7 Best Shared Expense Tracker App Options for 2025

Share

Stop Chasing Money: Your Guide to Effortless Group Finances

Remember the last time you tried splitting a dinner bill, a vacation rental, or monthly household utilities? The awkward conversations, the complicated math, and the endless "you owe me" reminders are a universal source of stress. In a world where we share everything from living spaces to travel experiences, managing joint costs is more common than ever. Yet, relying on manual tracking with spreadsheets or messy group chats is inefficient and prone to errors, often creating unnecessary friction. This is precisely where a dedicated shared expense tracker app becomes an indispensable tool.

These powerful apps automate the entire process of logging, splitting, and settling group costs, bringing clarity and harmony to your finances. They eliminate the guesswork, provide a transparent and permanent record of who paid for what, and make getting paid back simple and painless. Forget about chasing friends for money or feeling anxious about shared bills.

This guide dives deep into the top shared expense tracker apps available today. We will explore their specific features, highlight their ideal use cases for roommates, couples, and travel groups, and provide actionable tips to help you select the perfect solution to finally put an end to financial awkwardness.

1. Splitwise

Splitwise has become the go-to shared expense tracker app for millions, earning its reputation through a simple yet powerful interface designed to take the awkwardness out of finances between friends, roommates, and travel partners. At its core, Splitwise maintains a running tally of who owes whom, allowing users to add expenses, specify how they should be divided, and see their balances in real time. It effectively digitizes the informal "I'll get the next one" system, replacing it with a clear, transparent ledger that prevents misunderstandings and resentment.

The app's strength lies in its flexibility. For instance, a group of college roommates can create a "Household" group to manage recurring bills like rent and utilities. When one person pays the $120 internet bill, they can log it and split it equally. The next day, another roommate can add a $60 grocery run, splitting it by exact amounts consumed. This granular tracking ensures fairness in complex living situations.

Key Features and Implementation

Splitwise's design philosophy centers on accommodating real-world financial scenarios with ease. This is most evident in its versatile splitting options, currency handling, and streamlined settlement process. The platform is built not just for one-off dinners but for long-term, complex expense sharing.

To get started, you simply create a group for a specific context, like "European Vacation" or "Apartment 4B," and invite members. When adding an expense, you can choose to split it equally, by exact amounts, by percentage, by shares, or apply the full amount to one person. This is perfect for situations where contributions aren't equal. For example, in a shared meal, one person who only had a drink can be assigned a smaller portion of the bill.

