Master Your Group Expense Tracker and End Money Drama

Share

Let's be honest: trying to split bills with friends using a jumble of spreadsheets and chaotic group chats is a recipe for disaster. It’s a frustrating cycle that almost always ends with awkward reminders and quiet resentment. A good group expense tracker cuts through all that noise, offering a clear, transparent, and fair way to handle shared money—whether you're with roommates, on a trip, or managing family finances. It stops conflicts before they even have a chance to start.

Why Old-School Bill Splitting Is Broken

Picture the last group vacation you went on. One person puts the rental car on their card, another covers the first big dinner out, and someone else grabs all the groceries for the house. By the end of the trip, you’re staring at a mountain of receipts and scrolling through an endless group chat trying to figure out who owes what to whom. It’s a story we all know too well.

These old-school methods just don’t work. Relying on memory, manual spreadsheets, or back-and-forth messaging creates needless friction and turns what should be simple math into an emotional headache.

The Headaches of Manual Tracking

The fundamental problem with doing it all by hand is that it demands constant effort and a perfect memory—two things that rarely happen in the real world. A lost receipt or a forgotten "I'll get the next one" can quickly throw the balance off, creating unspoken tension.

This gets even trickier with recurring bills, like when you're living with roommates. Who bought the paper towels last month? Did everyone remember that one person pays a slightly larger share of the internet bill? These little details pile up, leaving you with a tangled mess of IOUs that are a nightmare to track and even harder to settle up fairly.

Chasing people for money is exhausting. A dedicated group expense tracker takes you out of the equation. It acts as a neutral third party, simply laying out the facts without any of the blame or awkwardness.

Manual Tracking vs. Group Expense Tracker

Here’s a quick look at how traditional methods stack up against a modern app for managing shared finances. The difference is night and day.

| Feature | Spreadsheets & Group Chats | Dedicated Group Expense Tracker |

|---|---|---|

| Record Keeping | Scattered across messages and files; easy to lose track. | All expenses are in one centralized, shared space. |

| Calculations | Manual, prone to human error, and a pain to update. | Automated calculations, even for complex or uneven splits. |

| Real-Time Balance | Impossible. You only know who owes what after a manual tally. | Instantly see who's paid and who owes what at any time. |

| Settling Up | Requires manual requests and separate payment app juggling. | Often includes integrated payment options for one-click settlement. |

| Reminders | Awkwardly chasing people for money yourself. | Automated, gentle nudges sent by the app. |

While a spreadsheet might seem "free," the hidden costs in time, stress, and potential arguments make a dedicated app a far better investment for your peace of mind.

A Modern Fix for an Old Problem

People are moving away from these outdated methods, and for good reason. As our finances become more digital, we expect better tools to manage shared costs. It's no surprise that the market for consumer expense tracking apps, which includes group tools, was valued at USD 7.15 billion in 2024 and is expected to hit USD 14.44 billion by 2030. You can dig deeper into these numbers in this detailed market analysis.

This incredible growth just confirms what we already know: people are tired of the old way. A modern group expense tracker solves these core issues by offering:

- A Single Source of Truth: Every single expense lives in one place, totally transparent and accessible to everyone in the group.

- Instant Clarity: You can see who owes what at any given moment. No more guesswork or end-of-the-month scrambles.

- Effortless Math: The app handles all the calculations for you, no matter how complicated the splits are.

- Easy Settlements: With integrated payment features, squaring up is as simple as tapping a button.

In the end, using a platform designed for this isn't just about making life easier—it's about protecting your relationships by removing one of the most common sources of stress and arguments.

How to Choose the Right Expense Tracker for Your Group

With what feels like a million apps out there, picking the right group expense tracker can be a real headache. But here's the secret I've learned from years of splitting bills: the best app isn't the one with the fanciest features. It's the one your group will actually use.

Think about it. A slick interface is useless if your least tech-savvy roommate gets confused trying to log a simple grocery run. The whole point is to get everyone on board. If even one person gives up, you’re right back where you started—chasing people down with awkward reminder texts.

Figure Out What Your Group Actually Needs

Before you hit the app store, take a minute to think about your specific situation. Are you roommates trying to manage recurring monthly bills? Or are you a group of friends planning a two-week trip to Japan? The perfect tool for one is often a clunky, complicated mess for the other.

