8 Essential College Money Saving Tips for 2025

Share

Navigating college finances can feel as challenging as your toughest final exam. Between tuition, textbooks, and living expenses, the costs add up quickly, leaving many students stressed about debt. But what if you could significantly reduce that financial pressure with a few strategic changes? The key isn't about drastic sacrifices; it's about making smarter, more informed choices every day.

This guide provides a comprehensive list of actionable college money saving tips that go beyond generic advice. We’ll dive into practical strategies you can implement immediately, from leveraging often-overlooked campus resources and maximizing student discounts to optimizing your spending on essentials like food and entertainment. We'll even explore modern solutions for reducing digital expenses, such as securely sharing subscription costs using platforms like AccountShare.

By implementing these specific tips, you can gain control of your budget, reduce the burden of future debt, and free up your focus for what truly matters: your education and college experience. Let's explore how to build a stronger financial foundation, one smart decision at a time. This list is your blueprint for a more financially secure and less stressful academic journey.

1. Buy or Rent Used Textbooks

One of the most immediate and significant expenses students face each semester is the staggering cost of new textbooks. A single book can easily cost over $200, and a full course load can quickly add up to a thousand dollars or more per year. This makes opting for used or rented textbooks one of the most effective college money saving tips available. Instead of paying full price at the campus bookstore, you can slash your costs dramatically by exploring second-hand markets and rental services.