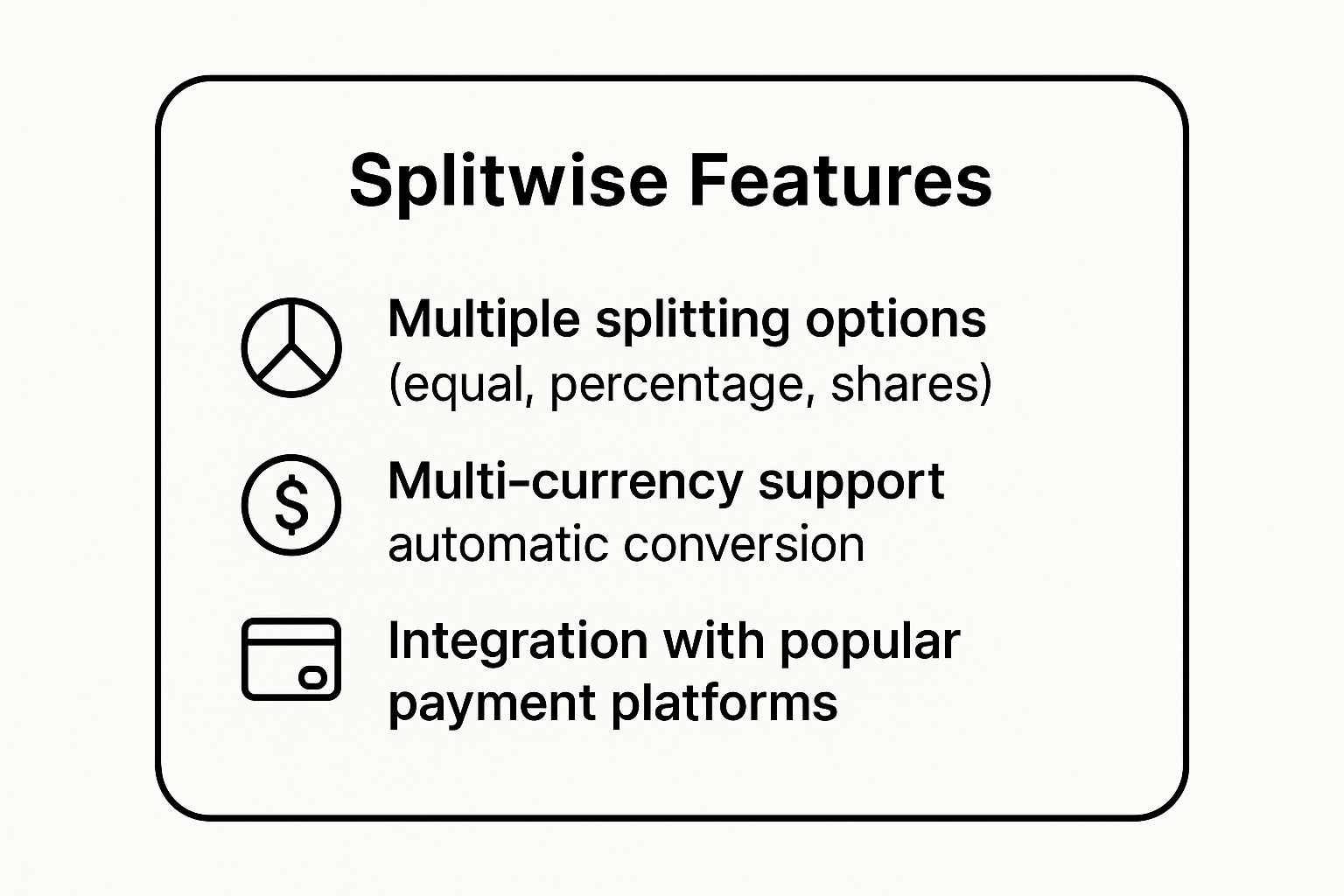

The following infographic highlights Splitwise's most powerful features for managing group finances.

These core functionalities make Splitwise a robust tool for everything from simple bill sharing to complex international trip planning. The integration with payment apps like Venmo and PayPal (in supported regions) is particularly useful, as it allows users to settle their balances directly through the app with just a few taps, closing the loop from tracking to payment.

When to Use Splitwise

Splitwise excels in scenarios involving ongoing, shared costs with a consistent group of people. It is the ideal choice for:

- Roommates and Cohabiting Partners: Easily track and split rent, utilities, groceries, and other household expenses.

- Travel Groups: Manage shared costs for accommodations, transport, and meals across different currencies without manual conversions.

- Couples: Keep a transparent record of shared finances while maintaining individual spending privacy.

- Long-Term Projects or Events: Organize budgets and track expenses for group gifts, event planning, or collaborative projects.

By using the receipt upload feature and regularly settling up, groups can maintain financial harmony and focus on the shared experience, not the shared expenses.

2. Tricount

Tricount offers a refreshingly simple and effective approach to group expense management, making it a popular shared expense tracker app, especially across Europe. Its design prioritizes speed and ease of use, making it ideal for one-off events and group trips where quick entry and clear balances are more important than complex features. The app’s core function is to provide a straightforward ledger where anyone in a group can add what they paid for, ensuring everyone knows their standing without a complicated setup.

The app's appeal is rooted in its user-friendly interface. For example, a group on a weekend getaway can quickly create a "tricount" for their trip. As one person pays for dinner, another covers museum tickets, and a third buys train passes, each expense is logged in seconds. Tricount instantly recalculates who owes what to whom, presenting a simple, actionable summary that eliminates confusion and streamlines the settlement process at the end of the trip.

Key Features and Implementation

Tricount’s design philosophy revolves around making expense tracking as frictionless as possible, focusing on core functionalities that serve the most common group finance needs. It shines in its ability to get a group up and running quickly, even when members are not tech-savvy. The platform is built for fast-paced environments like vacations and events.

Getting started is exceptionally easy: create a tricount, name it (e.g., "Bachelor Party Vegas"), and share a simple link or QR code with participants. No account creation is required to join, which is a major advantage for temporary groups. When adding an expense, you can quickly specify who paid and who participated. The app then automatically calculates the most efficient way for everyone to settle up, minimizing the number of transactions needed.

