Cost Allocation Methods: Top Strategies for Fair Resource Sharing

Share

Why Every Business Needs Smart Cost Allocation Methods

Picture this: you're out for dinner with friends. One person orders an expensive lobster, while another just gets a simple salad. When the bill arrives, how do you split it? If you just divide it evenly, the salad-eater ends up paying for someone else's fancy meal. That awkward moment is exactly what businesses face every day when they need to distribute shared costs across different departments, projects, or products.

Without a fair system, some parts of the business feel like they're always paying for the lobster when they only had a salad. This is where cost allocation methods come in. They act like a financial GPS, guiding every dollar of shared expense to its rightful destination based on who actually used the resource and benefited from it. This isn't just about keeping the accountants happy; it's about making smarter decisions that fuel growth and keep your teams working together smoothly.

The Impact on Decision-Making and Morale

The way a company allocates costs sends a clear message about what it values. If a lean, efficient department gets stuck with the same overhead costs as a resource-heavy one, it's incredibly demotivating. Why would anyone try to save money if their efforts aren't recognized? A poorly designed system can crush morale and discourage the very cost-saving behaviors you want to encourage.

A well-structured system, on the other hand, builds a culture of accountability. It's a key part of any strategy to reduce business costs. For large organizations, the stakes are even higher. A stunning 30% to 50% of total costs are often tied up in internal allocations between departments or locations. When that much money is mismanaged, it doesn't just create friction—it can lead to disastrous strategic blunders. To dig deeper into this common business challenge, you can read the full research from Deloitte to learn more about why organizations struggle with cost allocation.

Visualizing the Allocation Challenge

The chart below shows the biggest hurdles companies face when they try to put effective cost allocation into practice.

As the data shows, problems like a lack of transparency, the wrong tools for the job, and confusion over who is responsible are major pain points. These issues prove that successful cost allocation is about more than just numbers—it’s about clear processes and good communication. Ultimately, smart methods provide the clarity needed to see which parts of your business are truly thriving and which need a little more support, transforming a routine accounting task into a powerful strategic tool.

Mastering The Big Three Cost Allocation Methods

While there are many ways to slice the financial pie, finance teams generally turn to three reliable cost allocation methods. Each one offers a different trade-off between simplicity and accuracy, making them a good fit for different company needs. Getting a handle on these foundational approaches is the first step toward building a fair and effective cost management system.

The Direct Method: Simple and Straightforward

Think of the direct method as a dependable pickup truck—it's uncomplicated, efficient, and gets the job done without extra frills. This method takes all the costs from a support department (like Human Resources or IT) and assigns them straight to the operating departments (like Sales or Manufacturing). It completely bypasses any services that support departments provide to each other.

For instance, a hospital could allocate the costs of its central administration office directly to the patient care wings based on the number of employees in each. It's a quick and easy calculation.

- Best For: Organizations with simple structures where support departments have very little interaction.

- Key Advantage: Its simplicity makes it easy to put into practice and for everyone to understand.

- Main Drawback: It's the least accurate method because it overlooks how support services are often interconnected.

The Step-Down Method: A More Logical Sequence

The step-down method, sometimes called the sequential method, is like a well-organized assembly line. It recognizes that support departments do, in fact, help each other out. It allocates costs in a sequence, starting with the support department that provides the most services to other departments. Once a department's costs are allocated, it's considered "closed," and no more costs are assigned back to it.

Imagine you have an IT department and an HR department. If IT provides more services to HR than the other way around, you’d first allocate all of IT's costs to HR and the operating departments. Then, you'd take the newly increased costs of the HR department and allocate them to the final operating departments. This approach gives a more precise picture than the direct method but still isn't perfect.

The Reciprocal Method: The Gold Standard for Accuracy

Finally, we have the reciprocal method—the Swiss Army knife of cost allocation. This is the most complex but also the most accurate of the three traditional cost allocation methods. It fully acknowledges that support departments provide services to each other at the same time. It relies on a set of simultaneous equations to calculate the true cost of each department by factoring in these mutual relationships.

