Cancel Unwanted Subscriptions: Your Complete Freedom Guide

Share

The Real Story Behind Subscription Overload

We've all been there. You see a cool new productivity app or a streaming service with a must-watch show. The "free" trial is just a click away. You enter your credit card info, promising yourself you'll cancel it before the first payment. A few months later, a mysterious $19.99 charge pops up on your statement. After digging through old emails, you realize you've been paying for a service you haven’t touched since day one. If this story hits close to home, you're not imagining things. This cycle of signing up and forgetting is exactly why so many of us feel buried under our own expenses.

We've all been there. You see a cool new productivity app or a streaming service with a must-watch show. The "free" trial is just a click away. You enter your credit card info, promising yourself you'll cancel it before the first payment. A few months later, a mysterious $19.99 charge pops up on your statement. After digging through old emails, you realize you've been paying for a service you haven’t touched since day one. If this story hits close to home, you're not imagining things. This cycle of signing up and forgetting is exactly why so many of us feel buried under our own expenses.

This pile-up of small, recurring charges isn't just bad luck; it’s often by design. Many companies have mastered the art of making the sign-up process incredibly simple while making the journey to cancel unwanted subscriptions a frustrating trek through hidden menus and unhelpful support chats. It's not just about the money you lose—it's about the mental weight of keeping track of all these tiny financial drains. The stress of finding these forgotten charges can make you feel like your finances are spiraling out of control.

The Psychology of Subscription Traps

Companies tap into some basic human psychology to get us on the hook and keep us there. They rely on a few common tendencies to keep the payments rolling, often without us putting up a fight.

- Decision Fatigue: At the end of a long day, the last thing anyone wants is another complex task. Companies know this. Signing up is effortless, but cancelling? That often involves multiple steps, confirmation links, or even a dreaded phone call. This friction is just enough to make you think, "I'll get to it later."

- The "Free" Illusion: A free trial doesn’t feel like a real financial commitment. We treat it like a no-risk experiment. The problem starts when the trial ends and the auto-payments kick in, quietly blending into our regular financial activity. We get used to seeing the charge and just assume it's another one of our regular bills.

- Loss Aversion: Even if you hardly use a service, the idea of losing access can spark a fear of missing out (FOMO). When you go to cancel, companies often display a long list of all the amazing benefits you're about to lose, making you pause and second-guess your decision.

Why Subscription Fatigue Is a Real Problem

This feeling of being swamped by recurring payments has a name: subscription fatigue. It's the mental exhaustion that sets in when you're trying to manage countless payments for software, streaming, meal kits, and online courses. This is a big deal, with research indicating that about 39% of subscribers worldwide are thinking about cutting at least one subscription in the coming year. This shift shows people are getting smarter about these costs and are starting to reclaim control. You can dive deeper into these consumer trends by checking out these subscription behavior statistics on whop.com. Recognizing this overwhelm is the first step to getting your financial clarity back.

Uncovering Every Hidden Subscription Draining Your Money

It's time to put on your detective hat and start a financial investigation. Many people are shocked when they finally do a deep dive, discovering everything from forgotten website domain renewals to software licenses billed under an unfamiliar parent company name. The first place to start your hunt is where the money actually leaves: your bank and credit card statements. Don't just skim them; meticulously review at least three to six months of transactions.

It's time to put on your detective hat and start a financial investigation. Many people are shocked when they finally do a deep dive, discovering everything from forgotten website domain renewals to software licenses billed under an unfamiliar parent company name. The first place to start your hunt is where the money actually leaves: your bank and credit card statements. Don't just skim them; meticulously review at least three to six months of transactions.

Look for recurring payments, no matter how small. A charge for $4.99 might seem insignificant, but over a year, that's nearly $60 for something you might not even use. As you analyze these statements, pay close attention to the merchant names. Sometimes, the name on your statement won't match the service you signed up for. A quick search for "AWL*Charge Pro" might reveal it’s the billing name for that photo editing app you trialed last fall. This systematic review is your first line of defense to cancel unwanted subscriptions that are flying under the radar.

Digging Deeper: The Not-So-Obvious Hiding Spots

Beyond your primary bank accounts, forgotten subscriptions often lurk in less obvious places. Think about any payment platforms you use. Do you have a card linked to a PayPal, Apple Pay, or Google Pay account? These services can have their own recurring payment agreements that won't always appear with clear descriptions on your main bank statement. It's essential to log into each of these platforms and check your active payment authorizations.

