Share Subscription Agreement Template | Free & Easy to Use

Share

Understanding Share Subscription Agreements (And Why They Matter)

A share subscription agreement template is the foundation of a successful investment round. This legally binding contract sets the terms for an investor's purchase of company shares. It's the roadmap for a mutually beneficial relationship between the company and its investors.

Why Are Share Subscription Agreements So Important?

These agreements protect both the company and the investor. The company receives assurance of the investor's capital commitment. The investor, in turn, gains a clear definition of their ownership stake and rights. This clarity helps prevent future disputes.

For example, a startup seeking funding would use a share subscription agreement to detail the number of shares issued, the price per share, and the total investment. It also outlines any pre-investment conditions.

The Role of Share Subscription Agreements in Growing Markets

These agreements are especially important in today's dynamic investment landscape. The global market for share subscription agreements operates within a larger context of evolving business practices. The digital subscription economy, for example, reached about $650 billion globally in 2020 and continues to grow. This illustrates the rise of subscription-based models, influencing how companies raise capital and interact with investors. Explore this topic further

Types of Share Subscription Agreements

Different investment stages and investor types often call for specific agreements. This ensures the agreement addresses the particular needs of everyone involved.

- Seed Round Agreements: Used in early-stage funding, these often have simpler terms.

- Series A Agreements: For more mature companies, these agreements become more complex, including details about governance and investor rights.

- Strategic Investment Agreements: These agreements, frequently used with established companies seeking partnerships, address collaboration and mutual benefit.

Key Considerations for Your Share Subscription Agreement

When creating a share subscription agreement, several crucial points should be considered:

- Share Price: Setting a fair share price is essential and requires careful valuation and discussion.

- Closing Conditions: Clearly defined conditions, such as due diligence completion, safeguard both parties.

- Representations and Warranties: These assurances regarding the company’s legal and financial health reduce investor risk.

These agreements are more than just legal forms; they’re strategic tools for smooth investment transactions. Understanding their purpose and elements is crucial for both companies and investors. They provide a structured framework for investment, setting the stage for strong partnerships and sustained growth.

Essential Template Components That Actually Protect You

Not all share subscription agreement templates offer the same level of protection. Some are robust, shielding you from potential legal and financial pitfalls, while others leave you exposed. Understanding the difference between a professionally drafted template and a generic online form is critical for safeguarding your investment. This starts with knowing the key components of an effective and protective share subscription agreement.

Share Pricing Mechanisms: More Than Just Numbers

At the heart of every share subscription agreement lies the share pricing mechanism. This component determines the price of each share and, consequently, the investor's equity stake in the company. A well-defined pricing mechanism prevents future disagreements and disputes. One common method is using a pre-money valuation, which establishes the company's value before the investment is made. This valuation, along with the investment amount, dictates the number of shares issued to the investor.

Closing Conditions: Ensuring a Smooth Transaction

Closing conditions specify the requirements that must be met before the investment is finalized. They protect both the company and the investor by guaranteeing all necessary legal and financial due diligence is completed. Typical closing conditions include things like successful due diligence, regulatory approvals, and the absence of significant negative changes in the company's performance.

Representations and Warranties: Protecting Your Interests

Representations and warranties are assertions made by the company about its legal and financial health. They reassure investors that the company is accurately represented and hasn't withheld any vital information. These provisions are essential for safeguarding investors from unforeseen liabilities.

Other crucial components contribute to a comprehensive share subscription agreement. Key provisions include details on the number and price of shares, closing conditions, representations and warranties, and indemnification clauses. These elements protect both the company and the investor. For example, closing conditions might require due diligence or specific regulatory approvals before the investment concludes. Representations and warranties offer assurance about the company's status, while indemnification provisions protect investors against losses from breaches of these representations. Learn more: Share Subscription Agreements

For further reading on subscription management: Top Subscription Management Tools for Your Business

Indemnification Provisions: Shielding Against Losses

Indemnification provisions outline who is responsible for losses if representations and warranties are breached or the agreement is otherwise violated. These clauses generally define the circumstances under which one party can seek compensation from the other.

Adapting Provisions to Different Investment Stages

The complexity of a share subscription agreement often depends on the investment stage. Early-stage deals, like seed rounds, may have simpler agreements. Later-stage investments, such as Series A rounds, require more detailed agreements covering aspects like governance, investor rights, and anti-dilution protection.