Every group is different, but here are the most common scenarios I see:

- Living with Roommates: You need an app that automates recurring bills. This is a total game-changer for things like rent, utilities, and Wi-Fi. You plug in the numbers once, and the app logs the expense every single month without you having to lift a finger.

- Group Travel: If you're crossing borders, multi-currency support is an absolute must-have. Apps like Tricount are brilliant at this, automatically converting expenses into your home currency. This saves you from mental math gymnastics and makes sure every split is fair.

- One-Off Events: For a simple shared dinner or a weekend getaway, a lightweight app with a clean, no-fuss interface is probably your best bet. The goal here is speed—quick entry and a summary screen that's easy to understand at a glance.

My Personal Tip: Don't underestimate the power of a good summary screen. The best apps show you exactly who owes who in a simple, visual way. This kind of transparency is what keeps things from getting weird or complicated.

Features That Make a Real Difference

Once you've nailed down your core needs, you can start looking at features. It's easy to get distracted by shiny objects, but some functions truly save time and prevent arguments.

Here are the features I always look for:

- Receipt Scanning: This is a huge time-saver. Instead of manually typing in every detail, you just snap a picture of the receipt. The app does the heavy lifting by pulling the date, vendor, and total. Plus, it keeps a digital copy in case anyone questions a charge.

- Payment App Integration: The goal is to make settling up as painless as possible. Look for trackers that connect directly with services like PayPal or Venmo. This lets you pay someone back with a single tap, right from the app. No more excuses.

- Itemization: This is a lifesaver for big, shared shopping trips. Imagine a massive grocery bill where not everyone bought everything. A good app lets you go through the receipt line by line, assigning different items to different people. You can split the steak between two people, the vegan burgers between two others, and the paper towels among everyone.

- Offline Functionality: If you're traveling somewhere with patchy Wi-Fi, this is critical. An app that lets you log expenses offline and syncs them up later means you won't end up with a pocketful of crumpled receipts to sort through when you get back.

At the end of the day, picking the right group expense tracker is about finding that sweet spot between powerful features and dead-simple usability. Don’t get pulled in by a tool that does a million things you'll never need. Focus on finding one that solves your group's specific problems and is so easy to use that everyone sticks with it. That’s how you make sharing money feel fair, simple, and stress-free.

Getting Your Group Expense Tracker Set Up for Success

Choosing a great group expense tracker is just the first step. The real magic happens when you set it up in a way that everyone understands and actually uses. A little bit of groundwork upfront can save you from a lot of financial headaches and awkward conversations down the line.

Think of it like this: when you start a new board game, you explain the rules first, right? Doing the same with your expense tracker gets everyone on the same page from day one.

Let's walk through a classic scenario: you're sharing an apartment with a few roommates. Once you've invited everyone to the app, your first mission is to define clear expense categories. This one move brings instant clarity to the potential mess of shared bills.

Start with Smart Categories

Don't just create a random list of expenses as they pop up. A little organization here goes a long way. For a typical roommate situation, your categories might look something like this:

- Rent: The big, fixed monthly payment.

- Utilities: A catch-all for recurring bills like electricity, water, and gas.

- Internet: The monthly Wi-Fi bill that keeps everyone connected.

- Groceries: For all the shared food items everyone digs into.

- Household Supplies: Think paper towels, cleaning sprays, trash bags—the essentials.

By setting up this simple framework, there’s no guesswork. When a roommate picks up dish soap, they know exactly where to log the expense. It makes the whole process feel natural and easy.