Similarly, consider old email addresses. Many of us have that one ancient Hotmail or Yahoo account we barely check. It could be tied to a service you signed up for years ago, with billing notifications going completely unnoticed. I once helped a friend uncover a $120 annual charge for a cloud storage service linked to a college email they hadn't used in a decade. A simple search for terms like "subscription," "invoice," "receipt," and "your order" in these old inboxes can unearth a surprising number of costly relics.

To help you organize your search, I've put together a table outlining the most common places these hidden charges are found and how to spot them.

| Where Hidden Subscriptions Actually Hide |

|---|

| Strategic locations and methods for uncovering forgotten subscriptions with practical search techniques |

| Location/Account Type | Common Subscription Types | Search Strategy | Warning Signs |

|---|---|---|---|

| Bank/Credit Card Statements | Streaming services, software, news/magazines, gym memberships, subscription boxes | Review 3-6 months of statements for any recurring charges. Look for small, regular debits. | Vague merchant names (e.g., "Digital River," "AWL*"), charges on the same day each month, small price increases. |

| Digital Wallets (PayPal, Apple Pay, Google Pay) | Mobile apps, online tools, gaming subscriptions, digital content | Log into each account and navigate to "Pre-approved payments," "Subscriptions," or "Automatic Payments" sections. | Payments authorized years ago, services you no longer use, recurring payments to unknown companies. |

| Old Email Inboxes | Domain renewals, cloud storage, old software licenses, forgotten online courses | Search for keywords: "subscription renewal," "your invoice," "payment successful," "billing," "receipt." | Welcome emails from services you don't recognize, "Your subscription is about to renew" notices, password reset emails. |

| App Stores (Google Play/Apple App Store) | Premium app features, in-app purchases, ad-free versions, entertainment apps | Check the "Subscriptions" section within your Apple ID or Google Play account settings. | Active subscriptions for apps you've already deleted, multiple charges for the same service. |

| Direct Company Websites | E-commerce (e.g., Amazon Subscribe & Save), professional software, niche streaming platforms | Log into your account on sites where you've made purchases and check your account or billing settings. | An active "membership" or "pro" status you forgot about, automated product shipments. |

This table should give you a solid roadmap for your investigation. By checking these key spots, you're far more likely to catch every single charge that's been quietly eating away at your budget. Uncovering these hidden drains is a huge step toward taking back control of your finances.

Mastering Platform-Specific Cancellation Strategies

Once you’ve hunted down every rogue subscription, the real fun begins: actually canceling them. Every platform, from Apple to Amazon, has its own unique maze that can make this process a little trickier than it needs to be. Successfully navigating these requires platform-specific knowledge and a bit of patience. Forget the one-size-fits-all advice; let's get into what actually works.

For example, canceling a subscription billed through Apple is a multi-tap journey buried deep within your iPhone's settings. It’s not on the app itself, which is where most people look first. You have to dive into your Apple ID settings, find the "Subscriptions" menu, and manage it from there. Many people get frustrated and give up, not realizing the cancellation is handled by Apple, not the app developer. Knowing this small detail is the key to stopping payments for apps you don’t use anymore.