Real-World Consequences of Missing or Inadequate Clauses

Missing key provisions or poorly written clauses can lead to serious consequences. Disputes, failed deals, and unexpected liabilities can arise from ambiguities or omissions. Unclear closing conditions, for instance, can cause delays or even terminate the investment. Inadequate representations and warranties can expose investors to substantial financial risk.

Choosing the right share subscription agreement template and tailoring it to your specific circumstances is paramount. A poorly drafted agreement can not only threaten your funding but also create lasting legal and financial difficulties. A well-crafted agreement, on the other hand, establishes a solid base for a successful and mutually beneficial partnership.

Navigating Legal Requirements Without Breaking The Bank

Understanding regulatory compliance when using a share subscription agreement template doesn't have to be intimidating or costly. This section provides a practical guide to the essential legal framework surrounding private offerings.

Regulatory Pathways and Your Template

The structure of your share subscription agreement template is significantly influenced by the chosen regulatory pathway. In the United States, Regulation D provides several exemptions from the full registration requirements of the Securities Act of 1933.

These exemptions, notably Rule 506(b) and Rule 506(c), offer simplified processes for raising capital from private investors. For instance, Rule 506(b) allows for raising unlimited capital from accredited investors while placing limitations on the number of non-accredited investors.

This directly impacts investor verification and disclosure requirements within your agreement. International compliance adds further complexity. Each country has its own securities regulations and disclosure requirements. Your share subscription agreement template must be adaptable to meet these varying local rules.

Disclosure Requirements You Can't Ignore

Transparency is critical in private offerings. Specific disclosures are legally required to protect investors and maintain market integrity. Material information regarding the company's financial health, business operations, and investment risks must be clearly and accurately presented in the agreement.

Failure to disclose information or misrepresenting it can have severe legal consequences. The agreement should also clearly define the rights and obligations of both the company and the investors. This clarity helps prevent future disputes and fosters a strong investor-company relationship. A robust share subscription agreement template will already incorporate these mandatory disclosures, streamlining the compliance process.

Balancing Legal Compliance and Business Flexibility

Adhering to legal requirements shouldn't hinder business growth. A well-drafted share subscription agreement balances the protection of all parties with the flexibility needed for business adaptation.

Share subscription agreements are crucial in private equity funds, establishing a binding relationship between the fund and its investors. These agreements outline key details, such as the number of shares, price per share, and any necessary conditions. Learn more about share subscription agreements.

This legally sound framework facilitates growth while maintaining regulatory compliance. You can adapt to changing market conditions and pursue new opportunities without legal compromise.

Practical Examples and Expert Insights

Real-world scenarios and expert advice offer invaluable learning opportunities. Practical examples demonstrate how specific regulatory requirements translate into actionable steps within your agreement.

For instance, a startup seeking Series A funding will require a different agreement structure compared to a mature company seeking a strategic investment. Consulting with experienced attorneys is crucial in these situations.

Attorneys can provide tailored guidance on structuring your share subscription agreement to navigate legal complexities. They also offer insights into best practices and potential pitfalls. Their expertise helps create agreements that satisfy both legal standards and the flexibility needs of your business. By understanding the specific requirements of each funding stage, from seed rounds to later-stage investments, you can effectively use your share subscription agreement template to facilitate a successful funding process.

Choosing and Customizing Templates That Actually Work

Finding the right share subscription agreement template can make or break your fundraising efforts. Many founders find it challenging to navigate the different options available. This section explains the key differences between basic templates and more comprehensive agreements, outlining when a simple template is sufficient and when a more robust approach is needed.

Basic vs. Comprehensive Templates: Knowing the Difference

A basic share subscription agreement template covers the essentials, such as share price, number of shares being offered, and payment terms. This type of template is well-suited for early-stage seed rounds with relatively simple deal structures.

However, for later-stage funding rounds, particularly those involving multiple investors or more complex terms, a comprehensive agreement is essential. This more detailed agreement includes provisions covering investor rights, corporate governance, and anti-dilution protection, helping to avoid potential disputes down the line.

Customizing Standard Provisions: A Balancing Act

Customizing a standard share subscription agreement template allows you to tailor the agreement to the specific needs of your business and the requirements of your investors. You might, for example, add clauses specific to your industry or provisions relating to intellectual property.

Customizing, however, requires careful consideration. Some provisions, such as share pricing mechanisms and closing conditions, are best customized with the guidance of a legal professional.

