How to Reduce Monthly Expenses and Save More

Share

If you want to get serious about cutting your monthly bills, you can't just guess where your money is going. You need a crystal-clear picture of your spending habits first. This means tracking everything, sorting it out, and then pinpointing the non-essential costs that are ripe for cutting. The whole point isn't to live like a monk; it's to gain the knowledge you need to make deliberate choices with your money.

Your Starting Point for Cutting Monthly Costs

Before you can slash a single bill, you have to get honest about your financial habits. Think of it as a personal expense audit. This is the bedrock of taking back control of your cash flow. It’s about moving past assumptions and facing the hard numbers, one dollar at a time.

The idea is straightforward: for one full month, track every single penny that leaves your account. That means the morning coffee, the automatic bill payments you’ve forgotten about, and every last impulse buy. Whether you use a fancy budgeting app, a simple spreadsheet, or a good old-fashioned notebook doesn't really matter. Consistency is what counts here.

Categorizing Your Spending for Clarity

Once you’ve got a month of data, it’s time to sort everything into buckets. A really effective and popular way to do this is with the 50/30/20 rule, which gives you a great visual of how your money is being divided up.

- 50% for Needs: These are the absolute essentials. We're talking about your mortgage or rent, utilities, groceries, and getting to work.

- 30% for Wants: This is the fun stuff—the discretionary spending you enjoy but could survive without. Think dining out, concert tickets, and your collection of streaming services.

- 20% for Savings & Debt Repayment: This slice is for your future. It's about aggressively paying down debt and building your savings.

Using this framework can be an eye-opener. You might realize your "Wants" are inching up toward 40%, which explains why there's nothing left for savings at the end of the month. To really get a handle on this, focusing on mastering budgeting principles that align with this model is a game-changer.

An expense audit isn't about shaming yourself for past purchases. It's about arming yourself with the facts you need to make smarter, more conscious decisions from this day forward.

Identifying Your Budget Leaks

With all your spending neatly categorized, you can finally spot the "leaks"—those small, sneaky costs that bleed your bank account dry over time. These are the low-hanging fruit, the easiest cuts to make without feeling like you're sacrificing your entire lifestyle.

To get you started, here's a quick look at some common problem areas and how to tackle them right away.

Common Monthly Expense Leaks and Quick Fixes

This table highlights some of the most frequent areas where money quietly disappears and gives you a simple, actionable first step to plug the leak.

| Expense Category | Common Leak | Quick Fix |

|---|---|---|

| Subscriptions | Forgotten free trials that turned into paid services. | Log into your bank or PayPal account and review all recurring payments. Cancel anything you don't use. |

| Food & Dining | Frequent takeout or daily coffee shop visits. | Challenge yourself to a "no-spend" week on dining out. Track how much you save. |

| Utilities | "Phantom load" from electronics left plugged in. | Unplug chargers and devices when not in use, or use a power strip to turn everything off at once. |

| Shopping | Impulse buys driven by sales or social media ads. | Institute a 24-hour waiting period before making any non-essential purchase over $50. |

Finding these leaks isn't just about saving a few bucks here and there. This initial audit creates the blueprint for every other strategy you’ll use to shrink your monthly expenses for good. It's your first major step toward financial control.

Tackling Your Largest Bills: Housing and Debt

Alright, now that we’ve plugged the smaller leaks, it’s time to look at the heavy hitters in your budget. For most of us, that means housing and debt payments. These are the two expenses that eat up the biggest chunk of our income month after month.

It’s easy to think of these as fixed costs, totally out of your control. But you’d be surprised. Making even a small dent here can free up more cash than cutting out dozens of lattes. It takes more effort, sure, but the payoff is huge and lasting.

Reevaluating Your Housing Costs

Your rent or mortgage is probably the single biggest line item on your budget. This makes it the most powerful lever you have for creating real financial breathing room.

