Shared Expense Calculator: Master Bill Splitting Like a Pro

Share

Why Your Group Needs A Shared Expense Calculator

Let's face it: discussing finances can be uncomfortable, especially among friends or family. Whether you're splitting the bill after a group dinner, managing shared household expenses, or planning a trip together, these conversations can quickly become awkward. A shared expense calculator offers a solution. These tools provide a simple and effective way to keep everyone on the same page financially. They eliminate the guesswork and potential for disagreements that can strain relationships.

Transparency and Trust

One of the key benefits of using a shared expense calculator is the transparency it offers. Everyone can clearly see who paid for what and how much each person owes. This clarity helps prevent misunderstandings and fosters trust within the group. Imagine a scenario where one person covers the cost of a vacation rental upfront. Without a system for tracking expenses, it can be difficult to ensure everyone contributes their fair share. This lack of transparency can lead to uncomfortable conversations and even conflict.

The popularity of shared expense calculators has risen significantly. Platforms like Group Ledger and Kittysplit have seen a surge in users, particularly among millennials and Gen Z. These demographics often engage in group activities and value the convenience and transparency these tools provide. In fact, nearly 70% of millennials use some form of shared expense tracking, highlighting the increasing reliance on digital tools for managing finances.

Preventing Resentment and Strengthening Bonds

Small discrepancies in shared expenses can accumulate over time, causing resentment and affecting group dynamics. A shared expense calculator addresses this issue directly. By ensuring fair contributions from everyone, it prevents the buildup of small debts and associated negative feelings. This allows the focus to remain on enjoying shared experiences, rather than worrying about financial imbalances.

This approach encourages fairness and mutual respect, strengthening the bonds within the group. When everyone feels they're being treated equitably, it creates a positive and collaborative environment. This is essential for maintaining healthy relationships, whether among friends, family members, roommates, or colleagues.

Simplicity and Efficiency

Shared expense calculators simplify the process of splitting expenses. Instead of manual calculations, complicated spreadsheets, or awkward IOUs, these tools automate the process. This efficiency saves time and reduces the likelihood of errors. This is especially helpful for larger groups or complex expenses, where manual tracking can be a burden. A shared expense calculator simplifies everything, providing accurate and transparent splitting.

Finding Your Perfect Shared Expense Calculator Platform

Choosing the right shared expense calculator can make managing group finances a breeze. However, picking the wrong one can create more headaches than it solves. Finding the perfect platform requires carefully evaluating features, user experience, and the unique needs of your group.

Essential Features for Seamless Expense Sharing

Intuitive interfaces are essential for encouraging group adoption. If a platform is difficult to use, members might avoid it. Look for calculators with clear labels, straightforward input methods, and easy-to-understand reports. This ensures everyone can comfortably contribute and track expenses, regardless of their tech skills.

Another key feature is the notification system. Different groups prefer different communication styles. Some might want instant notifications for every transaction, while others prefer fewer alerts. A good platform offers customizable notification settings. For example, some apps let users choose between real-time updates, daily summaries, or weekly reports.

Finally, consider the pricing structure. Many basic shared expense calculators are free, but premium features often cost money. Evaluate if the benefits, like multi-currency support or advanced reporting, justify the cost for your group. You might be interested in: How to master group buying.

