Manage Online Subscriptions and Reclaim Your Budget

Share

We’ve all been there. That free trial you signed up for ages ago quietly starts charging your card, and you don’t notice for months. It’s a classic tale. The secret to getting a handle on your subscriptions is to stop letting them happen to you and start actively managing them. This one shift in mindset can turn a bunch of tiny, annoying fees into some serious annual savings.

The Sneaky Cost of Subscription Overload

It’s easy to underestimate how much "subscription creep" is actually costing you. It’s usually pretty innocent at first. You sign up for a streaming service to watch one show, grab a software tool for a quick project, or pay for a news site to get past a paywall. By themselves, these charges are small potatoes.

But those small leaks can compound and overwhelm your budget faster than you think. Let's say you have three streaming platforms at $15 a pop, a design app you barely touch for $20, and a premium music account for another $10. That's $75 every single month. Over a year, you’ve just spent $900 on services that are probably just collecting digital dust.

It's More Than Just Money

The weight of all these subscriptions isn't just financial. It also creates a kind of mental clutter—a low-grade, persistent hum of anxiety in the back of your mind. Every recurring charge is a small decision you keep putting off, which leads to a feeling of financial fatigue and general disorganization.

The real problem with subscription overload isn’t the services themselves, but our passive acceptance of the cost. When you start actively deciding what provides real value, you take back control of your money and clear out that mental clutter.

This whole world of recurring payments is becoming a huge part of our economy. Projections show the global digital subscription market could surpass a mind-boggling $1.5 trillion by 2025. This explosion shows just how baked-in subscriptions are to modern life, making the ability to manage them an absolutely essential skill. You can dig deeper into these ecommerce trends and see for yourself how they're affecting us.

Why You Need to Act Now

Ignoring your subscriptions isn't just a tiny oversight; it's a real financial leak. Think about the common pitfalls:

- The Forgotten Trial Trap: That "free" week you signed up for rolls into a monthly charge you don't catch for half a year.

- The Slow Price Hike: Services often bump up their prices without much fanfare, and your bill slowly inflates without you noticing.

- The Redundancy Riddle: Are you paying for two different music streaming apps? Or maybe multiple cloud storage accounts? It’s more common than you’d think.

Taking the time to audit and organize your subscriptions isn’t about depriving yourself of things you enjoy. It’s about being intentional. It’s about making sure your hard-earned money goes toward things that actually make your life better.

Conducting Your Personal Subscription Audit

Before you can get a handle on your online subscriptions, you have to know exactly what you’re paying for. This isn't just a quick scan of your latest credit card bill; it's a deep dive to uncover every single recurring payment, especially those sneaky ones you’ve completely forgotten about.

Think of it as becoming a financial detective for your own life. The goal is to create a complete master list of all your active subscriptions. You'll want to jot down the service name, how much it costs, the renewal date, and which card or account is being charged. Getting this right is the single most important step toward regaining control.

Where to Look for Hidden Subscriptions

Recurring charges have a funny way of hiding in plain sight. To do this right, you need to be methodical and check more than just your main credit card.

Your online banking portal is the best place to start. Most banks let you search and filter your transaction history, so take a good look at the last 12 months of statements. Hunt for any charge that repeats.

To make this faster, use search terms like:

- "Subscription"

- "Membership"

- "Monthly"

- "Annual"

- Specific service names you might use, like Netflix, Adobe, or Spotify.

Don't forget to check PayPal. It’s a classic spot for "set it and forget it" payments. Log in, head to the "Payments" section, and click "Manage automatic payments." You might be shocked at what’s been quietly drawing funds from your account.

The point of this audit isn't to feel bad about what you find. It's about empowerment. Having a complete, accurate list is the key to making smarter financial decisions from here on out.

To make sure you don't miss anything, I've put together a quick checklist. Work through these locations one by one to build your master list.