A large corporation with a central legal team, an IT helpdesk, and an internal administrative pool would find this method useful. The legal team might need IT services, while the IT team needs legal advice on software contracts. The reciprocal method captures this two-way street, delivering the most precise allocation possible. This level of accuracy is vital for platforms like AccountShare that manage shared subscriptions, where understanding true usage is essential for fair billing.

To help you choose the right approach, here's a table comparing these traditional methods.

Comparison of Traditional Cost Allocation Methods

A detailed comparison showing the complexity, accuracy, and best use cases for direct, step-down, and reciprocal allocation methods

| Method | Complexity Level | Accuracy | Best Use Cases | Implementation Time |

|---|---|---|---|---|

| Direct | Low | Low | Simple organizations with minimal interaction between support departments. | Short |

| Step-Down | Medium | Medium | Organizations where support department interactions are mostly one-way. | Moderate |

| Reciprocal | High | High | Complex organizations with significant mutual services between support departments. | Long |

As the table highlights, the direct method is fast but sacrifices accuracy, while the reciprocal method delivers precision at the cost of complexity. The step-down method sits comfortably in the middle.

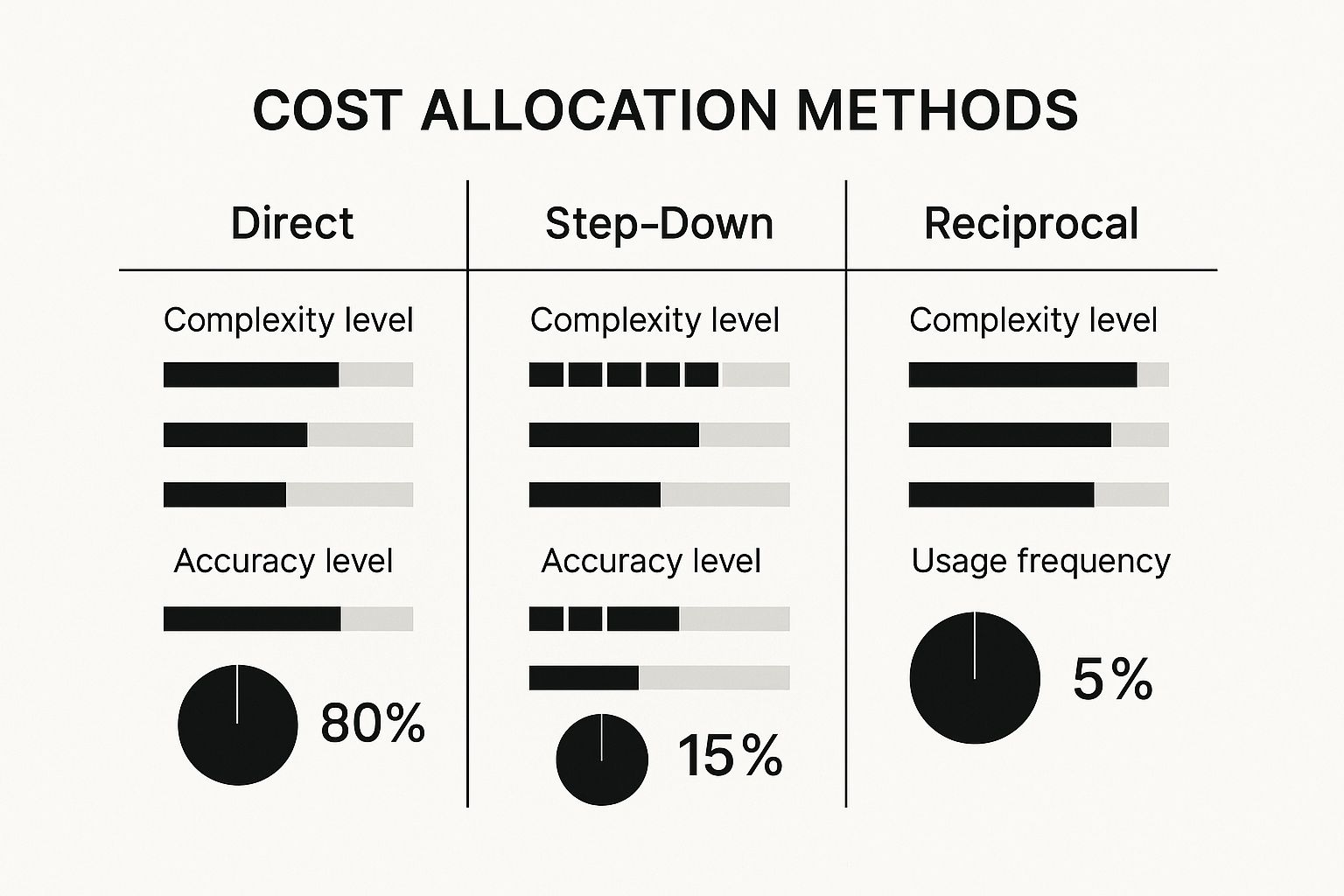

The infographic below offers a visual take on the trade-offs between these primary methods.

This visualization clearly shows a give-and-take: as accuracy and complexity rise from the direct to the reciprocal method, implementation becomes a bigger challenge.

Activity-Based Costing: A More Precise Way to Allocate Costs

While many cost allocation methods spread overhead costs evenly across departments, like spreading peanut butter on bread, Activity-Based Costing (ABC) offers a much more detailed approach. Instead of using broad metrics like department size or headcount, ABC digs deeper. It acts like a financial detective, tracing costs from the resources used to the specific activities they fuel, and ultimately, to the products or services that benefit.

This isn't just an accounting task; it's a way to uncover hidden truths about your business's profitability. Picture a company that makes two things: a standard part in huge quantities and custom parts in small batches. A simple allocation method might suggest the standard part is the big money-maker because of its high volume.