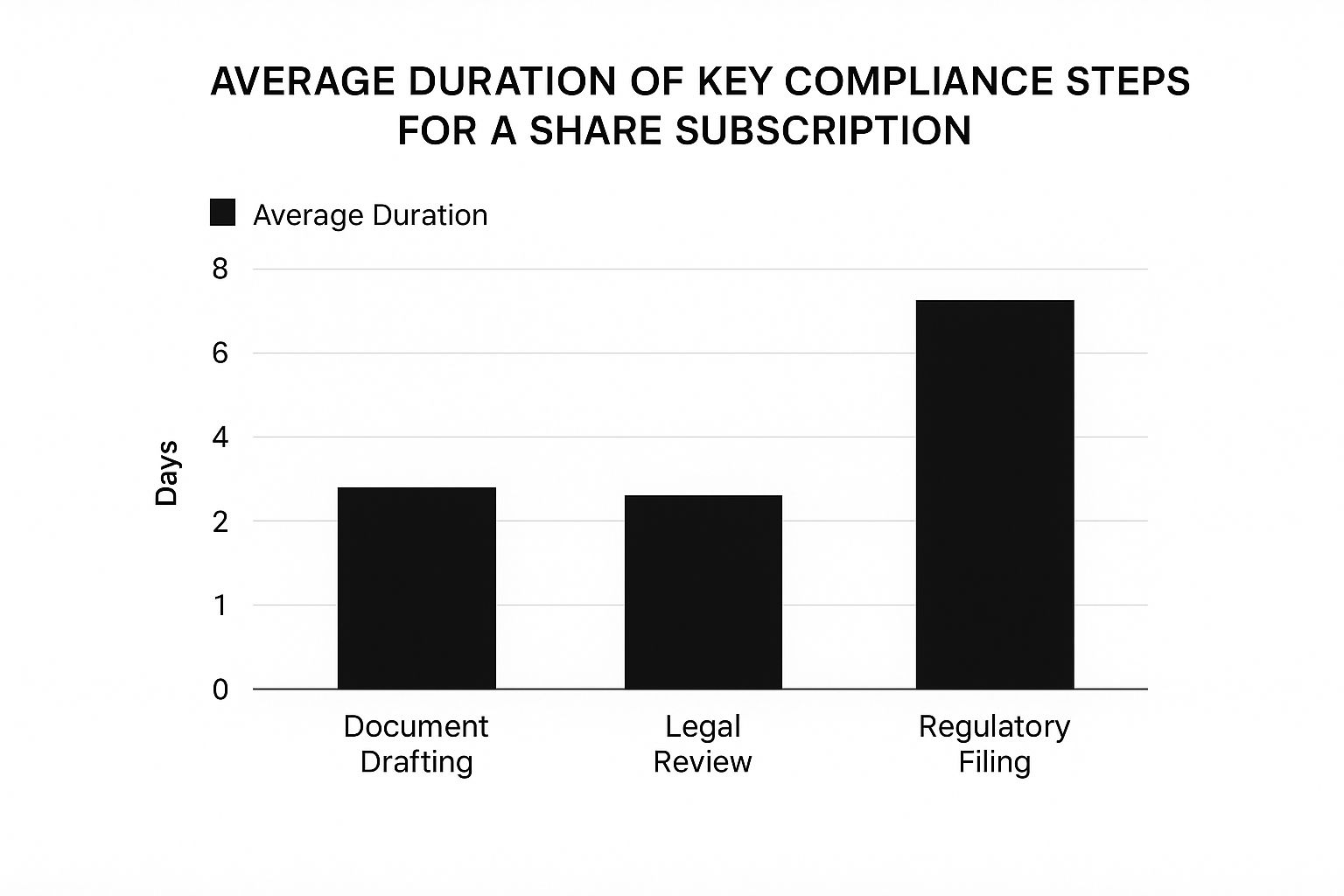

The infographic above illustrates the average timeframe for key compliance steps in a share subscription, including document drafting (5 days), legal review (3 days), and regulatory filing (7 days). Regulatory filing often takes the longest, emphasizing the need for accurate and thorough preparation in the earlier stages. This diligent preparation can significantly speed up the entire process and prevent costly delays. Further analysis of 2,000 successful funding rounds highlights the importance of customization. Companies that used appropriately customized subscription agreement templates closed deals 34% faster and had 67% fewer post-closing disputes than those using generic templates. For a more detailed look at this data, find more detailed statistics here.