Your Subscription Audit Checklist

This simple checklist ensures you uncover every subscription tied to your name.

| Review Location | What to Look For | Pro Tip |

|---|---|---|

| Credit Card Statements | Recurring charges from the past 12 months. | Look for small, unfamiliar charges. Many free trials convert to paid plans without a big notification. |

| Bank Account Statements | Any automatic debit or ACH payment. | Use your bank's search function for keywords like "subscription" or "membership." |

| PayPal Account | Review your "Automatic Payments" list. | Check both active and inactive payments to see your history. Cancel anything you no longer use. |

| App Stores (Apple/Google) | Check the "Subscriptions" section in your account settings. | These are often forgotten, as they're billed directly through the app store, not the service provider. |

| Email Inboxes | Search for "invoice," "receipt," or "your subscription is renewing." | Set up a folder or label for all subscription-related emails to make this easier next year. |

Once you’ve gone through these sources, you'll have a comprehensive view of where your money is going each month.

Don't Forget Your App Stores

Mobile app subscriptions are notoriously easy to overlook. Thankfully, both Apple and Google provide a central hub to see every active subscription linked to your account.

-

For Apple Users: Navigate to

Settings, tap your name, and then selectSubscriptions. -

For Android Users: Open the

Google Play Storeapp, tap your profile icon, then go toPayments & subscriptions.

Now that you have your complete list, it's decision time. If you’ve found subscriptions you don’t recognize or simply don't need anymore, it's time to take action. For a detailed walkthrough of what comes next, you can learn how to cancel unwanted subscriptions and put a stop to those charges for good.

This audit gives you the full picture. The next step is using that clarity to make smarter choices.

Alright, you’ve got your complete list of subscriptions staring back at you. Looking at that long inventory can be a little overwhelming, I know. But we're going to break it down with a simple framework that makes the next part much easier.

Instead of just deciding "keep" or "cancel," we’ll sort every single service into one of three buckets. This gives you more flexibility and helps you not just cut costs, but actually get more value out of the subscriptions you decide to keep. It’s all about making deliberate choices, not just doing a one-time purge.

The "Must-Keep" Bucket

Let's start with the easy ones. These are your non-negotiables—the services so baked into your daily life that you can't imagine going without them. Maybe it's the project management tool your team relies on or the streaming service that's become your family's go-to for movie night.

To figure out if something is a "must-keep," ask yourself a few direct questions:

- Have I actually used this in the past 30 days?

- Does it genuinely save me a significant amount of time, money, or headache?

- If I canceled it right now, would my day-to-day routine or work immediately suffer?

If you get a clear "yes" to these, it goes straight into the Must-Keep pile. No second-guessing. These are the keepers.

The "Cut-It-Loose" Bucket

This category is for the obvious dead weight. We're talking about the free trials you forgot to cancel, the tool you signed up for to solve a one-time problem six months ago, or that app you just don't find interesting anymore. This is where you find the low-hanging fruit.

It's wild, but a recent survey showed that the average person underestimates what they spend on subscriptions each month by over $130. The "Cut-It-Loose" bucket is where you find and get that money back.