However, ABC could tell a different story. It might show that the custom orders, despite their low volume, need far less machine setup time, quality checks, and engineering support per item. Suddenly, those "low-volume" orders are revealed as highly profitable, while the high-volume product is just scraping by. This is the real advantage of ABC: it connects spending directly to the actions that generate costs.

Cost allocation methods like ABC deliver greater accuracy by tracking exactly how much each department uses a specific resource. For instance, IT costs could be divided based on the number of support tickets filed by each department or how much they print. You can explore cost allocation insights from Phocas Software to see how this method compares with others.

How to Implement Activity-Based Costing

Putting ABC into action is more involved than simpler methods, but the payoff in accuracy is well worth the effort. The process typically unfolds in these stages:

- Identify Activities: First, pinpoint all the key activities needed to create a product or deliver a service. This includes more than just production; it covers support tasks like ordering materials, setting up machines, inspecting products, and handling customer calls.

- Create Cost Pools: After identifying activities, group their related overhead costs into cost pools. For example, all expenses tied to setting up machinery—labor, power, and maintenance—would form a "Machine Setup" cost pool.

- Select Cost Drivers: For each cost pool, you need to choose a relevant cost driver. This is the factor that directly influences the costs in that pool. For the "Machine Setup" pool, the driver would be the number of setups. For "Quality Inspections," it would be the number of inspections.

-

Calculate the Activity Rate: Next, figure out the rate for each activity by dividing the total cost in the pool by the total volume of its cost driver.

- Formula: Total Cost in Pool / Total Cost Driver Volume = Activity Rate

- Allocate Costs: Finally, assign the overhead costs to your products or services. You do this by multiplying the activity rate by the amount of the cost driver each product uses. A product that needs 10 machine setups would be allocated 10 times the setup cost.

This granular process gives you a much clearer and more realistic picture of your cost structure. It shifts overhead allocation from an educated guess to a strategic instrument that can help you refine pricing, improve processes, and better distribute resources throughout your company.