This simplicity is perfect for situations like a sports team splitting tournament fees and travel costs. One person can add the entry for the team hotel, another for the shared van rental, and each expense is immediately visible to all, maintaining transparency throughout the event.

When to Use Tricount

Tricount is at its best in scenarios involving short-term, event-based shared expenses with a dynamic group of people. It is the perfect choice for:

- Group Travel and Vacations: Effortlessly track shared meals, accommodations, and activities, especially with its offline functionality.

- Events and Parties: Manage costs for bachelor/bachelorette parties, group dinners, or birthday celebrations without forcing everyone to download and register on a complex app.

- Office Colleagues: Easily split costs for shared lunches, coffee runs, or group gifts.

- Casual Group Activities: Ideal for weekend outings, sports teams, or any situation where a quick and temporary expense ledger is needed.

By leveraging its offline mode during travel and using the simple link-sharing feature, groups can focus on their shared activity with the confidence that the finances are being tracked accurately and transparently.

3. SettleUp

SettleUp positions itself as a robust shared expense tracker app that caters to both casual users and more demanding financial situations, such as small business projects or investment clubs. Developed by SplitByte Software, it offers a clean interface that simplifies debt management while packing powerful features for complex scenarios. At its core, SettleUp tracks expenses within a group, ensuring everyone knows who paid for what and how debts are distributed, preventing the confusion that often accompanies shared finances.

The app's appeal comes from its ability to handle more than just a simple dinner bill. For instance, a small startup's co-founders can use it to meticulously track initial business expenses before official incorporation. One founder can log a $500 software subscription, while another adds a $150 expense for marketing materials, with each item clearly assigned and tallied. This creates a transparent and exportable record for future accounting, making it a valuable tool for informal business management.

Key Features and Implementation

SettleUp is designed for flexibility, offering features that accommodate intricate financial arrangements often found in business or large group events. Its strength lies in detailed reporting, recurring expense automation, and customized splitting rules that go beyond basic equal divisions.

To begin, you create a group for your specific purpose, like "Family Reunion 2024" or "Project Phoenix Expenses," and invite members via a link. When logging an expense, you can attach receipts and notes, and then select how to divide the cost. Beyond standard splits, SettleUp allows for custom rules, which is ideal for complex situations. For example, in an investment club managing a shared portfolio, transaction fees can be split based on each member's investment percentage, ensuring precise and fair allocation.

The platform also supports offline functionality, allowing users to add expenses even without an internet connection, which sync automatically once online. This is particularly useful for teams or groups traveling in areas with spotty connectivity.

When to Use SettleUp

SettleUp is an excellent choice for groups that require more detailed tracking, reporting, and customization than what a basic splitter offers. It is particularly well-suited for:

- Small Business Teams: Track project expenses, client lunches, and other shared costs with exportable reports for accounting.

- Investment Clubs: Manage shared costs, returns, and fees with precision.

- Large Family Groups: Organize finances for big events like reunions or vacations where expenses are numerous and complex.

- Startup Co-founders: Maintain a clear, informal ledger of business expenses before formal financial systems are in place.

By leveraging its advanced features, such as recurring payments for regular bills and data backups, users can maintain meticulous financial records. For those new to detailed tracking, it's beneficial to master the fundamentals first; you can learn more about how a shared expense calculator can help master bill splitting like a pro.

4. Honeydue

Honeydue is a specialized shared expense tracker app built exclusively for couples, focusing on joint financial transparency and collaborative goal-setting. Unlike general-purpose expense splitters, its design philosophy centers on partnership, helping couples manage everything from daily spending to long-term financial goals together. It provides a shared view of finances, allowing partners to link bank accounts, credit cards, loans, and investments, all in one place. This creates a holistic financial picture that fosters communication and teamwork.

The app's value lies in its focus on the unique dynamics of a couple's finances. For example, a newly married couple can link their joint checking account to track shared bills like mortgage and utilities, while also keeping their individual accounts visible (or private) to understand each other's spending habits. This transparency helps them build a budget together, set spending limits in various categories, and work towards common objectives like saving for a down payment on a home.