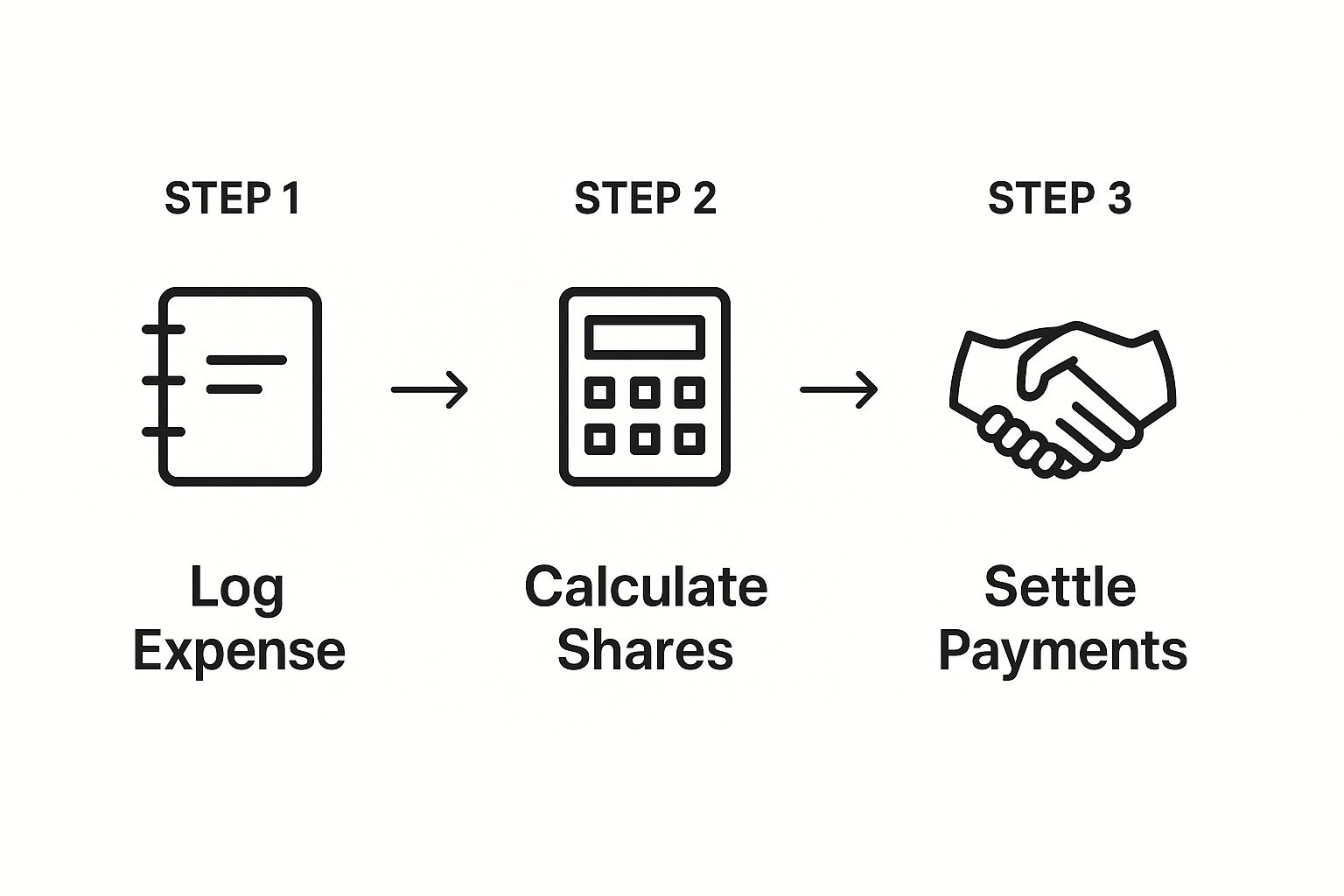

As you can see, a good system handles the tedious parts—like calculating who owes what—so you can focus on living, not crunching numbers.

A Few Pro-Tips for a Smooth Experience

Once you have your basic categories in place, a couple of simple ground rules can make a huge difference in keeping things running smoothly.

First, take a look at the notification settings. You can often set up automated, gentle reminders for people to log expenses or pay what they owe. This is a game-changer because the app becomes the "bad guy," not you. No more feeling like the group's bill collector.

Another tip I've found incredibly useful is creating a small "house fund" right within the tracker. Everyone chips in an equal, small amount—say, $20—at the beginning of the month. This pool of cash can then cover minor, shared purchases without anyone needing to log every little thing. It's perfect for those small, spontaneous buys.

The ultimate goal here is to build a system that runs on transparency and trust. When everyone can clearly see who paid for what and what they owe, it eliminates the confusion and resentment that can quietly poison a good living situation.

Taking a bit of time to get this initial setup right means your expense tracker will become a genuinely helpful tool that fosters harmony, not another chore that causes conflict. If you're still weighing your options, check out our guide on finding the perfect shared expense tracker app to fit your group's specific needs.