Choosing Winning Cost Drivers That Actually Drive Results

If cost allocation methods are the recipes for financial fairness, then cost drivers are the star ingredients. They are the specific, measurable factors that directly link a cost to the activity that created it. Choosing the right ones is a mix of art and science. A poor choice leads to a system that seems logical but sparks confusion and resentment. A great choice creates a system that not only distributes costs fairly but also encourages smarter business decisions.

Think of a cost driver as the DNA of an expense—it reveals the true connection between a cost and its origin. Using a weak driver is like blaming an entire family for a mess one person made. A strong driver correctly points to the source, ensuring clear accountability.

Volume vs. Complexity: Choosing the Right Lens

A common mistake is to rely solely on simple, volume-based drivers. While they are easy to measure, they don't always tell the whole story. Imagine a logistics company that first allocated its vehicle maintenance costs based on the total number of packages each team delivered. It seemed fair enough, but it treated a one-pound envelope going across town the same as a 50-pound box headed to a remote, rural address.

The team handling rural deliveries felt unfairly burdened. Their package count was lower, but their trucks suffered more wear and tear from long distances and rough roads. The company wisely switched to a complexity-based driver: a "delivery complexity score" that considered package weight, distance, and route difficulty. This new method not only felt fairer but also resulted in a 70% reduction in allocation disputes and pushed teams to discover more efficient routes.

- Volume-Based Drivers: Measure quantity, such as the number of employees, square footage used, or units produced. They're straightforward but can be misleading.

- Complexity-Based Drivers: Measure effort or intensity, like server processing time, customer support ticket complexity, or project-specific engineering hours. They give a much clearer picture of who is using what resources.

To help you find the right drivers, here’s a look at how different industries might approach common shared costs.

Industry-Specific Cost Drivers and Applications

Examples of effective cost drivers used across different industries for various types of shared costs

| Industry | Cost Type | Recommended Driver | Measurement Method | Benefits |

|---|---|---|---|---|

| SaaS | Customer Support | Number of Support Tickets | Tracked via help desk software (e.g., Zendesk, Jira Service Management) | Encourages product improvements to reduce common issues and fairly charges high-touch customers. |

| Manufacturing | Factory Maintenance | Machine Hours | IoT sensors or manual logs of machine run-time. | Directly links maintenance costs to production intensity, not just output volume. |

| Real Estate | Property Management Fees | Square Footage Occupied | Measured from floor plans or lease agreements. | Simple, transparent, and directly ties management effort to the size of the space being managed. |

| E-commerce | Warehouse & Fulfillment | Order Complexity Score | Algorithm combining item count, weight, and special packaging requirements. | Moves beyond a simple "per-order" fee to account for labor-intensive orders. |

| Consulting | Shared Admin Support | Billable Hours per Project | Logged in time-tracking or project management systems. | Ensures projects requiring more administrative overhead bear a proportional cost. |

| Healthcare | IT & EMR Systems | Number of Patient Records Accessed | Audit logs from the Electronic Medical Record (EMR) system. | Connects system costs to departmental activity and patient load. |

This table shows that the best driver is always the one that most accurately reflects how a resource is consumed, moving beyond simple, one-size-fits-all metrics.

A Framework for Selecting and Testing Drivers

So, how do you discover the ideal drivers for your company? Start by asking these four essential questions:

- Is there a strong cause-and-effect relationship? Does the driver actually cause the cost to go up or down? For IT support costs, the number of support tickets submitted by a department is a much stronger driver than its total headcount.

- Is the data easy and cost-effective to track? A theoretically perfect driver is worthless if tracking it is more expensive than the cost you're allocating. Thankfully, modern business intelligence tools make capturing granular data easier than ever.

- Is the driver easy for everyone to understand? If department managers can't see the logic behind why a cost is assigned to them, they won’t trust the system or feel motivated to control the driver. Transparency is key.

- Does it encourage the right behavior? A good driver naturally steers teams toward efficiency. For instance, allocating software license fees based on active usage encourages departments to de-provision unused accounts. You can explore more ideas in our guide covering strategies for effective software license optimization.