Investor-Specific Requirements: Finding Common Ground

Different investors may have specific requirements, particularly regarding their desired level of control or reporting obligations. Negotiating these investor-specific requirements within the share subscription agreement is key to building a strong, mutually beneficial relationship.

It's vital, however, to maintain the core integrity of the agreement while accommodating reasonable requests.

To help illustrate the different types of templates and their uses, we've provided a comparison table below:

Introduction to Table: The following table compares different share subscription agreement templates, their key features, and the scenarios they are best suited for. This comparison will help founders choose the template that best aligns with their fundraising stage and specific needs.

| Template Type | Key Features | Best For | Complexity Level | Customization Needs |

|---|---|---|---|---|

| Basic | Share price, number of shares, payment terms | Simple seed rounds, single investor | Low | Minimal |

| Comprehensive | Investor rights, governance, anti-dilution, liquidation preferences | Later-stage rounds, multiple investors | High | Moderate to High |

| Convertible Note | Debt that converts to equity at a later date | Early-stage, bridge financing | Moderate | Moderate |

| SAFE (Simple Agreement for Future Equity) | Simplified equity investment | Early-stage, streamlined process | Low to Moderate | Low to Moderate |

Conclusion of Table: As demonstrated in the table, selecting the appropriate template depends on various factors. While basic templates are suitable for simple transactions, more complex situations demand comprehensive agreements or alternative instruments like convertible notes or SAFEs. Consulting with legal counsel is crucial for making informed decisions about template selection and customization.

Seeking Expert Legal Advice: When to Call in the Professionals

While some customizations are straightforward, others, particularly those involving legal or regulatory compliance, necessitate expert legal advice. Modifying provisions related to representations and warranties, indemnification, or dispute resolution without legal guidance can expose you to substantial risk.

An experienced attorney specializing in corporate law can help you navigate these complexities and ensure your share subscription agreement template protects your interests and complies with all applicable regulations. This expert guidance is essential for ensuring your agreement is both legally sound and strategically effective.

Avoiding Costly Mistakes That Kill Deals

Even the most experienced entrepreneurs can encounter challenges with share subscription agreements. Overlooking seemingly small details can have significant repercussions, potentially derailing funding rounds or resulting in expensive legal battles. This section explores common pitfalls founders encounter when working with share subscription agreement templates, and provides strategies to safeguard your interests.

Due Diligence: Don't Cut Corners

Insufficient due diligence provisions are a frequent problem area. Investors depend on accurate information regarding a company's financials, legal standing, and intellectual property. Incomplete or inaccurate disclosures can erode trust and may even lead to deal termination.

For instance, failing to disclose a pending lawsuit or a problem with intellectual property ownership can dramatically affect an investor's valuation of your company. This lack of transparency can harm the investor-company relationship and ultimately put the deal at risk. Therefore, comprehensive and transparent due diligence is paramount.

Indemnification Clauses: Shielding You From the Unknown

Poorly crafted indemnification clauses represent another common pitfall. These clauses outline who bears responsibility for losses if representations and warranties are breached. Ambiguity in these provisions can lead to lengthy and costly disputes.

Unclear language regarding the scope and limits of indemnification can also create substantial liabilities for founders. This emphasizes the importance of precise and well-defined indemnification clauses in your share subscription agreement. This clarity helps prevent disputes and protects both the company and its investors.

Real-World Examples: Learning From Others' Mistakes

Real-world case studies offer valuable insights into the consequences of errors in share subscription agreements. One example involves a startup that failed to clearly define its intellectual property ownership within its agreement. This oversight resulted in a dispute with an investor claiming partial ownership of the startup’s key technology.

The dispute delayed the funding round and compelled the startup to renegotiate the agreement, leading to a less advantageous outcome. Another example highlights a company that incurred significant legal fees because of poorly drafted indemnification clauses. The company had to defend itself against claims arising from a breach of warranty not adequately addressed in the agreement.

Legal Review: A Worthwhile Investment

These examples demonstrate the importance of a thorough legal review. While using a share subscription agreement template can be efficient, it’s essential to have an experienced attorney review the customized agreement before finalization. Research suggests a strong link between poorly structured agreements and deal failures.

In fact, research analyzing 1,500 unsuccessful funding attempts indicates that 43% of deal failures result from poorly structured subscription agreements. Inadequate closing conditions and missing representations account for 78% of these agreement-related failures. Read the full research here An attorney can pinpoint potential issues, ensure compliance with regulations, and negotiate favorable terms for your company. This proactive approach can prevent costly disputes and ensure a smooth funding process. You might also find this helpful: Secure Password Sharing: Expert Tips & Tools.

