A Practical Guide to Small Business Budgeting

Share

A small business budget is simply a financial plan mapping out your expected income against your anticipated expenses. But don't think of it as a restriction. It's really a strategic roadmap that helps you put your resources in the right places, get a handle on your cash flow, and make smart decisions that actually drive growth.

Why Your Budget Is Your Most Powerful Growth Tool

So many entrepreneurs I talk to see a budget as a financial straitjacket—a long list of things they can't spend money on. Honestly, that perspective misses the entire point. A well-crafted budget is the single most powerful tool you have for building sustainable growth. It's not about just getting by; it’s about creating a resilient business that can weather market shifts and whatever the economy throws at it.

Think of it this way: without a budget, you're making business decisions based on gut feelings and guesswork. With one, every choice is informed by real data. This gives you the confidence to know when it's the right time to invest, hire that key person, or expand your operations. It’s the difference between navigating a dense forest with a map and compass versus just wandering aimlessly and hoping you find your way out.

Turning Anxiety Into Action

Let's be real, financial planning can feel completely overwhelming, especially when you're already juggling a dozen other critical tasks. The numbers, the projections, all the "what-ifs"—it's enough to cause some serious anxiety. But here's the secret: a budget actually reduces that financial stress by giving you clarity.

Instead of lying awake worrying if you can afford that new piece of equipment or that promising marketing campaign, your budget gives you a clear answer. It shows you exactly where your money is going and, more importantly, where it could be working a lot harder for you. This clarity is what transforms those vague financial fears into a concrete, actionable plan.

Your budget is so much more than a set of rules. It’s a framework for making decisions. It tells you when to be cautious, when it's smart to invest, and how to get ready for future opportunities before they even appear on the horizon.

Building a Foundation for Resilience

The business world is anything but predictable. A sudden market downturn, a surprise supply chain disruption, or a massive unexpected expense can completely derail an unprepared company. This is where all your budgeting efforts truly pay off. A solid budget builds financial resilience because it forces you to plan for the unexpected.

It makes you ask the tough, but necessary, questions:

- Do we have enough cash stashed away to cover at least three months of expenses if sales dried up?

- How would a 10% dip in sales impact our bottom line?

- Could we shift funds from a low-performing area to seize a new high-growth opportunity?

The statistics on startup finances really drive this point home. The initial capital needed can be steep, with many new businesses reporting startup costs anywhere from $50,000 to over $250,000. Even more telling is that running out of cash is the #1 reason for failure, cited by 38% of failed startups. This proves that managing your money is just as critical as making it in the first place. You can find more detail on these small business statistics at Cake.com. By facing these challenges head-on in your budget, you're building your best defense against volatility.

Assembling Your Financial Foundation

Before you can even think about creating a budget, you need a brutally honest picture of where your money is actually coming from and where it's going. This isn't the time for guesswork. A useful budget is built on a solid foundation of real numbers that tell the true story of your business's financial health.

Your first move is to track every single dollar of income. If you're a freelance graphic designer, this means looking at payments from your three retainer clients, plus the income from a couple of one-off projects each month. For a local café, it’s not just daily sales but also revenue from catering gigs and merchandise. Pull your bank statements and payment processor reports from the last three to six months to find a realistic monthly average. Don't just estimate.

Differentiating Your Costs

Once you have a clear handle on your income, it's time to get just as detailed with your expenses. The key here is to separate your fixed costs from your variable costs. Fixed costs are the predictable bills you have to pay every single month, no matter how much business you do. Variable costs, as the name suggests, go up or down depending on your business activity.

Here’s how to think about it in practice:

- Fixed Costs: These are your non-negotiables. Think of things like the monthly rent for your storefront, subscriptions for your accounting software, insurance premiums, and any business loan payments. They’re consistent, which makes them easy to plan for.

- Variable Costs: These expenses are directly tied to your sales. For an e-commerce shop, this would be the cost of the products you sell, shipping fees, or the wages for extra help you hire during the holidays. For a consultant, it could be the travel costs for on-site client meetings.

Understanding this difference is critical. It tells you the absolute minimum you need to earn just to keep the lights on and shows you how your costs will change as your business grows.

A common pitfall I see is people miscategorizing their costs. For instance, a full-time employee's salary is a fixed cost, but the overtime you pay them during a big product launch is a variable one. Getting this right is fundamental to building a budget that actually works.