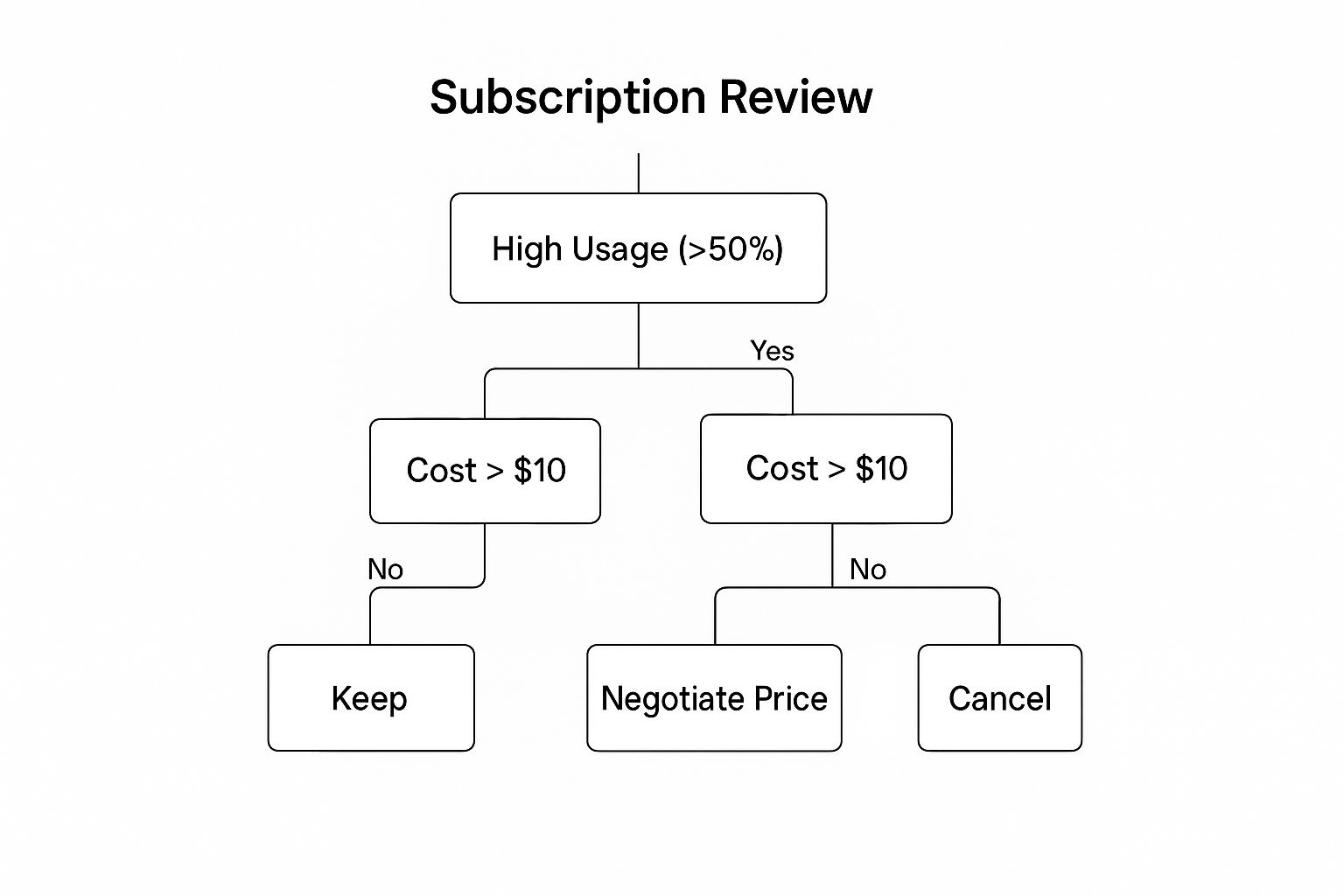

This quick decision tree can help you spot the easy cuts based on how often you use a service and what it costs.

As you can see, low usage is the main red flag. Cost then helps you decide whether to try and negotiate or just cancel it outright.

Honestly, be ruthless here. If a subscription isn't solving a problem or bringing you joy, it's just cluttering your finances. The goal is to trim these without hesitation.

The "Optimize-It" Bucket

Now for the interesting part. This is where the biggest savings are often hiding in plain sight. The "Optimize-It" bucket is for subscriptions you find useful but suspect you aren't using in the smartest, most cost-effective way.

Think about these possibilities:

- Downgrade Your Plan: Are you paying for a premium package but only ever touching the basic features? Dropping to a cheaper tier could give you everything you need for less.

- Go Annual: For your "Must-Keep" subscriptions, check for an annual billing option. Many services will knock 15-20% off the price if you pay for a year upfront. It’s an easy win.