If you’re renting, don’t just automatically sign that lease renewal. You have a chance to negotiate. Do your homework first—see what similar places in your neighborhood are going for. If you’ve been a great tenant (always paying on time, keeping the place in good shape), bring that up! Even knocking $50 or $100 off the monthly rent makes a massive difference over a year. You might also want to use a rent allowance calculator to see if you qualify for any financial help.

For homeowners, refinancing can be a game-changer, but only if the timing is right. A good rule of thumb is to consider it only if you can lock in a new interest rate that's at least one full percentage point lower than your current one. It's a bit of paperwork, but it can lower your monthly payment and save you thousands over the life of the loan.

Smart Strategies for Debt Management

High-interest debt, especially from credit cards, is a financial anchor. It just weighs you down. If you're only making minimum payments, you're mostly just paying off interest and barely touching the actual debt. It’s a cycle that can last for decades.

One of the most effective ways to break free is to consolidate your debts. This usually means getting a personal loan or finding a balance transfer credit card that offers a 0% introductory APR. You use that new, low-interest loan to wipe out all your high-interest balances.

Suddenly, you have just one payment to worry about, and it’s at a much friendlier interest rate. This doesn't just simplify your life; it helps you get out of debt faster because more of your money goes toward the principal. Mastering this is a core part of figuring out https://accountshare.ai/blogs/new/how-to-save-money-each-month effectively.

Key Insight: Trimming your biggest expenses isn't about making dramatic sacrifices. It's about smart, strategic moves—like negotiating rent or refinancing a loan—that permanently lower your monthly costs and give you more financial flexibility.

Smart Strategies for Daily Spending Habits

Once you've wrestled the big recurring bills into submission, the next frontier is your daily spending. These are the small, consistent habits that quietly add up and can either support or sabotage your budget.

This isn't about pinching every penny until it screams. It’s about becoming a more conscious consumer—someone who makes intentional choices with every purchase. The idea is to shift from just reacting to your needs and wants to proactively planning for them. You’d be amazed at how a few small, deliberate tweaks in your daily routine can free up a surprising amount of cash over a year, all without feeling like you're missing out.

Master Your Grocery Bill with Meal Planning

Food is one of those variable expenses with a massive potential for savings. We've all been there: you walk into the grocery store without a plan and walk out having spent a fortune on impulse buys. Or you get home, you're exhausted, and suddenly expensive takeout seems like the only option.

Meal planning is your secret weapon here.

Seriously, just dedicating one hour a week to this can be a game-changer. Before you even think about a list, look at what you already have in your pantry, fridge, and freezer. Build your meals around those items first. This one simple step prevents you from buying duplicates and ensures you actually use what you have before it goes bad.

From there, you can shop with a purpose:

- Follow the sales. Let the weekly flyer guide your menu. If chicken is on sale, plan a few chicken-based meals.

- Buy in bulk—but be smart about it. Stock up on non-perishable staples like rice, pasta, and canned goods when you find a great price. Just make sure you have the space and will actually use it.

- Make leftovers your friend. Cook bigger batches on purpose. A "leftover night" saves you from cooking, and packing the extras for lunch the next day saves a ton of money over buying lunch out.

Become a Smarter Shopper

Learning how to cut back on monthly expenses is really about adapting to the world around you, especially when prices are on the rise. And people are getting incredibly resourceful.

A recent Federal Reserve report gave us a fascinating look into this. When faced with higher prices, 63% of adults started buying cheaper alternatives, and 61% simply used less of certain products to make them last longer. Many also hit the pause button on major purchases to keep their cash flow healthy. It's a clear signal that people are spending more mindfully.

Conscious consumption isn't about sacrifice; it's about aligning your spending with what you truly value. Every dollar you save on an impulse buy is a dollar you can put toward a more important financial goal.

You can apply this same mindset to all that "fun money" spending—the non-essentials that bring you joy but can also blow up a budget in a hurry. The trick is to create a little friction.