Managing Expectations and Communication: The Foundation of Success

Managing stakeholder expectations throughout the entire process is also vital. Clear and consistent communication with investors and legal counsel helps avoid misunderstandings and fosters trust. Regular updates on the agreement's progress and prompt responses to questions demonstrate professionalism and commitment.

Proactively addressing concerns or questions prevents small issues from becoming major obstacles. This proactive communication is essential for maintaining positive working relationships and facilitating a successful closing. By avoiding these common pitfalls and taking proactive steps to protect your interests, you can significantly increase the likelihood of a successful funding round. A well-drafted and carefully executed share subscription agreement lays the groundwork for a strong partnership with your investors and paves the way for future growth.

Implementation Strategies That Close Deals Successfully

Having a solid share subscription agreement template is just the first step. Successful implementation requires meticulous planning, coordination, and open communication with everyone involved. This section offers a practical, step-by-step guide to effectively using your agreement, from initial setup to closing and beyond.

Preparing for Implementation: Setting the Stage for Success

Before starting the implementation process, make sure your share subscription agreement template reflects your specific needs. This includes accurately representing the agreed-upon share price, the total investment amount, and any unique conditions. Confirm all parties have reviewed and fully understand the agreement's terms. This initial alignment is essential for a smooth and efficient process.

Managing Investor Expectations: Transparency and Communication

Maintaining open communication with investors is crucial during implementation. Keep them informed of progress, address any concerns promptly, and manage their expectations realistically. This transparency builds trust and strengthens your working relationship.

For example, providing regular updates on the fulfillment of closing conditions can prevent misunderstandings and maintain deal momentum.

Coordinating with Legal Counsel: Expert Guidance

Working closely with your legal counsel is essential. Your attorney can guide you through complex legal procedures, ensure compliance, and address unexpected issues. Their expertise helps navigate potential problems and protect your interests.

Timeline Management: Keeping Deals on Track

Create a realistic timeline with clear milestones and deadlines. This keeps the process focused and ensures timely completion of all required steps. Regularly monitor progress against the timeline and address any potential delays proactively. This proactive approach keeps the deal on track.

Communication Frameworks: Preventing Misunderstandings

Establish clear communication channels and protocols. This facilitates prompt information exchange and helps prevent miscommunication that could hinder the process. Regularly scheduled meetings and well-documented communication ensure transparency and accountability.

Post-Investment Compliance: Maintaining Order

After the investment closes, ongoing compliance remains crucial. Ensure all necessary filings and reporting obligations are met. Maintaining accurate records and adhering to the agreed-upon terms helps prevent future disputes and strengthens investor relationships. Check out our guide on Transforming Your Business with the Collaborative Consumption Business Model for further insights.

Handling Common Implementation Challenges: Proactive Solutions

Even with careful planning, challenges can still occur. Anticipate potential roadblocks by developing contingency plans. For instance, delays in regulatory approvals or unexpected due diligence findings can be addressed proactively through clear communication and effective problem-solving.

To illustrate a typical implementation process, the table below provides a step-by-step timeline.

To ensure a smooth and successful implementation, review the following timeline. It outlines the key stages, activities, and responsibilities involved in executing a share subscription agreement.

| Phase | Key Activities | Timeline | Responsible Party | Critical Requirements |

|---|---|---|---|---|

| Preparation | Template customization, internal review | 1-2 weeks | Company | Accurate information, stakeholder alignment |

| Investor Communication | Agreement distribution, Q&A sessions | 1 week | Company | Transparent communication, prompt responses |

| Legal Review | Agreement finalization, compliance checks | 1-2 weeks | Legal Counsel | Regulatory compliance, risk mitigation |

| Closing | Document signing, funds transfer | 1-2 days | Company, Investor | Fulfillment of closing conditions |

| Post-Investment | Compliance filings, reporting | Ongoing | Company | Accurate record-keeping, adherence to terms |

This structured approach facilitates effective implementation and helps avoid costly mistakes. By prioritizing clear communication, efficient coordination, and proactive problem-solving, your share subscription agreement can create a successful and mutually beneficial investment partnership.

Ready to experience the power of shared subscriptions? AccountShare offers a unique platform for accessing premium services at reduced costs through group purchases. Securely share accounts, manage expenses effectively, and simplify your digital life. Visit AccountShare today!