Key Features and Implementation

Honeydue is designed to facilitate financial conversation and planning, not just expense splitting. Its features are tailored to help partners stay aligned on their financial journey. The platform promotes transparency while respecting individual financial autonomy.

To begin, both partners download the app and link their accounts. You can choose which accounts are shared and visible to your partner. The app automatically categorizes transactions and provides a feed where you can add comments to specific purchases, ask questions ("Was this for the new patio furniture?"), or add custom tags. The built-in chat feature keeps financial conversations organized within the app.

A key implementation detail is setting up reminders for upcoming bills. Honeydue automatically detects recurring bills from your linked accounts and alerts both partners, ensuring payments are never missed. You can also create custom monthly spending limits for categories like "Dining Out" or "Shopping" to proactively manage your joint budget and track progress toward your financial goals.

When to Use Honeydue

Honeydue is the perfect tool for partners at any stage of their relationship who want to merge their financial lives, either partially or fully. It excels in scenarios where financial collaboration is key:

- Married or Engaged Couples: Ideal for coordinating household budgets, managing joint accounts, and paying shared bills on time.

- Long-Term Partners: Track progress toward major financial goals, such as saving for a wedding, buying a home, or planning for retirement.

- Couples Maintaining Separate Finances: Provides a way to transparently track shared expenses (like rent and vacations) without fully merging bank accounts.

- New Parents: Manage new, shared costs like diapers, daycare, and other child-related expenses in a clear and organized way.

By using Honeydue to set up bill reminders and discuss transactions, couples can build healthy financial habits and turn money management into a collaborative effort.

5. Plates by Splitwise

Plates by Splitwise is a hyper-focused shared expense tracker app designed to solve one of the most common and contentious financial scenarios: splitting a restaurant bill. Developed by the team behind Splitwise, Plates hones in on the intricate details of a group meal, allowing users to divide costs item by item rather than just splitting the total. It replaces the frantic back-of-the-napkin math with a streamlined, digital process, ensuring everyone pays exactly for what they ordered.

This app is tailor-made for the modern dining experience where one person orders a salad, another gets a three-course meal, and a third just has a drink. Instead of awkward negotiations or unfair equal splits, Plates lets you take a photo of the receipt, assign each dish to a specific person, and automatically calculate individual totals, complete with tax and a customizable tip.

Key Features and Implementation

Plates is built around a simple, intuitive workflow: snap, assign, and split. Its optical character recognition (OCR) technology digitizes the receipt, and its user-friendly interface makes assigning items to diners a quick and easy task. This approach eliminates the manual data entry that can make other apps cumbersome for one-off events.

To use Plates, one person in the group downloads the app and starts a new bill. After photographing the receipt, the app attempts to identify each line item and its price. Users then drag and drop items onto the icons representing each diner. Shared items, like an appetizer or a bottle of wine, can be split evenly among those who partook. The app then calculates each person's subtotal, adds a proportional share of tax, and allows for a custom tip percentage to be applied, generating a final, individual total for everyone. For those looking to manage dining costs as part of a larger household budget, understanding how to apply these specific expenses can be invaluable. You can explore more about this with our top family budget tips to save money in 2025.

When to Use Plates by Splitwise

Plates excels in any situation involving a shared meal with unequal orders. It is the perfect tool for one-time events where installing a full-fledged expense tracker isn't necessary. It is the ideal choice for:

- Office Lunch Groups: Quickly and fairly split the bill when colleagues order different meals.

- Friends Dining Out: Avoids the "I only had a salad" dilemma by ensuring everyone pays their precise share.

- Business Meals: Provides a clear, itemized breakdown for individuals who need to expense their specific portion of a meal.

- Family Dinners: Perfect for when family members have different tastes and budgets, or for tracking spending on a casual outing.

By simplifying the bill-splitting process down to its core components, Plates ensures that the focus remains on the social experience of dining together, not the financial transaction at the end.

6. Cosplit

Cosplit offers a refreshing, back-to-basics approach in the world of feature-heavy financial tools, positioning itself as a streamlined shared expense tracker app. Its core philosophy is centered on simplicity, targeting users who need reliable bill-splitting functionality without the complexity of advanced accounting features. Cosplit is designed for quick, on-the-go expense logging, making it perfect for casual situations where transparency and speed are more important than detailed reporting.