Analyzing Platform Performance: Time, Accuracy, and Ease of Use

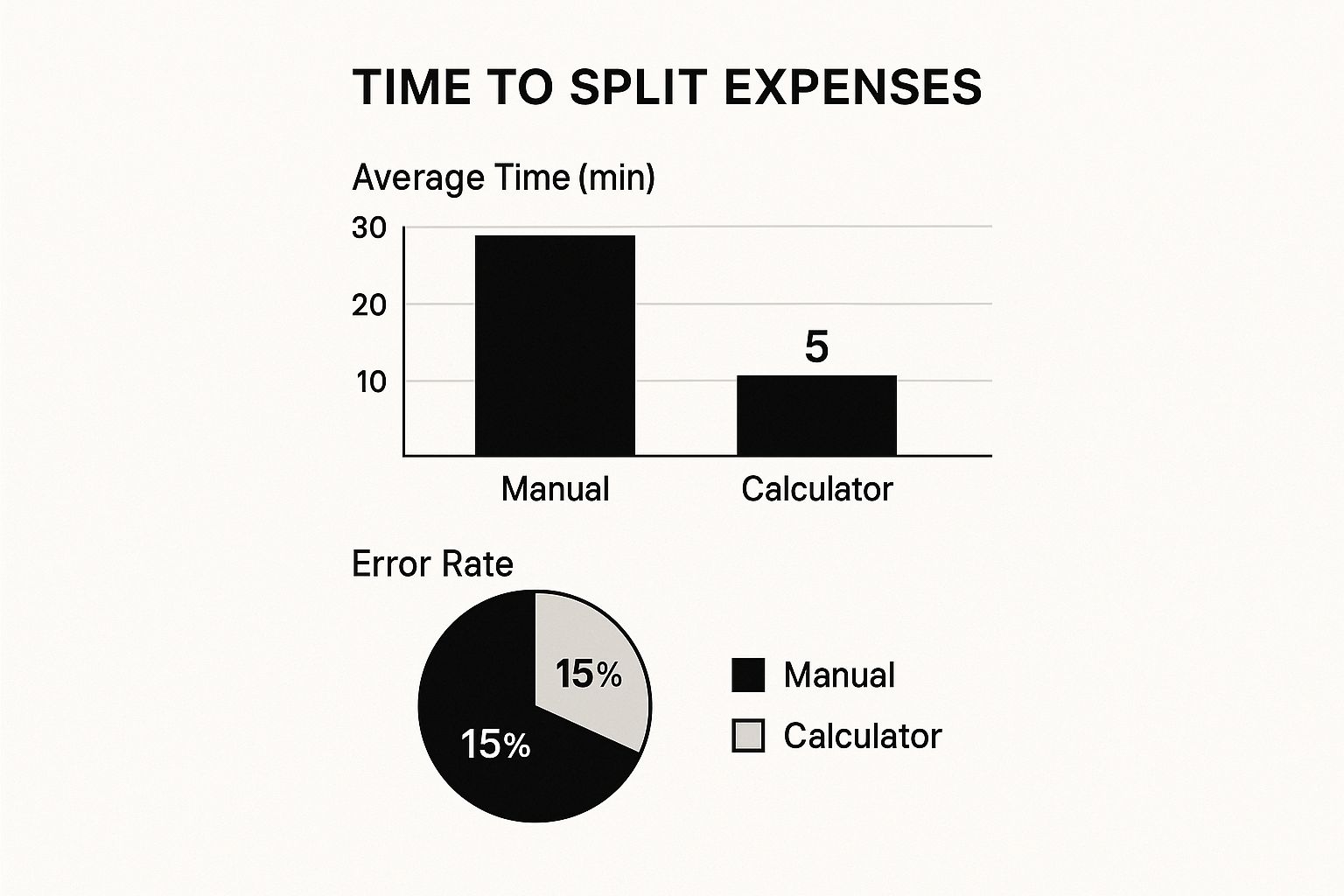

A crucial factor is how much time a platform saves you. The infographic below highlights the time difference between managing expenses manually and using a shared expense calculator. It also visualizes the reduction in errors achieved through automated calculations.

As the infographic demonstrates, using a shared expense calculator significantly reduces the average time spent on splitting expenses from 30 minutes manually to just 5 minutes. The error rate also drops dramatically, from 15% with manual calculations to a mere 2% when using a calculator. This increased accuracy and efficiency frees up more time for enjoying group activities.