Instead of buying something on the spot, try putting a 24-hour waiting period in place for any non-essential purchase over a set limit, say $50. You'll find that most of the time, that initial "I have to have it" feeling just... disappears. This simple habit is your best defense against buyer's remorse and a great way to separate a real need from a passing want.

Eliminating Subscription Creep and Recurring Fees

Let's talk about the silent budget killers: recurring fees and subscriptions. That $9.99 charge you forgot about, the free trial that rolled over into a paid plan—these little leaks can sink a budget. This slow drain is often called subscription creep, and it's more common than you think. The first step to plugging the hole is a full, honest audit of every recurring payment.

Seriously, grab your bank and credit card statements from the last few months. Go through them line by line and highlight every automatic charge. You’ll probably be surprised by what you find. Forgotten streaming services, apps you haven’t opened in ages, maybe even a gym membership from two years ago. We've all been there.

For a deep dive into hunting down and axing these charges, our guide on how to cancel unwanted subscriptions has you covered.

Beyond Cancellation: Smart Optimization

Just canceling services isn't the only move. A smarter, more modern approach is to optimize the subscriptions you actually use and love. This is where group-buying services have really changed the game, letting you legally and securely share the cost of family or group plans.

Think about it. Platforms like AccountShare connect people who want to split the bill for a single premium subscription. Instead of paying full price for a family plan when you only need one or two slots, you can join a group and pay just for your "seat." You keep the services you want for a fraction of the cost.

The goal isn't just to cut services, but to cut the cost of the services you value. Optimizing your subscriptions through cost-sharing is one of the most effective ways to lower your recurring bills without sacrificing your lifestyle.

