pay Yourself First” principle is beneficial for anyone who wants to build wealth, achieve financial security, and develop good financial habits. It’s particularly important for families who are:

- Saving for long-term goals like retirement, a down payment on a house, or their children’s education.

- Trying to pay down debt.

- Looking to build an emergency fund.

- Aiming to create a more secure financial future for themselves and their loved ones.

By adopting this principle and integrating it into your family budget, you'll be well-positioned to achieve your financial goals and build a strong financial foundation for the future. This principle, popularized by personal finance experts like George S. Clason in "The Richest Man in Babylon", David Bach, and Robert Kiyosaki in "Rich Dad Poor Dad", has proven its effectiveness time and again. Implementing it as part of your family budget tips can be truly transformative.

8 Key Family Budgeting Tips Compared

| Tip Title | Implementation Complexity 🔄 | Resource Requirements 💡 | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Track Every Expense | Moderate - requires consistent daily logging | Time-intensive, apps or manual tracking | Increased financial awareness, identification of waste | Beginners to advanced budgeters wanting full visibility | Reveals hidden spending, Creates accountability |

| Use the 50/30/20 Rule | Low - simple percentage allocations | Minimal - basic math, income info | Balanced budget, prioritized savings | Those seeking easy-to-follow budgeting guideline | Easy to understand, Flexible and scalable |

| Create an Emergency Fund | Moderate - gradual fund building over time | Consistent savings discipline, separate account | Financial security, reduced debt risk | Individuals needing safety net for unexpected costs | Prevents debt, Reduces financial stress |

| Implement Zero-Based Budgeting | High - detailed monthly planning per dollar | Time-consuming monthly planning tools or apps | Maximized money efficiency, prevents impulse spending | Those wanting total control over every dollar | Forces prioritization, Detailed spending plan |

| Automate Your Savings | Low to Moderate - setup once, then automatic | Bank accounts with auto-transfer capability | Consistent savings growth, reduced human error | Anyone wanting effortless, systematic saving | Removes temptation, Builds wealth consistently |

| Practice the Envelope Method | Moderate - physical or digital envelopes required | Cash management or budgeting apps | Controlled spending, prevents overspending | Cash-based users, those prone to overspending | Tangible spending limits, Eliminates credit debt |

| Conduct Regular Budget Reviews | Moderate - scheduled time and review commitment | Time commitment for meetings or personal review | Budget alignment, early problem detection | Families or individuals wanting ongoing budget optimization | Keeps budget relevant, Enables course correction |

| Use the Pay Yourself First Principle | Low - prioritizing savings before expenses | Automated transfers preferred | Steady wealth growth, savings prioritized | Those focused on long-term financial security | Builds discipline, Reduces lifestyle inflation |

Building a Brighter Financial Future, One Tip at a Time

Mastering your family budget is a journey, not a destination. This article provided eight practical family budget tips, ranging from diligently tracking every expense and utilizing the 50/30/20 rule to establishing an emergency fund and implementing zero-based budgeting. Key takeaways include automating your savings, using cash envelopes for targeted spending categories, conducting regular budget reviews, and prioritizing saving with the "pay yourself first" principle. By consistently applying even a few of these family budget tips, you'll gain greater control over your finances and pave the way for a more secure future. This empowers you to not just survive, but thrive, by achieving your financial goals, whether it's buying a home, early retirement, or simply enjoying greater peace of mind.

Remember, small changes add up over time. Start with one or two of these family budget tips that resonate with you and gradually incorporate more as you become comfortable. Tracking your progress and celebrating milestones along the way helps maintain momentum and reinforces positive financial habits. For more ways to stretch your budget and optimize your spending, particularly on shared services, consider exploring AccountShare. AccountShare allows families to securely share premium accounts for streaming, gaming, software, and more, reducing individual expenses and allowing you to allocate more funds towards your savings goals. Learn more about how AccountShare can help you maximize your family budget by visiting AccountShare today.