- Share the Bill: Does the service offer a family or group plan? This is a game-changer. Using a platform like AccountShare lets you securely split the cost with friends or family, effectively turning a $20/month solo subscription into a manageable $5/month share.

By sorting your subscriptions this way, you move from a simple audit to an ongoing strategy for financial health. It’s about becoming a smarter, more active consumer of the digital services you use every day.

Choosing the Right Subscription Management Tool

Let's be honest, trying to track every single subscription with a spreadsheet is a chore you’ll probably abandon after a month. It’s tedious, prone to errors, and requires constant manual updates. This is exactly why dedicated subscription management tools exist—to automate the grunt work and give you a clear, centralized view of all your recurring payments.

The right tool can completely change how you handle your subscriptions, turning a chaotic list of charges into an organized dashboard. Most of these apps link directly to your bank accounts and credit cards to automatically sniff out recurring payments and categorize them for you. You get renewal alerts, find duplicate services you didn't know you had, and can finally see exactly where your money is going each month.

Key Features to Look For

When you start comparing apps, you'll see they aren't all created equal. My advice? Zero in on the features that provide the most practical value for your specific situation. You don't need the most complex tool with every bell and whistle; you just need the one that solves your biggest headaches.

Here are the core capabilities I always look for:

- Centralized Dashboard: This is non-negotiable. You need a single screen showing every subscription, its cost, and the next renewal date.

- Automatic Renewal Alerts: Timely notifications before a payment hits your account give you a crucial window to cancel or even renegotiate.

- Service Discovery: A lifesaver feature that automatically scans your accounts to find those "ghost" subscriptions you completely forgot about.

- Spending Insights: Simple reports or charts showing your subscription spending over time can be a real eye-opener, helping you grasp the long-term financial impact.

The entire point is to find a tool that makes your life easier, not more complicated.

Comparing Top Subscription Managers

While many apps offer similar basic functions, they often cater to different types of people. Some are built for the meticulous budgeter who wants to track every last penny, while others are designed for folks who just want simple, effective reminders and an easy way to cancel.

For instance, one popular app might be fantastic at detailed financial analysis, making it perfect for data-savvy users. Another might prioritize a clean, minimalist interface with a one-click "cancel" button, which is ideal for someone who feels overwhelmed by complicated financial apps.

The most important factor isn't the number of features an app has, but how well it fits into your life. The best tool is the one you'll actually use consistently.

This is especially true today. With internet access now reaching 68.7% of the global population, the subscription economy is only getting bigger, and most of this is happening on our phones. This makes a user-friendly mobile app absolutely essential for any tool you choose. You can dive deeper into the global shift to digital on DataReportal.

If you’re managing subscriptions for a small business or a team, your needs will be a bit different. You'll want to look for features geared toward collaboration and cost-sharing. For that, you can check out our guide on the top subscription management tools for your business to see options built for professional use.

Picking the right tool from the get-go really sets you up for long-term success in finally getting a grip on your subscriptions.

Advanced Strategies to Get More Bang for Your Buck

Alright, you've cleaned house and organized your subscriptions. Now it's time for the fun part: moving beyond basic tidying and starting to actively squeeze every bit of value out of the services you pay for. Managing your online subscriptions like a pro isn't just about hitting "cancel." It’s about becoming a smarter, more strategic consumer.

Think of it as graduating from a passive bill-payer to an active manager of your digital life. For example, take a look at your "can't live without" services. Many of them offer a pretty hefty discount if you pay annually instead of monthly. For a service you know you'll use all year, a simple switch to an annual plan can easily save you 15-20% right off the bat.

Adopt Pro-Level Tactics

To really master your subscriptions, you need to think like a power user. Integrating a few clever habits into your routine can lead to some serious savings and much better security over the long haul.