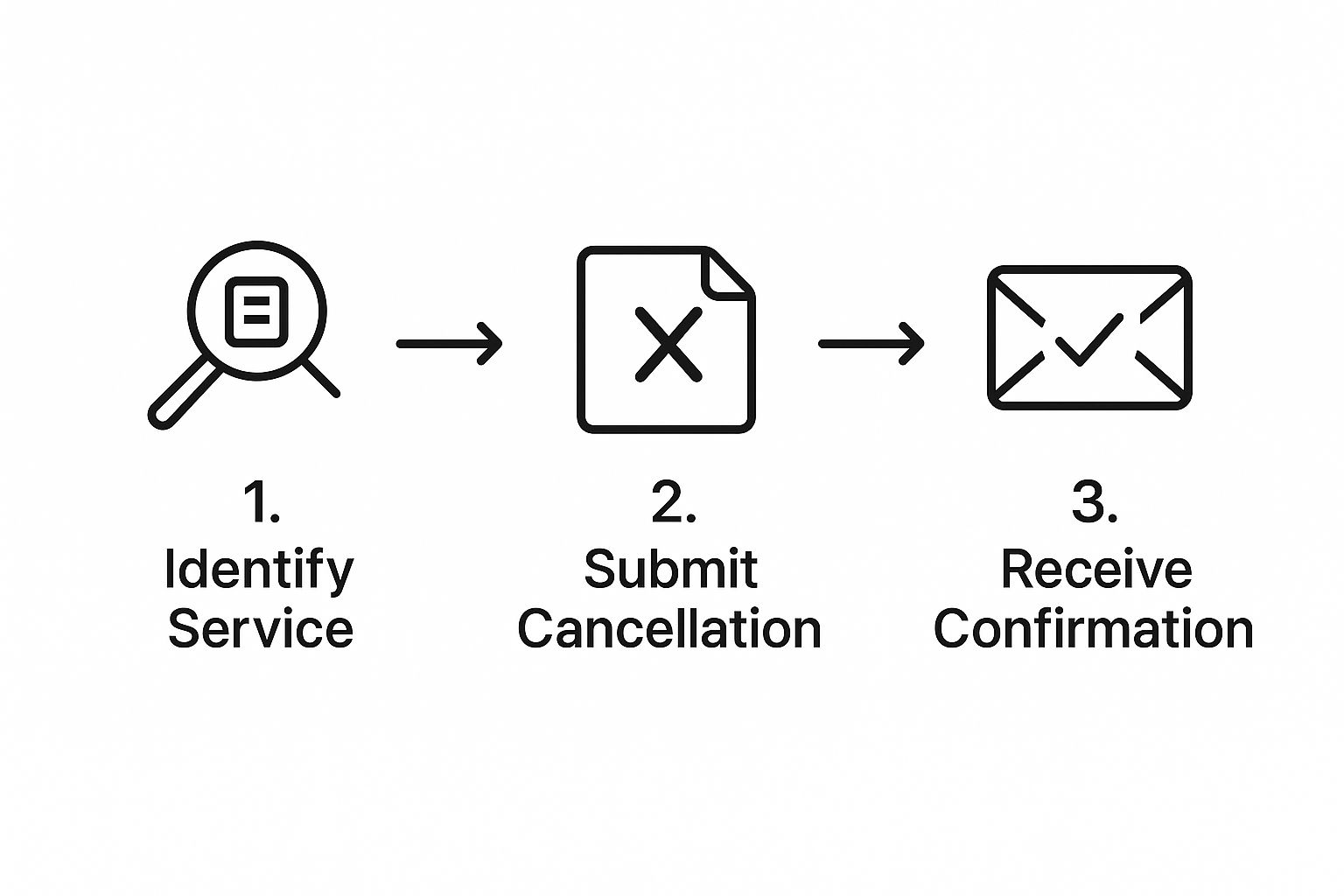

This visual guide breaks down the general flow for most cancellation requests.

The infographic simplifies the journey into three core actions: identify, submit, and confirm. This is the universal backbone of any successful cancellation effort, no matter the platform.

To help you out, I've put together a quick-reference table based on my own battles with these platforms. It gives you a realistic idea of what to expect.

Platform Cancellation Success Blueprint

Tested cancellation methods for major platforms with realistic timeframes and proven tactics

| Platform | Best Cancellation Path | Difficulty Rating | Time Investment | Success Tips |

|---|---|---|---|---|

| Apple App Store | iPhone/iPad Settings > Apple ID > Subscriptions | Easy | < 2 minutes | Don't look in the app itself. The subscription is tied to your Apple ID, not the app installation. |

| Google Play Store | Play Store App > Profile Icon > Payments & subscriptions > Subscriptions | Easy | < 2 minutes | Deleting the app won't cancel the subscription. You must do it here. |

| Amazon Prime | Account & Lists > Memberships & Subscriptions > Prime Membership > End Membership | Medium | 5-10 minutes | Be persistent. Amazon will show you multiple pages of benefits you're losing. Just keep clicking to proceed with cancellation. |

| Streaming Services (Netflix, Hulu, etc.) | Website Login > Account Settings > Subscription/Billing | Varies (Easy to Medium) | 2-5 minutes | Always get a confirmation email. If one doesn't arrive within an hour, the cancellation likely failed. |

| Software/SaaS (Adobe, Microsoft, etc.) | Direct Website Login > Account/Billing Section | Varies (Medium to Hard) | 5-15 minutes | Some may require you to contact support. Look for a "cancel" link first, but be prepared to chat or email. |

This table shows that while some cancellations are simple, others, like Amazon Prime, are designed to make you reconsider. The key is to know the path and stick to it.