By concentrating on drivers that mirror actual resource consumption, you can elevate your cost allocation from a simple accounting chore into a powerful instrument for strategic management and operational improvement.

Real Companies, Real Results: Cost Allocation Success Stories

Theory and frameworks are a great starting point, but the real measure of any business strategy is how it performs in the wild. When we move past the concepts, the stories of companies that have put new cost allocation methods into practice offer powerful, tangible lessons. These aren't just minor accounting tweaks; they are strategic changes that can reshape how a company operates, sets its prices, and measures profitability. Let's look at how a few different organizations used precise cost allocation to see real results and get ahead of the competition.

The SaaS Company That Redefined Its Service Model

Imagine a rapidly expanding Software-as-a-Service (SaaS) business. At first, they spread the cost of their customer success team evenly across all subscribers using a simple headcount-based approach. But as they grew, they found their support team was constantly overworked and running over budget. The turning point came when they switched to activity-based costing (ABC). The new system revealed a surprising fact: a small group of enterprise clients was behind over 60% of all support tickets and requests for new features.

This insight was a complete game-changer. The old, simple allocation method hid the true expense of serving their most demanding clients, making their standard subscription plans appear less profitable than they actually were. With this clear data, the company overhauled its service offerings. They created a premium support package for enterprise clients at a higher price, which not only paid for the extra support but also opened up a new revenue stream. The change led to a more manageable workload, better profitability, and clearer service levels for every customer.

The Healthcare Network That Discovered Hidden Gems

A regional healthcare network operated under a widespread assumption: its huge, urban flagship hospital was the main source of profit. Most overhead costs, like central administration and IT systems, were allocated based on patient volume. This naturally made the busy city hospital look like the star performer. But this logic was hiding a different truth.

When the network's finance department adopted a more detailed allocation method—one that considered the complexity of care and specific resource use—the numbers painted a very different picture. They discovered that their smaller, rural clinics were actually more profitable on a per-patient basis. These clinics handled simpler cases with great efficiency, using far fewer overhead resources than anyone realized. This discovery completely altered their growth strategy. Instead of building another large urban hospital, they began opening more satellite clinics in underserved rural areas, a move that was both financially smart and true to their mission.

The Manufacturer That United Its Business Units

Finally, think of a large manufacturing company with twelve separate business units. To cut costs, they decided to centralize functions like HR, finance, and procurement into a shared services center. The launch was difficult. Managers of the business units complained, saying the allocation method—a flat percentage of their revenue—was unfair and didn't match how much they actually used the services.

Instead of forcing the issue, the leadership team listened. They worked with the units to create a hybrid allocation model. IT costs were assigned based on the number of active user accounts, HR costs by employee headcount, and procurement costs by the number of purchase orders each unit generated. This transparent approach created a clear link between cost and consumption. The complaints stopped, and a sense of shared ownership took hold. The company not only saved money but also gained a clear view of its operational costs across the board, showing how the right cost allocation methods can bring even the most different parts of a business together.

The Smart Evolution Of Cost Allocation Methods Through History

Cost allocation didn't just pop up in a corporate strategy meeting one day. It has a surprisingly deep history that goes back almost a century, starting as an academic puzzle before becoming the business tool it is today. For a long time, it was just seen as a tricky accounting problem, not a strategic lever. But this early theoretical work paved the way for the refined methods we now rely on.

From Theory to Practice

The idea of fairly sharing costs has its roots in economics and mathematics. Game theory, which models how people make decisions in strategic situations, provided a powerful lens. One of the most influential early ideas was Ramsey pricing, a model developed way back in 1927 to figure out how to assign fixed costs while causing the least amount of economic friction. This showed that there were mathematically "fair" ways to split the bill for a shared resource. You can explore a detailed analysis of these foundational concepts and learn more about the history of cost allocation theory.

These abstract models, especially from cooperative game theory, proved perfect for solving massive, real-world puzzles. They offered blueprints for allocating costs for city infrastructure, national telecommunications networks, and huge joint business ventures. The screenshot below, from a key academic paper, gives a glimpse into the complexity of these early theoretical frameworks.