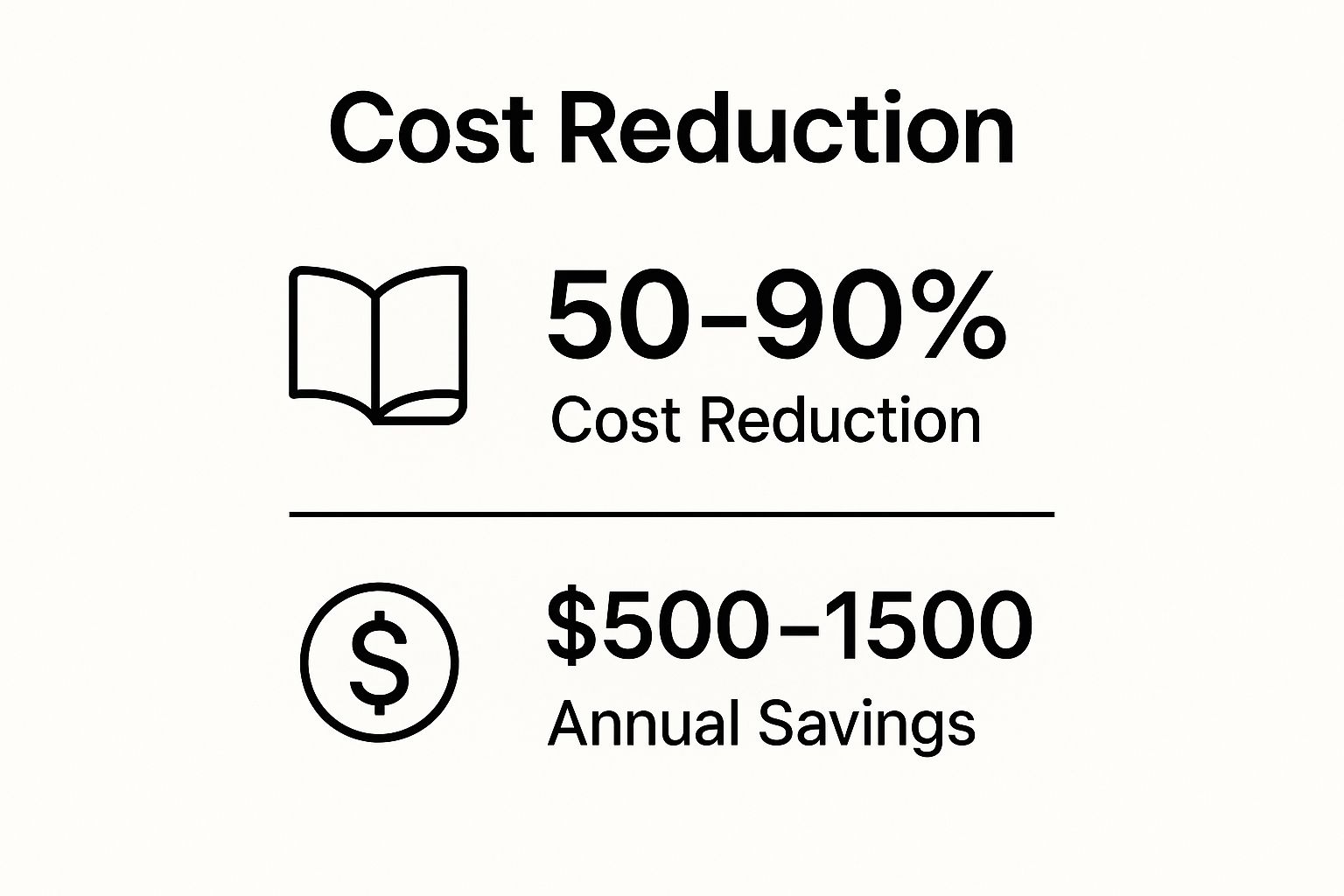

This strategy involves acquiring the required course materials from sources other than the publisher's direct-to-student pipeline. By doing so, you can often cut your textbook spending by 50% to 90%. For example, a student at the University of Michigan can save an average of $600 per year through textbook exchange programs, while others have reported saving over $800 in a single semester by using rental services like Chegg instead of buying new.

How to Maximize Your Textbook Savings

Getting the best deal requires a bit of strategic shopping. Don't just settle for the first used copy you find; a few extra minutes of research can yield significant savings.

- Compare Prices Aggressively: Use platforms like BookScouter, which compares prices from dozens of vendors, to find the absolute lowest price for buying or renting.

- Confirm Edition Requirements: Before purchasing an older, cheaper edition, email your professor to confirm if it’s acceptable. Often, the changes between editions are minor and won't affect your coursework.

- Join Student Exchange Groups: Search for Facebook or campus groups dedicated to textbook exchanges at your school. Buying directly from a fellow student is often the cheapest method and cuts out the middleman.

The following infographic highlights the potential savings you can achieve by avoiding the campus bookstore's new-book prices.

These figures underscore just how impactful this single change in spending habits can be, freeing up a significant portion of your budget for other essential college expenses.

2. Take Advantage of Student Discounts

One of the simplest yet most underutilized financial perks of being a student is the widespread availability of student discounts. Thousands of businesses, from global tech giants to local coffee shops, offer special pricing exclusively for enrolled students. This makes taking advantage of these offers one of the most powerful college money saving tips. By consistently presenting your student ID, you can unlock significant savings on everyday purchases, entertainment, and essential academic tools.

This strategy involves actively seeking out and using discounts that can range from 10% off a meal to over 50% off powerful software subscriptions. The savings add up quickly. For instance, students can save over $300 annually on an Adobe Creative Cloud subscription, get Spotify Premium at a fraction of the standard price, and receive hundreds of dollars off a new laptop from Apple or Dell. These discounts directly reduce your expenses without requiring any change in your essential purchases.

How to Maximize Your Student Discount Savings

To get the most out of these offers, you need to be proactive and prepared. Making it a habit to inquire about discounts can lead to hundreds, if not thousands, of dollars in savings over your college career.

- Always Ask: Make it a reflex to ask, "Do you offer a student discount?" at checkout, whether you're online or in a physical store. Many businesses don't advertise them prominently.

- Use Verification Platforms: Sign up for free services like UNiDAYS and Student Beans. These platforms aggregate thousands of online and in-store discounts, making them easy to find and redeem.

- Keep Your ID Ready: Always carry your physical student ID card. For online purchases, have a digital copy or be ready to use a verification service to prove your student status.

- Prioritize Student Software Versions: Before buying any software for your classes, check for a student version. As you can learn more about getting student software deals, companies like Microsoft and Adobe offer their full-featured products at a steep discount for students.

3. Cook Meals Instead of Eating Out

The convenience of campus dining halls, food trucks, and takeout apps comes at a high price, often becoming one of the largest drains on a student's budget. The constant small purchases of $10 for lunch or $20 for dinner quickly accumulate, leading to significant overspending. Making the switch to cooking your own meals is one of the most impactful college money saving tips for gaining control over your finances and building a valuable life skill. Instead of paying for service, overhead, and convenience, you can dramatically lower your food expenses by purchasing raw ingredients and preparing meals yourself.

This strategy involves planning meals, shopping for groceries strategically, and preparing food at home or in a dorm kitchen. By doing this, you can reduce your food costs by an astonishing 60-80%. For example, a graduate student was able to cut their weekly food spending from $150 on takeout down to just $50 on groceries. Similarly, many students who embrace meal prepping report reducing their monthly food costs from over $400 to around $150. Over an academic year, this simple change can easily save you between $2,000 and $4,000.