Dealing with Different Platform Quirks

Each service has its own personality when it comes to cancellations. Amazon, as mentioned, is famous for its multi-step Prime cancellation that includes several pages highlighting all the great perks you're about to lose. The trick here is to stay focused and keep clicking that "end membership" button until you see a final confirmation screen. Don't fall for the last-minute offers designed to make you second-guess your choice.

When it comes to streaming, the process can differ quite a bit from one service to another. If you're trying to trim your entertainment budget, our guide on how to save money on streaming services offers excellent strategies that go beyond just canceling. When you do decide to cancel, always aim to get a confirmation email. This email is your proof of cancellation if a company tries to bill you again. Keep it until your billing cycle is officially over.

The Apple and Google Play Store Method

For subscriptions you bought through your phone’s app store, the process is usually centralized, which is a huge help. This makes it much easier to cancel unwanted subscriptions with just a few taps once you know where to look.

A common mistake is deleting an app and thinking the subscription is canceled along with it. This is almost never the case. You have to manually go into your App Store or Google Play settings to terminate the recurring payment. I make it a habit to double-check my subscriptions list every time I delete an app I've paid for, just to be sure. It's a simple step that has saved me from paying for services I completely forgot about.

Conquering Companies That Fight Your Cancellation

There’s a special kind of frustration that comes from trying to do something simple—like cancel a service—only to have the company throw up a brick wall. We’ve all been there: stuck in a phone queue for 45 minutes, bounced between departments, or cornered by a retention specialist who makes you feel like you’re making a huge mistake. These tactics are designed to wear you down until you just give up. Winning these battles requires a different strategy.

A common roadblock is the "you can't cancel mid-cycle" line. While you might not get a prorated refund, you absolutely have the right to stop future payments. Don’t let this discourage you. Insist on canceling all future renewals and always, always ask for a confirmation number or email as proof. This digital paper trail is your best defense against those mysterious "mistake" charges that can pop up later. Also, be ready for last-minute discount offers. A sweet deal can be tempting, but remember why you decided to cancel unwanted subscriptions in the first place. Sticking to your guns is a win for your budget and your sanity.

Navigating Retention Specialists and Legal Rights

When you finally get a human on the phone, they're often a retention specialist whose entire job is to keep you from leaving. They have scripts and prepared answers for every reason you can possibly give. The most effective approach is to be polite, firm, and repetitive. A simple phrase like, "I understand, but I need to process the cancellation today," is incredibly powerful. You don't owe them a detailed explanation.

Knowing your rights is also a game-changer. In many places, laws like the Restore Online Shoppers' Confidence Act (ROSCA) in the U.S. require companies to provide simple and clear ways to cancel. If a company makes cancellation nearly impossible, they could be breaking the law. If they keep charging you after you’ve already canceled, a chargeback through your credit card company is a potent tool. A chargeback reverses the payment and sends a clear message to the merchant that their practices are being questioned.

Billing errors are another major reason people decide to leave. In fact, incorrect billing is a factor in over 23% of subscriber churn, which shows just how often companies get it wrong. This is why it’s so important to be watchful. Interestingly, people seem more willing to give monthly plans a second chance, which see a 12% reactivation rate, compared to just 6% for yearly ones. This suggests that consumers really value flexibility. You can explore more data about what drives subscription loyalty on whop.com.

If you find a service you love but need to cut costs, there might be another option. Our guide on subscription sharing tips has some great ideas for getting the services you want at a fraction of the price.

Building Your Subscription Defense System

After you’ve cleared out the clutter and dealt with companies that make canceling a pain, it’s time to make sure this doesn't happen again. The absolute best way to cancel unwanted subscriptions is to avoid signing up for them without a second thought. Building a solid defense system isn't about missing out; it’s about being deliberate. This involves creating a simple, repeatable process for looking at any new subscription before you click "start trial" and give away your payment details.

A good defense starts with a strong offense. Instead of giving in to an impulse signup, pause and ask yourself a few direct questions. Will this service actually solve a real problem I have or bring genuine value to my life? How often am I really going to use it? A bit of honesty upfront can prevent a future cancellation headache before it even starts.

The Trial Period Test Drive

Free trials are practically designed to lure you in and make you forget, but you can turn them to your advantage. Think of them as a serious test drive, not a free pass to everything.

- Set an Immediate Reminder: The second you sign up, go to your calendar and create an alert for two or three days before the trial ends. Don't stop at one—set a few. I usually put one on my phone's calendar and stick a physical note on my computer monitor. The idea is to make it almost impossible to miss.