The app’s strength lies in its uncluttered and intuitive interface. For instance, a group of friends on a weekend trip can use Cosplit to quickly log shared expenses like fuel, snacks, and activity tickets. One person pays for the $40 gas fill-up and logs it, splitting it equally in seconds. Another friend covers the $25 for concert tickets and adds it to the group's running total. This straightforward process avoids confusion and ensures everyone pays their fair share without getting bogged down in a complicated app.

Key Features and Implementation

Cosplit’s design prioritizes ease of use and rapid entry, making it an excellent tool for straightforward financial tracking. It strips away extraneous features to provide a clean, focused experience for managing shared costs among small, informal groups. The platform is built for immediate needs rather than long-term, complex financial management.

To begin, you create a group for a specific event, like "Beach Day" or "Colleague Lunch," and invite friends. When adding an expense, the process is direct: enter the amount, select who paid, and choose the participants. The app then automatically calculates who owes whom, presenting a clear summary of all balances. Its simplicity is its main feature; there are no complex splitting options or currency converters, which makes it incredibly fast for common scenarios.

This minimalist approach makes Cosplit highly effective for users who find other apps overwhelming. The focus remains squarely on capturing the expense and clarifying the debt, which is often all that is needed for simple sharing.

When to Use Cosplit

Cosplit is the ideal choice for short-term events or infrequent shared expenses where simplicity is key. It excels in scenarios that do not require detailed historical data or complex splitting rules. Consider using Cosplit for:

- Casual Meals with Friends: Quickly divide the bill for a dinner or brunch outing.

- Weekend Trips: Track shared costs for travel, lodging, and activities without a steep learning curve.

- Small Group Gifts: Easily manage contributions when buying a shared gift for a birthday or holiday.

- Informal Office Pools: Track who has paid for coffee runs or shared lunch orders among colleagues.

By focusing on fundamental expense splitting, Cosplit ensures that managing casual debts remains a simple, hassle-free task. It is the go-to shared expense tracker app for users who value speed and ease over extensive features.

7. Tab - The Simple Bill Splitter

Tab positions itself as the ultimate shared expense tracker app for immediate, in-the-moment social situations like group dinners and bar crawls. Where other apps focus on long-term ledgers, Tab is designed for the fast-paced environment of a single event. Its core function is to create a temporary, shared "tab" that multiple people can add items to in real time, making it perfect for nights out where different people are buying rounds or contributing to a shared meal.

The app's strength is its simplicity and real-time synchronization. Imagine a group dinner where one person orders drinks for the table, another pays for shared appetizers, and everyone orders their own main course. Instead of a messy post-dinner calculation, each person can add their contribution to the shared Tab as it happens. Everyone can see the running total and their individual share, which updates instantly. This live tracking removes the guesswork and makes settling the bill at the end of the night incredibly straightforward.

Key Features and Implementation

Tab’s design philosophy prioritizes speed and ease of use for short-term events. Its features are built to handle the dynamic nature of social spending, from splitting individual items to settling the final bill quickly. The platform excels at creating a collaborative and transparent financial space for a single outing.

To start, one person creates a new bill and shares a simple code or link with the group. Others join, and everyone can begin adding items from the receipt. A key feature is the ability to claim items; you simply tap the items you consumed, and the app calculates your individual total, including tax and tip. If multiple people shared an item, like a bottle of wine or an appetizer platter, they can all claim a portion of it, and Tab splits the cost among them automatically.

Once everyone has claimed their items, the app shows exactly what each person owes. This clarity is invaluable for groups where spending is uneven. It eliminates the need for one person to act as the "banker" and manually calculate each person's share, turning a potentially tedious task into a quick, collaborative process.

When to Use Tab

Tab excels in scenarios involving a single event with multiple small expenses contributed by various people. It is the ideal choice for:

- Group Dinners and Bar Tabs: Easily split complex restaurant bills with shared appetizers, drinks, and individual mains.

- Bachelor/Bachelorette Parties: Track ongoing expenses for activities, drinks, and food throughout the event.

- Short Trips or Weekend Getaways: Manage costs for a specific trip without creating a long-term group ledger.

- Event Planning: Keep a running total of costs as different people make purchases for a party or gathering.