Uncovering Hidden and One-Time Expenses

Finally, you need to hunt down the expenses that don't show up every month. These are the sneaky costs that can completely wreck an otherwise perfect budget if you aren't prepared for them. The best way to find them is to comb through your financial statements from the last year.

Keep an eye out for these often-forgotten expenses:

- Annual software renewals that you forget about until the invoice hits your inbox.

- Quarterly tax payments that you absolutely must plan for.

- One-time equipment purchases, like a new laptop or a specialized tool for your trade.

- Professional development costs, such as the fee for that big industry conference you attend once a year.

By spotting these expenses ahead of time, you can start setting money aside for them. What could have been a financial fire drill becomes just another planned, manageable cost. Taking the time to build this complete financial picture is the most important part of the entire small business budgeting process. It ensures your budget is grounded in reality, not just wishful thinking.

How To Build Your First Business Budget

Alright, you've gathered all your financial data. Now comes the part where you actually put that information to work and build your first real small business budgeting plan. This is where you shift from simply looking at numbers to actively deciding where your money goes.

Forget the idea that you need to find a rigid, one-size-fits-all template. The best budget is one that’s built for your business—reflecting your industry, your business model, and where you are in your growth journey.

There are a few popular ways to approach this. For example, some swear by zero-based budgeting, where you have to justify every single expense from scratch each month. It's incredibly effective for cutting out unnecessary spending. Others prefer percentage budgeting, which is simpler; you just assign a certain percentage of your revenue to big categories like marketing or payroll. What you choose really depends on how hands-on and detailed you want to be.

Choosing Your Budgeting Framework

For a new business, especially if you're in a fast-moving space like e-commerce, I've found a hybrid approach often gives you the best of both worlds. You can use that zero-based mentality for your variable costs to keep things lean, but apply a percentage model for more predictable expenses, like your marketing budget. This gives you a nice balance of control and flexibility.

Let's imagine you're running a small e-commerce store that sells handmade goods. Your budget needs to be nimble enough to handle sales that go up and down and inventory costs that change, but you also need some stability for your core operations. A smart approach would be to base your budget on a mix of fixed operational needs and goals tied directly to your revenue.