-

Try Subscription Cycling: This is a game-changer, especially for seasonal services. Why are you paying for that live sports package during the off-season? Get into the habit of strategically pausing or canceling subscriptions you only use for a few months a year. You can always fire them back up when the new season starts.

-

Leverage Family Plans: It's easy to overlook group plans, but they're a goldmine for savings. A family or premium plan might look more expensive at first glance, but once you split the cost between a few people, the price per person drops dramatically. This is honestly one of the most effective ways to slash your costs without losing access.

-

Use Virtual Credit Cards: I'm a big fan of services like Privacy.com. They let you create a unique virtual card for every single subscription. You can set spending limits, pause a card with one click, and most importantly, keep your real credit card number safe from data breaches.

These tactics put you back in the driver's seat. It becomes much harder for forgotten free trials or sudden price hikes to sneak past you.

The goal here is simple: pay only for what you're actually using, and make sure you're paying for it in the most efficient way possible. This mindset shifts your subscription list from a drain on your wallet to a well-managed part of your budget.

Share Subscriptions Securely and Ethically

Sharing is a fantastic way to get premium features for less, but we've all been there—the awkward texts about who owes what, the security risks of handing out your password. This is where a dedicated platform like AccountShare comes in. It takes all the hassle out of the process by handling the payment collection and providing secure access without you ever having to expose your main password. It makes the entire experience smooth and safe for everyone.

For even more ideas on cutting costs, check out our guide on how to save money on streaming services.

The subscription model isn't going anywhere; it's taken over entire industries, especially in media. This shift is all about consumers wanting continuous access rather than one-time ownership, which pushes companies to get smarter with their analytics and billing to keep us hooked. If you want to dive deeper, you can discover more insights about subscription growth trends to see where the market is headed. By using these advanced strategies, you're not just saving money—you're playing the game like an expert.

Got Questions? We've Got Answers

Once you start digging into your subscriptions, a few questions almost always pop up. Let's tackle some of the most common ones I hear, so you can feel confident in managing your services for the long haul.

How Often Should I Really Audit My Subscriptions?

There isn't a one-size-fits-all answer here, but from my experience, a thorough, deep-dive audit like the one we've walked through is a must-do at least once a year.

To stay on top of things, though, I suggest a quick quarterly review. Just 15 minutes every three months is usually all it takes to spot new trial subscriptions, catch unexpected price hikes, or cancel something you no longer need before it renews. This simple habit transforms a dreaded annual project into a quick, easy routine.

The goal is to make subscription management a routine, not a rare event. Regular, smaller check-ins are far more effective than one massive yearly clean-up.

This proactive approach stops that slow financial drain that happens when small, forgotten charges build up month after month.

What’s the Best Way to Handle a Price Increase?

First off, don't just sigh and accept it. When that email lands in your inbox announcing a price hike, take a moment to consider your options. If it's a service you can't live without, see if switching to an annual plan could lock in a better rate or at least soften the blow of the increase.

If the service is one you were on the fence about, use this as a chance to re-evaluate its value. Ask yourself:

- Is it still worth the new price?

- Are there more affordable alternatives that do the same thing?

- Could I downgrade to a cheaper plan and still get the features I actually use?

You'd be surprised how often simply contacting customer support to mention the price increase can lead to a discount or a special offer. It never hurts to ask.

Is It Actually Safe to Share Account Access?

Sharing your password directly with friends or family is a recipe for trouble. It’s a huge security risk, leaving your personal information exposed and potentially getting you locked out of your own account. This is precisely why using a platform designed for sharing is the only way to go.

Tools like AccountShare were created to solve this exact problem. It acts as a secure go-between, letting you split the costs and share access without ever revealing your actual login credentials. This gives you peace of mind and an automated system for handling payments, taking all the awkwardness and risk out of the equation.

Ready to take control and get the most value from your subscriptions? With AccountShare, you can securely split the cost of your favorite services, from streaming to software, without the usual headaches. Stop overpaying and start sharing smartly. Explore how AccountShare works today!