Handling Complex Scenarios and Uneven Splits

Let's be honest, real-world group expenses are rarely a clean 50/50 split. Life is just messier than that, and your group expense tracker needs to handle that complexity without causing more headaches. This is where a truly capable app proves its worth over a simple spreadsheet, giving you the tools to manage tricky situations fairly and transparently.

Simple, equal shares are easy. But what about the situations that truly test a group's financial harmony? From roommates with different-sized rooms to international trips with multiple currencies, a solid tracker turns these challenges into manageable tasks.

Managing Uneven Recurring Bills

One of the most classic examples I see is with roommates. What do you do when one person has the master bedroom with the attached bathroom and naturally pays more rent? Trying to remember and manually calculate this every single month is just asking for trouble—it's tedious and easy to get wrong.

This is where a robust group expense tracker shines. It should let you set up recurring bills with custom, uneven splits. You can configure the rent expense once, telling the app to automatically charge each person their specific amount or percentage.

- Scenario: Let's say rent is $2,400. Sarah pays $950 for the huge main bedroom, while Mark and Chloe each pay $725 for the other rooms.

- Solution: You just set up one recurring monthly expense and assign the exact share to each person. The app remembers this split for you every single month. No more manual math, and no more arguments.

This same logic works perfectly for other shared costs. Maybe one person works from home and has agreed to cover a larger slice of the internet bill. You can create custom splits for any recurring expense, building fairness right into your system from the start.

Tackling Complicated One-Off Expenses

Group trips and big shopping hauls are legendary for creating financial chaos. I’ve seen a single grocery receipt nearly cause a civil war when people have different diets or preferences. In these moments, itemization is an absolute lifesaver.

The single best piece of advice I can give is to agree on the split method before a purchase is made. A quick chat about how you'll divide a big dinner bill or a rental car can prevent so many headaches down the line.

Instead of just splitting a $180 grocery bill three ways and hoping for the best, a good app lets you get granular:

- Assign specific items: Those $30 steaks Mark and Chloe wanted? You can assign that cost directly to them.

- Split some items differently: The $20 bottle of wine can be split just between the two people who actually drank it.

- Share communal goods equally: The $15 for paper towels and cleaning supplies can be split evenly among everyone.

This level of detail means no one ever feels like they’re paying for someone else's expensive taste in cheese. It transforms a potentially tense situation into a simple, fair calculation. For anyone managing shared finances, knowing the different ways to divide costs is a game-changer. You can check out a variety of approaches in our guide to cost allocation methods to see what fits your group best.

This also applies to travel. If you're abroad, a group expense tracker with multi-currency support is a must-have. When someone pays for dinner in Euros and another person pays for a tour in British Pounds, the app can convert everything back to your home currency, keeping the final tally crystal clear for everyone.

How to Settle Debts Without the Awkwardness

You've tracked everything perfectly. The numbers are clear, the splits are fair, and the math is done. Now for the tricky part: actually getting everyone to pay up. This is where even the most organized system can hit a snag if you don't handle the human side of things with a bit of finesse. The whole point is to get everyone’s balance back to zero without making things weird.

The good news is that having a transparent tracker has already done most of the heavy lifting. It takes all the guesswork and emotion out of the equation, boiling it all down to simple, undeniable facts. That alone makes the "you owe me" conversation a whole lot easier because it’s not personal—it’s just about the numbers.

Gentle Reminders and Diplomatic Nudges

Even with the best tools, you’ll probably have that one friend who’s always a little slow to pay their share. Chasing them down feels uncomfortable, but letting it slide can lead to resentment. The key is to be polite but direct, and always assume they just forgot.

A simple, low-pressure message usually does the trick. Instead of a blunt "You owe me money," try framing it as a collaborative effort:

- "Hey! Just closing out our expenses for the ski trip. The app says you owe $45. Let me know the easiest way for you to send it over!"

- "Ready to settle up for this month's bills? My share comes out to $112. Once you send your part, we'll be all square."

These prompts feel friendly and position the settlement as a final, shared task. It shifts the focus from "You owe me" to "Let's get this wrapped up together."

Handling Disputed Charges and Forgetful Friends

So, what happens when someone questions an expense? Or what about the friend who never seems to log what they've paid for? These are common hurdles.

If a charge is disputed, the best approach is a calm, private conversation. Just open the app together and look at the entry. More often than not, it’s a simple misunderstanding.