To help you further explore options, the following table compares some popular platforms:

Popular Shared Expense Calculator Platforms Comparison Comprehensive comparison of leading shared expense calculator platforms including features, pricing, and best use cases

| Platform | Key Features | Pricing | Best For | User Rating |

|---|---|---|---|---|

| Splitwise | Expense tracking, bill splitting, IOUs, group management | Free, optional paid features | Friends, roommates, travelers | 4.5/5 |

| Settle Up | Multi-currency support, offline access, expense categorization | Free, optional paid features | International travel, large groups | 4.0/5 |

| Tab | Bill splitting, Venmo integration, tip calculation | Free | Restaurants, bars | 4.3/5 |

| Trip Splitter | Expense tracking, currency conversion, detailed reports | Free trial, paid plans | Group trips, vacations | 4.2/5 |

This table offers a quick overview of some leading platforms. Remember to check each platform’s website for the most up-to-date information.

Tailoring Your Choice to Specific Scenarios

Different groups have different needs. A calculator ideal for tracking daily expenses between roommates may not be the best for managing a complex group trip. Consider your group's primary use case. If you’re planning a trip, features like currency conversion and expense categorization are crucial. For roommates, recurring expense tracking and bill reminders might be more valuable.

Ensuring Group Buy-In

Introducing a new tool can sometimes meet resistance. To encourage adoption, emphasize the benefits of using a shared expense calculator. Highlight how it simplifies bill splitting, promotes transparency, and reduces financial friction within the group. This positive framing can help overcome any initial hesitation.

Platform Limitations and Honest Insights

While shared expense calculators offer many advantages, they also have limitations. Some platforms may lack robust reporting, while others might have limited functionality for complex splitting scenarios. Be aware of these potential drawbacks and choose a platform that truly aligns with your group's needs. Researching user reviews and comparing features can provide valuable insights. This is especially helpful when considering regular expenses like splitting bills within a family or among roommates. The right tool can make managing these regular payments significantly easier.

Mastering Group Travel and Event Expense Management

Group trips and events can often present financial challenges. Using a shared expense calculator is essential for smoothly navigating these issues. It's about going beyond simply splitting the bill and accommodating different budgets, optional activities, and unexpected expenses.

Structuring Expense Categories

Organizing expenses is key. Smart planners categorize costs effectively, separating shared costs like accommodations and transportation from individual expenses like meals and optional activities. This clarity prevents confusion and ensures a fair split.

Creating specific categories such as "Accommodation," "Shared Meals," "Optional Activities," and "Transportation" allows for accurate tracking of individual contributions. This approach makes it easy to see who paid for what.

Managing Pre-Trip Deposits and Settlements

Many trips require upfront payments, such as deposits for accommodations or flights. A shared expense calculator helps track these pre-trip costs, clarifying who owes what before the trip even begins. This eliminates the hassle of chasing receipts and reimbursements later.

Having a clear financial picture upfront also helps prevent awkward situations regarding unpaid balances, especially when dealing with currency conversions. This proactive financial management contributes to a smoother trip experience.

The increasing popularity of group travel has led to a rise in the use of shared expense calculators. During peak holiday seasons, group trips are common, leading to many shared expenses. A 2022 travel survey indicated that approximately 75% of group travelers use digital tools to manage expenses such as bookings and meals. More detailed statistics can be found here. You might also be interested in this article: How to master group buying.

Handling Varying Budgets and Preferences

Within a group, not everyone has the same budget or preferences. Some might prefer luxury accommodations, while others prioritize budget-friendly options. A shared expense calculator addresses these differences.

By allowing for itemized tracking and individual spending limits, it ensures everyone contributes fairly based on their choices. This flexibility respects individual financial constraints and preferences.

Real-Time Expense Tracking and Transparency

Tracking expenses in real-time during the trip or event promotes financial transparency and avoids surprises. This helps prevent discrepancies between estimated and actual costs.

Real-time tracking also allows for immediate spending adjustments if necessary. For example, if the group realizes they're overspending on meals, they can collectively decide to adjust their dining choices.

Currency Conversions and Payment Methods

International trips often involve multiple currencies and payment methods (cash, card). Modern shared expense calculators simplify this by offering built-in currency conversion and the ability to track both cash and card transactions. This removes manual calculations and reduces the risk of errors.

Ensuring Fairness and Maintaining Group Harmony

Using a shared expense calculator ensures everyone feels the final split is fair. This fosters positive group dynamics and prevents potential resentment.