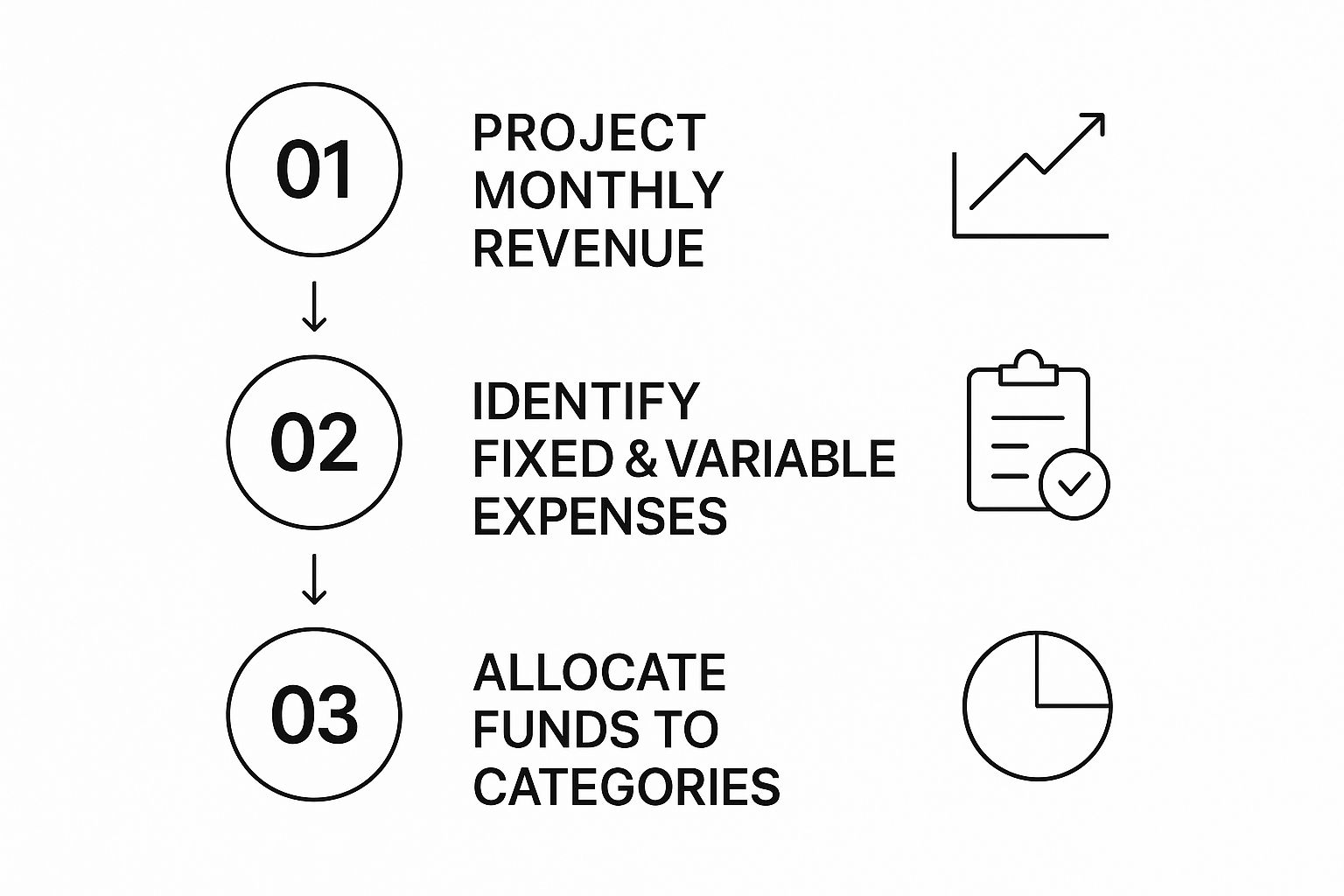

This simple workflow helps visualize how you can move from forecasting to final allocation.

The big takeaway here is the logical flow. You have to get a handle on what you expect to bring in before you can realistically decide what you can afford to spend.

To put this into practice, here is a sample table that shows what a monthly budget might look like for a small e-commerce business. It separates income from expenses and breaks those expenses down into fixed and variable costs, giving you a clear picture of where the money is going.

Sample Monthly Budget for a Small E-commerce Business

| Category | Item | Projected Amount | Notes |

|---|---|---|---|

| Income | Online Sales | $5,000 | Projected from last month's data. |

| Income | Pop-up Market Sales | $500 | One market event planned this month. |

| Total Income | $5,500 | ||

| Fixed Expenses | Shopify Subscription | $39 | Basic plan. |

| Fixed Expenses | Website Hosting | $20 | Annual plan, paid monthly. |

| Fixed Expenses | QuickBooks | $30 | Self-employed plan. |

| Fixed Expenses | Owner's Salary | $1,500 | Fixed monthly draw. |

| Variable Expenses | Raw Materials & Inventory | $1,650 | 30% of total projected income. |

| Variable Expenses | Shipping & Packaging | $440 | Estimated at 8% of income. |

| Variable Expenses | Marketing (Social Ads) | $550 | 10% of total projected income. |

| Variable Expenses | Transaction Fees | $165 | Approx. 3% of income. |

| Variable Expenses | Part-time Help | $300 | For the pop-up market event. |

| Total Expenses | $4,694 | ||

| Net Profit | $806 | Total Income - Total Expenses. |

This kind of breakdown transforms your budget from a list of numbers into a strategic tool, showing you exactly what's left over to reinvest, save for a rainy day, or pay down debt.

Allocating Funds for Key Business Functions

With a clear framework in place, the next step is to start assigning dollars to your specific business categories. This is the moment your budget stops being a document and starts being an operational game plan. You’re not just listing costs; you’re intentionally funding the activities that will push your business forward.

A budget isn't just about controlling spending; it's about directing your resources. Every dollar you allocate to marketing is a vote for growth. Every dollar for new software is a vote for efficiency. Be intentional with your votes.

Let's go back to our e-commerce store owner. Here’s a more detailed look at how they might divvy up their funds:

- Inventory & Supplies: Since this is a product business, this is a huge variable cost. They've decided to allocate 30% of their projected revenue to buying new materials and finished goods.

- Marketing & Advertising: To attract more customers, they're setting aside 15% of revenue. This will cover things like social media ads, their email marketing software, and maybe a collaboration with an influencer.