For the friend who always "forgets" to log their spending, a gentle nudge can help them build the habit. Something like, "Hey, I think you grabbed coffee for everyone this morning—don't forget to add it to our tracker so you get paid back!" works wonders.

The most effective way to avoid conflict is to settle up regularly. Don't let debts linger for months. Settling at the end of every trip, event, or billing cycle keeps balances small and manageable, preventing minor IOUs from snowballing into bigger problems.

The Final Step: Closing the Loop

Once everyone is on the same page, it's time to actually move the money. Modern group expense trackers are fantastic for this, often integrating directly with payment apps like Venmo or PayPal. This one-click settlement is easily the cleanest way to close the loop.

This push for easy, integrated payments isn't just a consumer trend. In the corporate world, the expense management software market is expected to hit nearly USD 6 billion by 2025, a boom driven by tools that offer seamless payment processing. You can see more insights about the growth of integrated expense software on marketreportanalytics.com. It just goes to show how critical smooth settlement features are, whether for business or personal finances. Simplifying these final steps is one of the key advantages of group purchasing.

To make sure everything ends on a high note, here's a quick rundown for a clean closing:

- Announce the Settlement: Let the group know it's time to close out the expenses for a specific period (e.g., "Alright, let's settle up for May").

- Do a Final Review: Give everyone a day or so to look over the summary and raise any last-minute questions.

- Use Integrated Payments: Encourage everyone to use the in-app payment links. It’s fast, trackable, and leaves no room for error.

- Confirm and Archive: Once everyone’s balance is zero, mark the group or event as settled. Done and dusted.

Following these steps helps ensure that every shared financial adventure ends on a positive and fair note, strengthening your friendships instead of straining them.

Your Group Expense Questions Answered

Diving into a group expense tracker for the first time? It's completely normal to have a few questions pop up. Getting those sorted out from the start makes the whole process feel way less stressful for everyone. Let's walk through some of the most common things people ask.

What Is the Best Free Group Expense Tracker App?

This is the big one, and honestly, the "best" app really comes down to what your group needs. That said, a few names always come up for a reason. Most people land on Splitwise, Tricount, or Settle Up.

I've found that Splitwise is a lifesaver for ongoing, complicated situations like living with roommates. It’s built for tracking who-owes-who over the long haul. On the flip side, Tricount is beautifully simple, which makes it perfect for a weekend trip or a one-off dinner with a big group. Then you have Settle Up, which is great if you need more muscle—like handling different currencies on an international trip or setting custom split rates.

Think about your situation. Do you need to manage recurring monthly bills? Are you traveling abroad? Or do you just need something fast and simple? Your answer will point you to the right tool.

How Do You Handle Expenses When One Person Pays Upfront?

Ah, the classic "one person puts it all on their card" scenario. This happens all the time on vacation or when booking event tickets. It's actually pretty simple to manage.

The person who paid just needs to be diligent. As soon as they make a purchase, they should log it in the app, assigning the full cost to themselves.

The magic happens next: they specify exactly how to split that cost. Whether it's divided equally, by custom amounts, or by percentage, the app does all the math. It keeps a running, transparent tally of who owes what to the original payer.

This completely eliminates that dreaded "who owes what again?" conversation at the end of the trip. The final settlement is just a few taps away.

Is It Rude to Track Money with Close Friends?

Not at all. In fact, I'd argue it's one of the most considerate things you can do for your friendship. Using an app takes all the emotion and awkwardness out of the money conversation.

It shifts the dynamic from relying on fuzzy memories to relying on clear data. When you suggest it, frame it as a tool to keep things fair and easy for everyone. It shows you value the friendship enough to prevent small money misunderstandings from ever turning into real problems.

What if Someone Disputes a Shared Expense?

This can feel tricky, but open communication is the only way through. First, double-check the entry. Was it logged correctly? Is the description clear? This is why I always recommend attaching a photo of the receipt—it heads off most disagreements before they even start.

If they still question it, have a quick, private chat to hear them out. Maybe there was a simple misunderstanding. The great thing about these apps is that you can easily edit or even delete a single charge without messing up the entire balance. It’s always better to sort out a small issue calmly than to let it simmer and build resentment.

Ready to take the guesswork out of sharing costs for subscriptions and premium services? AccountShare makes it easy to manage group purchases for everything from streaming to software, ensuring fairness and security. Learn how AccountShare can simplify your shared digital life today.