How to Maximize Your Food Savings

Successfully cooking for yourself doesn't require culinary expertise. It’s about planning and consistency. A few smart habits can turn your kitchen into a powerful savings tool.

- Plan and Prep Ahead: Dedicate a few hours on the weekend to plan your meals for the week. Cook large batches of versatile staples like rice, pasta, and chicken that you can use in different dishes.

- Shop Smart: Always make a grocery list and stick to it. Focus on store brands, which are often identical to name brands but cheaper, and look for sales on produce and protein.

- Invest in Basic Equipment: You don't need a gourmet kitchen. A simple rice cooker, a slow cooker, a good knife, and a few pans are enough to create a huge variety of delicious, low-cost meals.

- Team Up with Roommates: Share the cost of bulk ingredients and take turns cooking for the group. This not only saves money but also reduces the daily time commitment for everyone.

By mastering a few simple recipes and making cooking a regular part of your routine, you can eat healthier, learn a critical skill, and free up a significant amount of money for other college necessities.

4. Use Campus Resources and Facilities

One of the most overlooked college money saving tips involves taking full advantage of the resources already paid for through tuition and fees. Universities are packed with facilities and services that students often pay for separately out of pocket, not realizing a free or heavily subsidized version is available right on campus. From state-of-the-art gyms and extensive library services to career counseling and health clinics, these resources represent a massive hidden value.

This strategy is about shifting your spending from external commercial providers to the built-in campus infrastructure. By doing so, you can eliminate hundreds or even thousands of dollars in annual expenses. For instance, a student at a large state university who cancels their $60 per month commercial gym membership and uses the campus recreation center instead saves over $700 a year. Similarly, utilizing free on-campus tutoring services, which can be valued at $50-$100 per session, offers significant academic and financial benefits.

How to Maximize Your Campus Resource Savings

Getting the most out of your campus requires proactive exploration. Many valuable services go unused simply because students are unaware they exist, so a little research at the beginning of each semester pays off.

- Take a Comprehensive Tour: Go beyond the standard orientation tour. Visit the student union, recreation center, library, and student health services to see everything they offer. Ask about lesser-known perks like equipment rentals or free software.

- Leverage Academic Support: Before paying for private tutoring, check with your department or the campus learning center. They almost always offer free tutoring, writing labs, and study groups for challenging courses.

- Utilize Free Entertainment: Campuses are hubs of activity. Check the university events calendar for free movie nights, concerts, guest lectures, and sporting events instead of spending money on off-campus entertainment.

- Use Tech and Printing Services: Avoid paying for printing at commercial stores by using the computer labs and libraries on campus, which often provide a generous printing credit to students each semester.

5. Apply for Scholarships and Grants

Unlike student loans that accumulate interest and require repayment, scholarships and grants are essentially free money for your education. This makes pursuing them one of the most powerful college money saving tips you can adopt. Billions of dollars in scholarship funding go unclaimed each year simply because students don't apply, mistakenly believing they won't qualify. However, awards are available for a vast range of criteria, including academics, demographics, hobbies, and unique personal circumstances.

A consistent application strategy can significantly reduce or even eliminate your reliance on loans. For instance, an engineering student could earn $40,000 over four years from professional organization scholarships, while another student might secure a $2,500 award from a local community foundation’s essay contest. These individual awards add up, and a dedicated effort can lead to thousands of dollars in funding that you never have to pay back.

How to Maximize Your Scholarship and Grant Winnings

Securing this type of aid requires a proactive and organized approach. By treating the application process like a part-time job, you can dramatically increase your chances of receiving substantial financial support.

- Cast a Wide Net: Apply to many smaller, local scholarships instead of focusing only on large, national awards. These often have fewer applicants, increasing your odds of success.

- Use Multiple Search Engines: Don't rely on a single source. Create profiles on platforms like Fastweb and Scholarships.com, and also check with your college's financial aid office for institution-specific opportunities.

- Tailor Every Application: Avoid sending generic essays. Customize your application to align with the specific mission and values of the organization offering the scholarship. When you are ready to put together your applications, consider these top grant writing tips to make your submissions stand out.

- Apply Every Year: Don't stop after your freshman year. New scholarships become available annually, and your eligibility may change as you progress through your degree program.

6. Choose Community College for General Education

The traditional four-year university experience is an aspiration for many, but the associated price tag can be a major financial barrier. One of the most powerful college money saving tips is to strategically begin your higher education journey at a community college. By completing your general education requirements there before transferring, you can drastically reduce the overall cost of your degree while still graduating from your target four-year institution. This path allows you to pay significantly lower tuition for the first one or two years of foundational courses.