Clear communication and upfront agreement on expense categories and splitting methods are crucial. This encourages open discussions and addresses any financial concerns before they escalate. This proactive approach strengthens relationships and ensures a harmonious trip.

By implementing these strategies and utilizing a shared expense calculator, group travel and events can be managed efficiently and transparently. This focus on financial organization allows more time and energy for enjoying the shared experience.

Bringing Shared Expense Calculators Into The Workplace

Smart teams are recognizing the benefits of shared expense calculators, moving beyond personal use and integrating them into professional settings. These tools simplify expense management for a variety of situations, from team lunches to conference travel, reflecting a growing trend toward digital financial organization in the workplace.

Streamlining Team Expenses

Imagine a team lunch. Instead of one person juggling cash or deciphering a complex bill, a shared expense calculator can instantly calculate each person's portion. This streamlines the process, eliminates awkward reimbursement requests, and prevents small debts from accumulating and potentially straining professional relationships. These tools can also manage shared office supplies or other team costs, ensuring fairness and transparency. A 2020 workplace survey found that 40% of employees used digital tools for shared expense management at work. Explore this topic further: Split Expenses Calculator.

Navigating Different Salary Levels and Spending Comfort Zones

One challenge in workplace expense sharing is accommodating varying salary levels and spending comfort. Shared expense calculators offer clear cost visibility and flexible splitting options, easing potential awkwardness and ensuring everyone feels comfortable contributing fairly. This transparency strengthens professional relationships.

Integrating With Company Policies and Client Entertainment

Integrating shared expense calculators effectively often means aligning their use with existing company policies. For example, if a company has specific guidelines for client entertainment expenses, the chosen calculator should accommodate those rules. This ensures compliance and simplifies expense reporting for both employees and the company. This structured approach to shared costs enhances team productivity by reducing administrative tasks.

Fostering Team Building Without Awkwardness

Using these calculators for team-building activities fosters camaraderie without financial awkwardness. Clearly outlining costs and ensuring fair distribution maintains a positive team dynamic. This clarity builds trust and respect, vital for a productive work environment. Team members can participate in group activities without worrying about financial imbalances or uncomfortable reimbursement discussions.

Professional Communication and Transparency

Clear communication is crucial when introducing shared expense calculators in the workplace. Setting clear usage expectations, establishing categories for expense types, and maintaining open communication about shared costs prevents misunderstandings. This transparency builds trust and keeps everyone aligned. This contributes to a more positive and collaborative work environment, further demonstrating the benefits of shared expense calculators.

Advanced Shared Expense Calculator Strategies For Complex Situations

Life rarely involves perfectly equal splits, especially when it comes to sharing expenses. This is where advanced strategies and a robust shared expense calculator become essential. These tools can help navigate the often-complicated scenarios of unequal consumption, varying income levels, and mixed group-personal expenses.

Weighted Splitting and Percentage-Based Allocations

Weighted splitting offers a fair way to assign different contribution percentages. These percentages can be based on factors like individual consumption or income. For instance, if one roommate uses significantly more utilities, their assigned percentage for that specific cost can be adjusted accordingly.

Similarly, percentage-based allocations are useful for shared meals where everyone orders different items. This ensures each person pays only for their portion, preventing disagreements. Imagine a group ordering takeout: one person gets an appetizer, while others order full meals. Percentage-based allocation ensures fair payment.

Custom Rules for Unique Situations

A powerful shared expense calculator should allow for custom rules. This flexibility is invaluable for unique living situations. For example, if one person is responsible for pet expenses, a custom rule can automatically deduct their contribution from those costs. This simplifies tracking and ensures accurate splitting.

Handling Partial Group Participation and Recurring Expenses

Not every expense involves the entire group. A good shared expense calculator handles partial group participation seamlessly. If only three out of five roommates attend a concert, the expense is easily split between the three attendees. This prevents confusion and simplifies the reimbursement process.