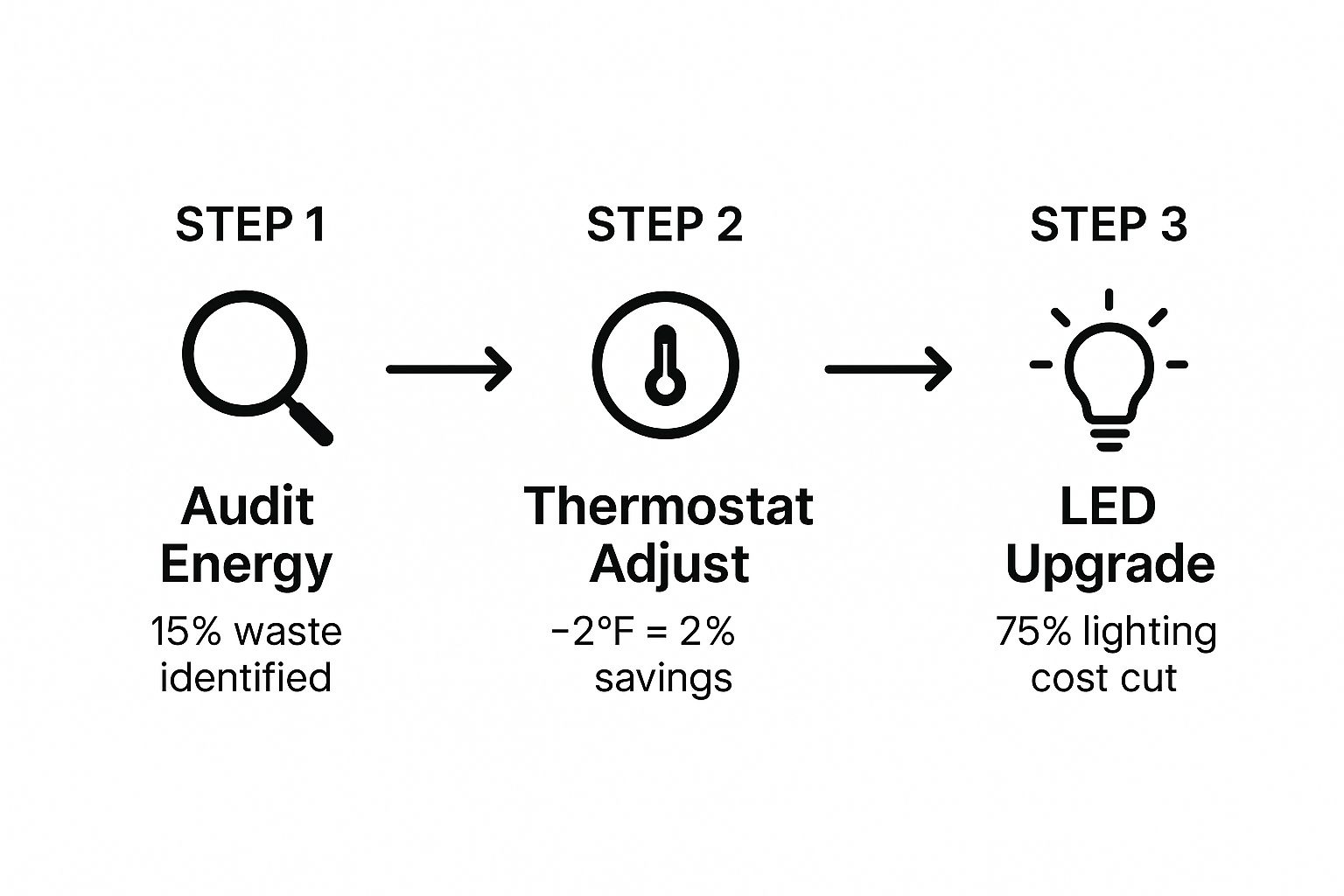

This flow shows how small, focused changes can lead to big savings, a principle that works just as well for subscriptions as it does for your utility bills.

The key takeaway is that a methodical audit, followed by strategic moves like using cost-sharing platforms, can unlock significant savings hiding in plain sight.

Auditing All Your Recurring Bills

Don't stop with streaming services. Apply that same critical eye to your other big recurring bills, especially your phone and internet. Providers almost always have better deals available, but they aren't exactly shouting them from the rooftops for existing customers. You often have to ask.

Take a hard look at your data usage, for instance. Are you paying for an unlimited plan when you rarely break 10GB a month? A five-minute call to your provider to switch to a more suitable plan could easily save you hundreds a year.

If you want to get really granular with your phone and internet bills, checking out some actionable telecom cost management strategies can show you how the pros audit invoices and find savings.

How an Emergency Fund Slashes Future Costs

Trimming your monthly bills isn't just about having more cash in your pocket today. It's one of the smartest things you can do to prevent a financial fire drill tomorrow. Think of an emergency fund as your financial first-aid kit—it's the buffer that stands between a surprise expense and a mountain of high-interest debt.

Without that cushion, a sudden car repair or an unexpected medical bill can send you scrambling for credit cards or personal loans. That doesn't just solve the immediate problem; it saddles you with a brand new monthly payment, trapping you in a cycle that’s tough to break.

Building this safety net is all about playing financial offense. When you have a dedicated stash of cash, you can handle a $1,000 surprise without flinching. More importantly, you sidestep the crippling interest charges that can easily double or triple the original cost over time. It keeps your financial goals from getting knocked completely off course.

Why Is Saving So Hard Right Now?

If you feel like you’re swimming upstream trying to save money, you’re in good company. The current economic climate has made building that emergency fund a real challenge for millions of people.

Bankrate's Annual Emergency Savings Report paints a clear picture: nearly 73% of Americans say they're saving less because of inflation, rising interest rates, and income changes. When faced with an unexpected $1,000 bill, 13% of people said they’d have to cut back on other essentials just to cover it—a testament to how determined people are to stay out of debt.

This data really drives home a crucial point: even a small emergency fund gives you the breathing room you need to handle life’s curveballs without torpedoing your entire budget.

An emergency fund is the ultimate cost-reduction tool. It transforms a potential financial crisis into a manageable inconvenience, saving you from the high price of desperation debt.