This strategy works by leveraging the massive cost difference between institution types. Annual tuition at a community college often ranges from $3,000 to $4,000, while a four-year university can cost anywhere from $10,000 for in-state public schools to over $50,000 for private ones. For example, a student in California can save more than $25,000 in tuition by completing their first two years at a community college before transferring to a UC campus. The credits for core classes like English, math, and history typically transfer seamlessly, satisfying the same degree requirements for a fraction of the price.

How to Maximize Your Transfer Savings

A successful transfer plan requires careful planning and proactive communication. Ensuring your credits are accepted and that you qualify for scholarships is key to making this strategy work effectively.

- Research Transfer Agreements: Proactively look up articulation agreements between your local community college and your desired four-year universities. These official documents outline which courses are guaranteed to transfer.

- Meet with Advisors Early: Schedule meetings with academic advisors at both institutions. This ensures you are creating a course plan that aligns perfectly with your future major's requirements and prevents you from taking unnecessary classes.

- Maintain a High GPA: A strong academic record at community college not only ensures your admission to a better four-year school but also makes you eligible for valuable transfer-specific scholarships, further reducing your costs.

- Consider Dual Enrollment: If you're still in high school, explore dual enrollment programs. This allows you to earn college credits at the community college rate (or sometimes for free) before you even graduate high school.

7. Find Free or Low-Cost Entertainment

The social aspect of college is crucial, but it often comes with a high price tag. Movie tickets, concerts, and frequent nights out can quickly drain a student's bank account. A powerful strategy among college money saving tips is to actively seek out free and low-cost entertainment options. Campuses and their surrounding communities are typically bustling with events that offer fun and social engagement without the hefty cost of commercial venues.

This approach means swapping expensive outings for activities that are either free or heavily discounted for students. By tapping into campus-sponsored events and local community offerings, you can maintain a vibrant social life while keeping your budget intact. For example, a student at Penn State could attend over 50 free on-campus concerts, movie nights, and cultural festivals a year, saving hundreds of dollars they might have otherwise spent on paid entertainment. Similarly, exploring local parks or joining a hiking club provides social and physical activity for free.

How to Maximize Your Entertainment Budget

Finding affordable fun requires a shift in mindset and a little proactive planning. Instead of defaulting to costly commercial options, explore the rich variety of activities available right at your doorstep.

- Follow Campus Calendars: Regularly check your university's event calendar and follow the social media accounts of student life departments and campus activities boards. They are your primary source for free movies, concerts, guest lectures, and festivals.

- Leverage Student Discounts: When you do opt for paid entertainment, always ask about student discounts. Many theaters, museums, and even local restaurants offer significant price reductions with a valid student ID.

- Organize Group Gatherings: Host a potluck dinner or a game night with friends instead of going out to eat. This creates memorable social experiences at a fraction of the cost. Even for digital entertainment, you can save by exploring student discount streaming services instead of paying full price.

- Explore the Outdoors and Community: Take advantage of local parks, hiking trails, and free community events like farmers' markets, art walks, and public festivals. These are excellent ways to explore your new city and meet people without spending money.

8. Share Living Expenses with Roommates

Housing is often the largest single expense for a college student, far surpassing tuition for many who live off-campus. Sharing these costs with roommates is one of the most powerful college money saving tips, allowing you to slash your biggest monthly bill significantly. By splitting rent, utilities, internet, and even groceries, you can reduce your individual financial burden by 50-75%, freeing up hundreds of dollars each month for savings or other essential expenses.

This strategy involves dividing the costs of a shared living space among multiple occupants. It's a fundamental approach that works for both on-campus dorms and off-campus apartments or houses. For example, four students sharing a house could see their individual rent drop from a potential $800 to just $300 per month each. Beyond rent, roommates can save an average of $600 annually by splitting grocery bills and cooking meals together, while sharing streaming subscriptions can save each person over $200 per year.

How to Maximize Your Roommate Savings

A successful roommate arrangement depends on clear communication and organization from the start. A few proactive steps can prevent financial friction and ensure everyone benefits fairly.

- Establish Clear Agreements Upfront: Before signing a lease, have a frank discussion about finances, chores, guests, and quiet hours. Documenting these rules in a roommate agreement can prevent future conflicts. When securing a place, exploring top lease negotiation tips can also significantly reduce your monthly housing costs for everyone.

- Use Expense-Tracking Apps: Manually splitting bills can be a headache. Use apps like Splitwise to track shared expenses fairly and transparently. For a deeper dive into managing group finances, you can learn more about how a shared expense tracker app can streamline this process.