- Use a Specific Payment Method: Think about using a virtual credit card or a service like PayPal for trials. These tools often give you more direct control, allowing you to stop a recurring payment right from their dashboard. This is a great backup plan if a company makes it difficult to cancel on their end.

- Track Your Usage: Make a real effort to use the service while the trial is active. If a week flies by and you haven’t even logged in, that’s a massive red flag. It’s a clear sign you probably don't need it.

Crafting a Sustainable Subscription Budget

A subscription budget isn't just about numbers; it gives you clarity and helps you set firm boundaries. Start by picking a total monthly amount you’re willing to spend on all your recurring services. This number is your spending cap. When a new subscription catches your eye, you have to see if it fits within that budget. If it doesn't, you have a choice: either forget the new service or cancel an old one to free up space. This creates a "one in, one out" policy that stops subscription creep in its tracks.

This proactive mindset is important because companies are always trying to find new ways to keep you subscribed. Sometimes, the value you signed up for can disappear overnight. A recent study revealed that a huge 40% of subscribers will cancel a service when a key feature, like free shipping, is removed. You can dig into more data about why people unsubscribe over at sticky.io. By having your own defense system, you can quickly assess if the service is still worth your money when things change.

Tools That Actually Make Subscription Management Simple

Going through your subscriptions by hand is a solid first step, but let's be real, technology can be your secret weapon in this ongoing fight. Plenty of apps out there promise to make your life easier, but they're not all the same. Some just track your spending, while others act like a personal concierge, stepping in to cancel unwanted subscriptions for you. It's all about figuring out how much automation you're comfortable with.

Subscription Tracking Apps and Bank Features

The most basic tools are the trackers. Apps like Mint or YNAB (You Need A Budget) link up with your bank accounts and automatically highlight recurring payments. This gives you a clear picture of where your money is going every month. The biggest win here is simple visibility. Before you download anything, check your own banking app. Many big banks, like Chase and Capital One, now have these features built right in, so you might already have a free tool waiting for you.

These apps are fantastic for a do-it-yourself approach. They shine a light on the problem, but it's still on you to follow through and cancel. If you want a more hands-off solution, you might want to look at services that do the canceling for you.

Automated Cancellation Services

This is where you pass the baton. Services like Trim and Rocket Money don't just find your subscriptions—they can actually cancel them on your behalf. You give them the green light, and their team (or an automated system) handles the often-annoying cancellation process. This can be a massive time-saver, especially for those stubborn services that make you call them to cancel.

Of course, this convenience has its trade-offs. You'll be sharing financial information or even account logins. Some of these services also come with a fee, either taking a cut of the money they save you or charging a monthly rate. It's really important to read their privacy policy and understand the costs before you jump in.

The subscription business is always changing. As companies find it harder to get new customers, they're fighting harder to keep the ones they have. In fact, new subscriber growth has dropped from 4.1% in 2021 to 2.8% in 2024, which means they're putting a lot more effort into retention. This can make canceling even more of a headache, which in turn makes these automated services look even better. You can check out more data on these trends and discover insights about the state of subscriptions at Recurly.com.

If you're aiming to get your whole system in order, you might want to revamp your subscription management workflow by using a mix of these different tools.

Your Personal Subscription Freedom Action Plan

It's time to turn all this information into a real-world blueprint for your own finances. This is your personal strategy to cancel unwanted subscriptions and set up a system that keeps your accounts clean in the long run. The idea is to do more than just save a few dollars; it's about cutting down on financial anxiety and taking back control. Let's begin by putting together a simple audit checklist so nothing slips through the cracks.

Crafting Your Ongoing System

The next move is to build a realistic budget for your recurring payments that actually fits your life. This isn't about cutting out everything you enjoy, but about spending with purpose. A handy trick I've used is to get a dedicated virtual card just for new trials. It makes it so much easier to track what you've signed up for and pull the plug before a charge hits. When you do reach out to cancel, be polite but firm. A straightforward, "Please process my cancellation request effective today," is usually all it takes.

Keep in mind that companies will work hard to keep you on their books. It's a tough market for them—in North America, the annual subscriber retention rate is only about 27%. Because of this, they often make the cancellation process confusing on purpose. You can learn more about these challenges in subscriber loyalty on whop.com. By being organized and persistent, you regain the upper hand.

What about the services you genuinely like but wish were cheaper? There are clever ways to handle that, too. For instance, platforms like AccountShare offer a way to get access to premium software and streaming services by splitting the cost with others. This way, you get to enjoy all the perks without shouldering the full price tag.