- Payroll & Compensation: The owner pays themselves a fixed salary, which is a predictable fixed cost. But they also budget for a part-time helper during busy seasons, making that a variable cost.

- Overhead & Operations: This bucket is for all the non-negotiable fixed costs that keep the lights on—things like website hosting, e-commerce platform fees from a service like Shopify, and their accounting software.

This practice of assigning funds is really the heart of budgeting. If you want to get more advanced in how you spread costs across different projects or departments, our guide on cost allocation methods is a great next step. Getting this right from the beginning ensures that every part of your operation has the fuel it needs to thrive.

Turning Your Budget into a Roadmap for Growth

A budget that only looks backward is a missed opportunity. It tells you where your money went, sure, but a truly powerful budget shows you where your money can go. This is where you shift from just tracking expenses to actively forecasting your future.

Think of it this way: you’re moving from being a passenger to being the pilot of your business. Instead of just reacting to the bills as they come in, you can start making confident, forward-thinking decisions about expansion, hiring, or that big equipment purchase you've been dreaming of.

From Past Data to Future Profits

So, how do you actually do this? You start with what you know. Look at your sales history from the last year or two. Can you spot the patterns? Maybe things always pick up in the fall and slow down in late winter. Use these real-world trends to map out a baseline revenue forecast for the next 12 months.

Once you have a handle on potential revenue, you can make some very educated guesses about your costs. For instance, if your cost of goods sold has consistently hovered around 30% of your sales, it's reasonable to apply that same percentage to your projected revenue. Suddenly, you have a much sharper picture of your potential profit month by month.

The real magic happens when your budget helps you answer the question: "If we nail our sales target in six months, what's our profit, and what can we do with it?" That's the kind of thinking that separates a business that's just surviving from one that's built to thrive.

This forward-looking mindset is more critical than ever. The global small business market was valued at an incredible $2.572 trillion in 2023 and is expected to nearly double to $4.985 trillion by 2032. While that signals huge opportunity, it also means the competition is getting tougher. A smart, predictive budget helps you claim your piece of that pie. You can dive deeper into these small business market projections on Entrepreneurshq.com.

Making Smart Moves with Strategic Investments

Forecasting isn’t just about numbers on a spreadsheet; it’s about funding the big moves that will take your business to the next level. Maybe you need to finally hire a dedicated marketing person or invest in software that automates the tedious parts of your job. These aren't just expenses—they're strategic investments that need to be planned for.

The best way to do this is to set your big goals and then work backward to figure out how to pay for them.

-

Your Goal: Hire a part-time assistant in six months.

-

The Plan: Start putting aside $800 a month right now to build up a cushion for their first few months of salary and training.

-

Your Goal: Buy a new piece of equipment for $12,000 next year.

-

The Plan: Open a separate savings account—what some call a sinking fund—and set up an automatic transfer of $1,000 every month. That way, the money is ready and waiting when you are.

This approach transforms your goals from vague wishes into concrete financial tasks. It takes the stress and uncertainty out of making big decisions because you know the capital will be there when you need it. Your budget stops being a restrictive document and becomes the very engine that drives your growth.

Keeping Your Budget Agile in a Changing Market

A budget isn't something you create in January and file away. Think of it less as a rigid blueprint and more as a living, breathing guide for your business. A static budget is a failing budget, especially today. When the market shifts—and it always does—a business that can't adjust its financial plan is taking a huge risk.

Just think about the last year. Maybe a key supplier hiked their prices by 20% because of supply chain issues. Or perhaps a new competitor popped up, forcing you to pour more cash into digital ads just to keep your head above water. If your budget is set in stone, these are full-blown crises. But if it's agile, they're just manageable adjustments.

Building in Flexibility From Day One

The secret to an adaptive budget is to plan for surprises before they happen. This means you can't allocate every single dollar you expect to bring in. The smartest move is to build a contingency fund right into your budget—a pool of cash set aside for the unexpected.

A good rule of thumb is to aim for 5-10% of your total expenses. This isn't your savings for a fancy new espresso machine for the breakroom; this is your "everything's gone sideways" fund. It's the money that lets you absorb that sudden price hike from your supplier without having to gut your marketing spend or, even worse, delay payroll. It gives you the breathing room to make clear-headed decisions instead of panicked ones.