Additionally, differentiating between one-time expenses and recurring expenses, such as rent or utilities, enables automated recurring splits. This saves time and effort, eliminating the need for manual calculations and reminders each month.

Addressing Income Differences While Maintaining Harmony

Income disparities within a group can be a sensitive subject. Open communication is vital. A shared expense calculator can facilitate transparent discussions and agreements regarding contributions.

Those with higher incomes might agree to cover a larger percentage, while others contribute proportionally less. Transparency and mutual agreement are crucial for maintaining positive relationships.

Let's take a look at some common scenarios and how a shared expense calculator can help:

The following table outlines some tricky expense-splitting scenarios and provides potential solutions using a shared expense calculator:

| Scenario | Challenge | Recommended Approach | Calculator Features Needed | Tips |

|---|---|---|---|---|

| Unequal Food Consumption | One person consistently eats less or has dietary restrictions. | Percentage-based splitting or individual itemization. | Itemized expense entry, percentage-based allocation. | Discuss dietary needs and preferences upfront. |

| Varying Income Levels | Group members have significantly different incomes. | Openly discuss comfortable contribution levels and consider proportionate splits. | Percentage-based allocation, custom rules. | Transparency and open communication are key. |

| Mixed Group-Personal Expenses | Some expenses benefit the whole group, while others are individual. | Create clear categories and assign expenses accordingly. | Customizable categories, individual expense tracking. | Establish clear guidelines for group vs. personal expenses. |

| Partial Group Participation | Not everyone participates in every activity. | Split expenses only among participants. | Subgroup creation, partial expense allocation. | Clearly communicate who is included in each expense. |

By using these advanced strategies and features, a shared expense calculator becomes much more than a simple tool. It's a valuable resource for maintaining financial harmony and strengthening relationships within any group.

Building Long-Term Success With Group Expense Management

Technology, like a shared expense calculator, is a great starting point. But truly successful, long-term group expense management relies on smart practices and open communication. These practices create a sustainable framework for financial harmony, not just a quick fix for one-time events.

Setting Expectations and Establishing a Rhythm

First, set clear expectations. Like a team outlining their game plan, a group needs to agree on spending limits, budgeting methods, and how to handle unexpected costs. This upfront alignment prevents later disagreements. For instance, a group planning a trip could agree on a daily food budget or establish a protocol for handling optional, more expensive activities.

Establish a regular review rhythm, too. Just as businesses conduct regular financial reviews, groups should periodically check in on their expenses. This could involve a weekly check-in with the shared expense calculator or a monthly summary to make sure everyone stays informed. Consistent monitoring keeps small discrepancies from becoming major issues.

Navigating Different Spending Styles and Maintaining Engagement

People have different spending habits. Some are meticulous budgeters, others more spontaneous. Successful groups accommodate these differences. A shared expense calculator can help. Features like individual spending limits or expense subcategories offer flexibility. One person might set a limit on "entertainment" spending while still contributing to shared "accommodation" costs.

Keeping everyone engaged with the tracking system is crucial. A shared expense calculator is most effective when everyone actively uses it. Encourage consistent logging of expenses and participation in reviews. Shared responsibility fosters accountability without micromanagement.

Resolving Disagreements and Preventing Conflicts

Disagreements about money are inevitable. The key is addressing them constructively. A shared expense calculator provides a factual basis for discussion. By referencing recorded transactions, the group can objectively address discrepancies. This focus on data depersonalizes disagreements and helps find solutions. The calculator acts as a neutral referee.

Practical Strategies and Checklists

Successful groups develop strategies for common challenges. Consider creating a checklist for initial financial setup, documenting agreements on splitting methods, and outlining conflict resolution techniques. These proactive steps establish a solid foundation for handling financial matters.

It's important to be realistic. Shared expense systems work best with group commitment and reasonably complex expenses. For very simple situations or groups with strong existing trust and communication, simpler methods might suffice. The best approach depends on the group's specific dynamics and needs.

Ready to simplify group expenses and build stronger relationships? Try AccountShare, the platform for seamless shared expense management. Discover how AccountShare can transform your group's finances.