This document shows how economists and mathematicians used advanced formulas to model equitable cost distribution. This shift was critical; it turned cost allocation from a necessary chore into a tool for strategic planning.

Why Advanced Methods Are Now Essential

Despite being theoretically sound, these advanced cost allocation methods stayed in the realm of academia for decades. The main problem was a practical one: the calculations were just too complex for the tools available. Businesses had to stick with simpler, though less precise, methods out of sheer necessity.

Fast forward to today, and three major shifts have pulled these powerful theories from the textbook into the workplace:

- Computational Power: Modern software and computers can effortlessly run the complex algorithms that were once impossible to execute.

- Business Complexity: Today's companies, with their global reach, tangled supply chains, and shared-service platforms like AccountShare, need a much more exact way to allocate costs.

- Demand for Transparency: Everyone from department heads to investors now expects a clear, defensible explanation of how shared costs are divided and managed.

This convergence of factors has made sophisticated allocation not just a "nice-to-have," but a core business need. Companies finally have the tools to implement fair, strategically sound cost allocation, transforming a historical academic exercise into a real source of competitive strength.

Building a Cost Allocation Strategy That Actually Works

Turning cost allocation from frustrating guesswork into a strategic tool doesn't happen by chance. It needs a practical roadmap that builds a system tailored to your organization. The first and most critical step—one many businesses skip—is to conduct a thorough cost allocation audit. This is more than just number-crunching; it’s about understanding where you currently stand, identifying key stakeholders, and setting clear goals that support your business strategy, not just your accounting rules.

Once you have this foundation, you can start designing a system that makes sense for you. This involves carefully choosing the right cost allocation methods for different kinds of expenses.

Laying the Groundwork for Success

Before you allocate a single dollar, you need to define what success will look like. This begins with a clear set of objectives. Are you trying to get a better handle on product profitability, push departments to be more mindful of the resources they use, or simply spread overhead costs more fairly? Each of these goals might point you toward a different allocation approach.

Next, you need to map out every cost pool and its potential drivers. This is where you dig into the details, looking beyond simple metrics like headcount. For instance, a marketing team's costs might be driven by the number of campaigns they launch, while IT support costs are better tied to the number of support tickets generated. Getting these drivers right is essential for earning credibility and buy-in from department heads. Our detailed guide on SaaS cost optimization offers more ideas on how tracking usage can reveal significant value.

Designing and Testing Your New System

With your objectives and potential drivers identified, you can begin to match methods to cost types.

- For straightforward costs: The direct method is perfect for expenses with a clear beneficiary. Think of allocating the cost of a specific software license directly to the one department that uses it.

- For shared support costs: The step-down method is a good fit for allocating HR or general administrative costs in a logical, tiered sequence.

- For complex, interconnected operations: Activity-based costing (ABC) is the gold standard. It paints the most accurate picture by connecting costs to the specific activities that consume resources.

However, you shouldn't try to roll out a new, intricate system across the entire company all at once. A better approach is to launch a pilot program with one or two departments. This minimizes risk and lets you gather feedback, spot unexpected problems, and fine-tune your model in a controlled environment. During the pilot, be sure to track key performance indicators (KPIs) that measure not just financial accuracy but also user satisfaction and understanding.

Ensuring Adoption and Driving Value

A technically perfect allocation system is useless if no one trusts or uses it. This makes change management a crucial part of the process. Create a clear communication plan that explains the "why" behind the changes, showing how a fairer system gives everyone better data for making decisions. Offer training and practical templates to help teams see how the new model works and how their actions affect the costs assigned to them.

By following this structured approach, you can build a cost allocation system that is much more than a simple accounting task. It becomes a dynamic tool that delivers real insights, encourages efficiency, and drives measurable business value.

For teams managing shared digital subscriptions, getting allocation right is especially important. AccountShare makes this easier by allowing for group purchasing and transparent management of shared accounts, making sure costs are split fairly based on who actually accesses and uses the service.