Practical Steps to Build Your Fund

You don't need a huge chunk of cash to get started. The real secret is to begin small and stay consistent. Seriously, even tucking away $20 or $50 a week can grow into a substantial sum over a year. The best way to make it stick? Put it on autopilot.

Here are a few simple, actionable ways to start building your fund today:

- Automate It. The easiest win. Set up an automatic transfer from your checking account to a separate high-yield savings account the day you get paid. Treat it like any other bill.

- Bank Your Windfalls. Get a small bonus at work, a tax refund, or some birthday cash? Before you even think about spending it, slide at least half of it directly into your emergency fund.

- Trim and Transfer. This is where your cost-cutting efforts pay off twice. After you manage online subscriptions and cancel a service, immediately redirect that money. If you saved $15 a month, set up a recurring $15 monthly transfer to your savings.

Taking these small, steady steps creates a powerful financial shield. It’s one of the most effective strategies for anyone serious about reducing their monthly expenses for good, making sure one bad day doesn’t wipe out months of hard work.

Got Questions? Let's Find Some Answers.

Even the most well-laid plans to cut your monthly costs can hit a snag. It's totally normal to run into questions or feel a little stuck. Let's walk through some of the most common hurdles I see people face and get you some clear, practical answers to keep you moving forward.

Where Should I Look for the Biggest, Fastest Savings?

If you need to free up cash now, don't get bogged down in the small stuff. Go straight for the "Big Three": housing, transportation, and food. These are almost always the heaviest hitters in anyone's budget. While trimming a few subscriptions is great, making one smart change in these areas can have a much bigger impact.

Think about it: refinancing your mortgage could literally save you hundreds each month. Even successfully negotiating a small rent reduction at renewal time makes a huge difference over a year. On the food front, I've seen small families slash their grocery bills by $200-$400 a month just by committing to a solid meal plan and cutting down on eating out. These aren't tiny tweaks; they're the big levers you can pull for immediate relief.

How Can I Possibly Budget on an Irregular Income?

Budgeting with a variable income can feel like trying to build a house on shifting sand. The secret isn't to create a rigid budget, but a flexible plan that can adapt.

First things first, figure out your "bare-bones" number. This is the absolute minimum you need to cover your non-negotiables—rent, utilities, basic groceries. That’s your survival line. Then, in the months when you have a windfall, funnel everything above that number into a separate savings account. This is your buffer. When a lean month comes along, you'll pull from that buffer to cover your essentials without panicking.

A fluctuating income demands a flexible budget. Ditch the rigid monthly spreadsheet and focus on covering your core expenses first. Use the good months to build a cushion for the lean ones.

This method transforms the feast-or-famine cycle into a much smoother, more predictable financial reality.

What if I Just Get Tired of All This?

Oh, budget fatigue is absolutely a real thing. It’s that moment when you're just sick of pinching pennies and feel like all your hard work isn't paying off. When that feeling creeps in, you have to stop and reconnect with your "why."

Why did you even start this? Was it to finally get out of debt? Save up for a down payment on a house? Or just to have a little breathing room at the end of the month?

- Keep Your Goal in Sight: Stick a picture of that dream house on your fridge. Write your "debt-free" date on a sticky note on your mirror. Make your motivation visible.

- Look How Far You've Come: Don't just focus on the mountain ahead. Look back at the progress you've already made. Seeing those numbers go down (debt) or up (savings) is a huge boost.

- Build in a Little Fun: A budget that has no room for joy is doomed to fail. You have to plan for small, guilt-free treats. It’s what keeps you from burning out and giving up entirely.

Staying the course isn't about being perfect. It’s about consistently reminding yourself what you’re working for—the financial freedom that's waiting on the other side.

Ready to take a big bite out of your subscription costs? AccountShare helps you keep the premium services you love for a fraction of the cost by making it safe and simple to share accounts with a group. See how much you can save by visiting https://accountshare.ai today.