By centralizing the bill in real time, Tab ensures everyone pays their fair share without friction. For those looking to extend this mindset to other recurring costs, you can learn more about how to save money on shared subscriptions with some easy strategies on accountshare.ai. This approach makes Tab a powerful tool for one-off events, complementing other apps used for ongoing expenses.

Feature Comparison of Top 7 Expense Apps

| App | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Splitwise | Moderate (multiple groups, features) | Moderate (multi-platform, sync) | Accurate, detailed group expense tracking | Travel groups, roommates, couples | Flexible splitting, multi-currency, payment integrations |

| Tricount | Low (simple interface) | Low (no forced accounts, offline) | Straightforward expense splitting | European travel, events, casual group expenses | Extremely user-friendly, quick setup |

| SettleUp | High (advanced features, complex) | Moderate (requires some setup) | Sophisticated debt management, reporting | Business and complex group financials | Advanced debt simplification, strong analytics |

| Honeydue | Moderate (focused on couples) | Moderate (account linking needed) | Joint financial planning and budgeting | Couples managing shared finances | Budgeting, communication, joint goals |

| Plates by Splitwise | Low to Moderate (specialized use) | Low (restaurant-focused) | Precise restaurant bill splitting | Dining groups, restaurants, itemized bills | Item-level splits, tax & tip calculation |

| Cosplit | Very Low (basic features) | Low (minimalist design) | Simple, fast expense splits | Casual friend groups, small simple expenses | Extremely simple, no premium tiers |

| Tab | Very Low (session-based) | Very Low (no registration needed) | Instant, real-time expense splitting | Bars, events, dynamic group spending | Real-time collaboration, no setup |

Choosing Your Perfect Partner in Shared Finance

Navigating the landscape of shared expenses can feel like a complex puzzle, but as we've explored, the right digital tool can transform confusion into clarity. The journey to financial harmony isn't about finding a single, universally "best" shared expense tracker app; it's about identifying the one that seamlessly integrates into your specific life situations and relationships. The power of these platforms extends far beyond simple arithmetic. They act as neutral, data-driven mediators that remove awkwardness and prevent the small resentments that can build over mismanaged shared costs.

Recapping Your Top Choices

Let's distill the core strengths of the top contenders to help you make a final decision. Your ideal choice hinges directly on your primary use case:

- For Long-Term, Ongoing Balances: If you live with roommates, frequently travel with the same group, or manage any long-term shared finances, Splitwise remains the gold standard. Its robust feature set for tracking complex IOUs, simplifying debts, and generating monthly summaries makes it an indispensable tool for ongoing financial relationships.

- For Romantic Partnerships: Couples aiming for greater financial transparency and joint goal-setting will find Honeydue to be a uniquely tailored solution. It’s designed not just for splitting but for uniting finances, making it a powerful ally in building a shared financial future.

- For Group Dining and Events: The chaos of a group dinner bill is a specific, acute pain point. Plates by Splitwise and Tab are surgical tools for this exact scenario. Their focus on item-by-item assignment and optical character recognition (OCR) makes them incredibly efficient for settling restaurant bills on the spot.

- For Simplicity and Speed: When you just need to split a single bill for a one-off event without the overhead of creating accounts and groups, Tricount and SettleUp shine. Their straightforward, no-frills approach prioritizes getting the job done quickly and efficiently.

From Tracking Expenses to Reducing Them

Adopting a shared expense tracker app is a foundational step towards financial wellness and stronger interpersonal bonds. It establishes a system of fairness and accountability, ensuring everyone pays their fair share without constant, uncomfortable conversations. This isn't just about managing debt; it's about building trust and fostering healthier communication with the people you share your life and experiences with. By automating the process, you free up mental and emotional energy to focus on what truly matters: enjoying the moments you’re sharing, not worrying about who paid for what.

The ultimate goal, however, isn't just to track your expenses but to actively lower them. Once you have a clear system for splitting costs, the next logical step is to reduce the total cost of the subscriptions and services you're sharing in the first place. This is where you can unlock a new level of savings.

Ready to take the next step in collaborative savings? While your new app helps you split costs fairly, AccountShare helps you reduce those costs from the start by making it easy and secure to share premium subscriptions. Stop overpaying for individual plans and start saving together by visiting AccountShare to see how much you can save on the digital services you already use and love.