- Create a Shared Household Budget: For recurring costs like groceries and cleaning supplies, create a shared budget. Each roommate can contribute a set amount each month to a common fund, simplifying purchasing and ensuring fairness.

By being intentional about how you manage shared living, you transform a simple cost-cutting measure into a highly effective financial strategy for your college years.

College Money Saving Tips Comparison Matrix

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Buy or Rent Used Textbooks | Moderate (searching multiple platforms) | Low to Moderate (time to compare & rent/buy) | High cost savings (50-90% reduction) | Students needing textbooks on budget | Significant savings, option to resell, eco-friendly |

| Take Advantage of Student Discounts | Low (requires student ID and verification) | Low (just proof of enrollment) | Moderate to high savings (10-50% off) | Frequent shoppers, software/electronics users | Wide variety of discounts, software freebies |

| Cook Meals Instead of Eating Out | Moderate to High (meal planning, cooking skills) | Moderate (kitchen tools, grocery shopping) | Very high savings ($2,000-4,000 annually) | Students with access to kitchen facilities | Healthier meals, valuable life skills, cost-effective |

| Use Campus Resources and Facilities | Low to Moderate (awareness and scheduling) | Low (already included in tuition) | Moderate savings ($1,000-3,000 annually) | Students on campus seeking services | No extra fees, professional support, convenient |

| Apply for Scholarships and Grants | High (time-intensive applications) | Moderate (time for research and applications) | Potentially very high financial aid | Academically qualified or diverse students | Debt-free funding, wide eligibility, reduces tuition |

| Choose Community College for Gen Ed | Moderate (planning transfer, researching credits) | Low to Moderate (tuition, advising) | High savings (40-60% total education cost) | Students planning a 4-year degree | Lower tuition, smaller classes, improves GPA |

| Find Free or Low-Cost Entertainment | Low to Moderate (research and planning) | Low (mostly time investment) | Moderate savings ($100-300 per month) | Social students on a budget | Unique experiences, social networking, budget-friendly |

| Share Living Expenses with Roommates | Moderate (coordination and agreements) | Low to Moderate (shared bills and groceries) | Very high savings ($3,000-8,000 annually) | Students seeking housing cost reduction | Major cost split, social support, shared responsibilities |

Turn Savings into Success

The journey through higher education is as much about financial management as it is about academic achievement. Navigating this path successfully means moving beyond simply surviving each semester and instead, actively building a strong financial foundation for your future. The strategies detailed in this article, from sourcing used textbooks and leveraging student discounts to applying for every possible scholarship, are more than just a collection of college money saving tips; they are the fundamental building blocks of lifelong financial wellness.

From Small Habits to Big Wins

The power of these strategies lies not in grand, one-time actions, but in consistent, daily choices. Opting to cook a meal instead of ordering takeout might seem insignificant on a Tuesday night, but compounded over four years, that decision can save you thousands of dollars. Similarly, making full use of the campus gym, library, and free entertainment events doesn't just cut costs, it enriches your college experience without draining your bank account.

The most impactful takeaway is that financial control is within your reach. You are not a passive participant in your financial life. By proactively implementing these tips, you transform from a consumer into a strategic planner. This mindset shift is invaluable, turning potential financial stress into a sense of empowerment and security.

Your Action Plan for Financial Freedom

Graduating with minimal debt is one of the most significant advantages you can give your future self. It opens doors to opportunities, reduces long-term stress, and accelerates your ability to build wealth. The key is to start now, no matter how small.

Here are your actionable next steps:

- Review Your Spending: Take one hour this week to track your expenses. Identify the top three areas where you can implement one of the tips we've discussed.

- Create a Simple Budget: Don't aim for perfection. A basic budget that allocates funds for needs, wants, and savings is a powerful first step.

- Choose One Habit to Master: Pick a single strategy, like cooking three more meals at home per week or canceling one unused subscription, and stick with it for a month.

These college money saving tips are not about deprivation; they are about prioritization. They empower you to allocate your limited resources toward what truly matters: your education, your well-being, and your future. By mastering these habits today, you are investing in a future where you are in control, graduating with the confidence and financial freedom to pursue your dreams without the heavy burden of debt.

Ready to start saving immediately on your digital subscriptions? Join the thousands of students who are cutting their monthly bills by sharing services like streaming, music, and software on AccountShare. It’s the smartest way to enjoy premium access without the premium price. Find your group and start saving today at AccountShare