A budget should be written in pencil, not in pen. Its real value comes from guiding your decisions as conditions change, not from being followed perfectly down to the last cent. Regular check-ins are what make this happen.

The Power of Regular Budget Reviews

So, how do you actually keep your budget responsive? The answer is simple, but it requires discipline: you have to look at it. Often. I’m a big advocate for a monthly "budget vs. actual" review. This is where you sit down, either by yourself or with your team, and compare what you planned to spend and earn against what actually happened.

This habit is absolutely essential for staying profitable and navigating a volatile economy. The current climate demands extra vigilance from business owners. For instance, while average monthly revenues for small businesses were around $531,900 in March 2025, that number actually marked a significant drop from the previous year. This downturn, detailed in reports on small business revenue trends from VenaSolutions.com, shows just how much inflation and rising costs are squeezing owners and forcing them to get smarter with their cash flow.

During your monthly review, ask yourself a few tough questions:

- Where did we go over budget? Was this a one-off surprise, or is it a new, permanent cost increase we need to account for from now on?

- Where did we come in under budget? Great! Is there an opportunity here to reallocate those savings to a more promising area, like a new ad campaign that's showing real potential?

- Did we hit our revenue targets? If not, what do we need to tweak in our sales strategy or spending plan next month to close the gap?

This proactive cycle of reviewing and adjusting helps you catch small financial leaks before they become catastrophic floods. It also uncovers opportunities you might have otherwise missed. Maybe you'll notice one marketing channel is crushing it while others are lagging. An agile budget lets you shift funds and double down on what’s clearly working. Finding ways to do more with less is always a winning strategy, and you can find more ideas in our guide on how to reduce business costs with 7 smart tips. This is what makes your small business budgeting a truly effective tool for growth.

Answering Your Top Small Business Budgeting Questions

Even with the best budget in hand, real-world questions always come up. That’s perfectly normal. Let's walk through some of the most common hurdles I see entrepreneurs face. Getting these right is key to building good financial habits and making sure your budget actually works for you.

Think of this as the practical advice you need when the numbers on your spreadsheet meet the chaos of daily business.

How Often Should I Actually Look at My Budget?

I've found that for most small businesses, a monthly review is the sweet spot. It’s frequent enough to catch problems before they snowball but not so often that you’re obsessing over minor daily blips. This monthly check-in is your financial pulse-check.

If you’re swamped, a deep dive every quarter is the absolute minimum. Any less than that, and you're flying blind. On the flip side, some businesses need to be more vigilant. If you run a seasonal shop or you're in a fast-moving industry, you might even want to peek at your cash flow and key spending every single week.

What’s the Single Biggest Budgeting Mistake?

It’s a classic, and it’s a killer: underestimating expenses while overestimating revenue. Every entrepreneur is an optimist—it’s practically a job requirement. But when it comes to your budget, you need to be a realist.

It’s so easy to get carried away by exciting sales forecasts. The real danger, though, lies in the costs you forget. I’ve seen countless new owners get tripped up by small things like software subscriptions that add up, or they simply have no cash set aside for that inevitable day when a critical piece of equipment breaks.

A good rule of thumb I always share is this: be pessimistic with your costs and conservative with your revenue. It's far better to end the month with a surprise surplus than to be in a panic trying to cover bills you didn't see coming.

Should I Pay Myself a Salary?

Yes. One hundred percent, yes. This is a non-negotiable part of building a real, sustainable business. You need to pay yourself a regular salary and log it as a fixed business expense, even if it’s a small amount to start.

Why is this so important? Two big reasons:

- It tests your business model. Your business has to prove it can stand on its own two feet and support its founder. If it can't, you don't have a viable business—you have an expensive hobby.

- It shows your true profit. Your time and effort aren't free. Factoring in your salary is the only way to get an honest look at your company’s actual profitability.

Treating your own pay as a mandatory cost from day one forces a level of financial discipline that pays off for years. It's interesting how this same principle of separating personal and "business" money applies at home, too. You can actually apply similar strategies to your household finances, which we cover in our guide on top family budget tips to save money. It’s all about smart financial management.

Ready to cut costs on essential business tools? With AccountShare, you can get access to premium software and subscriptions at a fraction of the price through secure, managed group buys. Stop overpaying and start saving. Check out how much you can save at AccountShare.