Organize Online Accounts: Simplify Your Digital Life

Share

The Hidden Cost of Digital Chaos

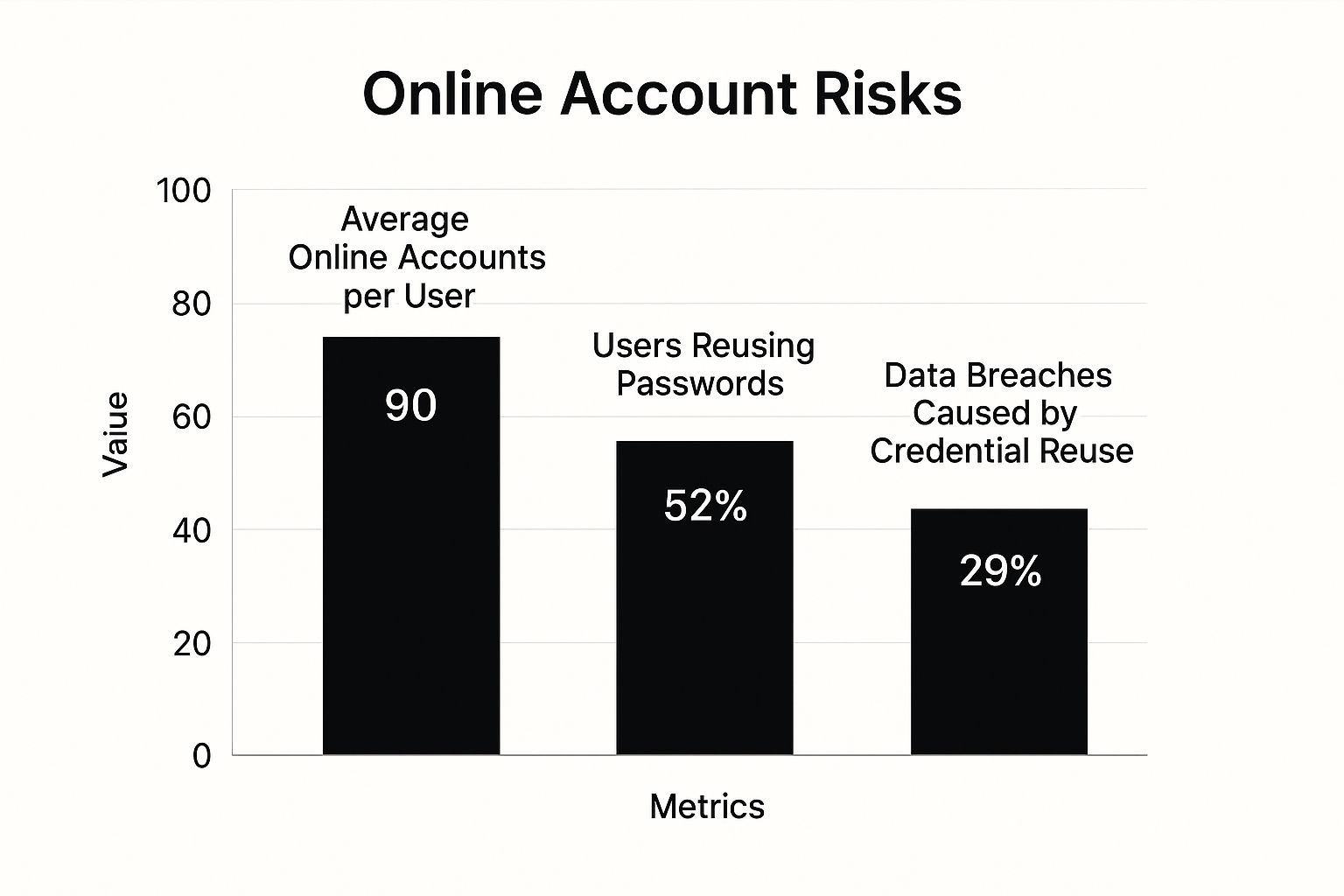

The infographic above highlights some serious risks tied to managing numerous online accounts. These include the sheer volume of accounts, our password habits, and how vulnerable we are to data breaches. The data paints a concerning picture: the average user has around 90 online accounts, with 52% reusing passwords. Alarmingly, 29% of data breaches stem from this very practice.

This illustrates the clear link between these issues and underscores the need for a reliable system to organize our digital lives. Imagine trying to remember 90 different, strong passwords! It’s no wonder many people resort to risky shortcuts like password reuse.

The Stress of Digital Overload

This explosion of online accounts brings with it a new type of stress: digital overload. Juggling logins, passwords, and security updates creates a significant cognitive burden. It’s like trying to manage a massive library with no cataloging system. Finding the right “book” (or account) becomes a frustrating and time-consuming chore.

This stress can manifest in wasted time recovering passwords, dealing with the fallout of security breaches, and simply feeling overwhelmed by the sheer volume of digital information we face daily.

The Financial Implications of Disorganization

Beyond the mental strain, disorganized online accounts can impact our finances. Forgetting about subscriptions can lead to unnoticed recurring charges, slowly chipping away at our bank balances.

The growth of digital banking has magnified these risks. The global digital banking market, valued at $10.9 trillion in 2023, is expected to hit $22.3 trillion by 2026. With more financial activity online, staying organized is essential. Over 3.6 billion people are projected to use online banking services in 2025, highlighting the growing need for effective digital financial management. For more detailed statistics, check out this resource: Learn more about online banking statistics.

Security Risks and Data Breaches

Perhaps the most serious consequence of disorganized accounts is increased vulnerability to security breaches. Weak or reused passwords are a welcome mat for hackers. This is especially worrying given the significant percentage of data breaches linked to compromised login details.

Just like leaving your house keys under the doormat, poor password practices put your sensitive personal and financial information at risk. Organizing your online accounts isn’t just about convenience; it’s a crucial step in protecting your digital security and peace of mind. Using tools like AccountShare, a platform designed for securely sharing and managing premium subscriptions, can help mitigate these risks. Learn more about AccountShare here: AccountShare.ai.

To further illustrate the prevalence of online accounts and their distribution across different age groups, consider the following table:

The following table provides a breakdown of the average number of online accounts held by individuals across different age demographics, categorized by account type.

| Account Category | 18-29 years | 30-44 years | 45-60 years | 60+ years |

|---|---|---|---|---|

| Social Media | 7 | 6 | 4 | 2 |

| 3 | 4 | 3 | 2 | |

| Shopping | 5 | 6 | 5 | 3 |

| Financial | 4 | 5 | 6 | 4 |

| Entertainment | 6 | 5 | 4 | 2 |

| Other | 15 | 14 | 8 | 7 |

| Total | 40 | 40 | 30 | 20 |

This data emphasizes the prevalence of online accounts across all age groups, although younger demographics tend to hold a larger number and diversity of accounts. This difference highlights the need for tailored organizational strategies for different age groups, reflecting varying levels of digital engagement and potential security risks.

Building Your Digital Inventory Blueprint

Before tackling digital disorganization, it's essential to understand your online presence. This begins with creating a digital inventory: a comprehensive list of all your online accounts. This blueprint will guide you in simplifying your digital life and enhancing your online security.

Uncovering Your Digital Footprint

Think of this as a digital archaeology project. Start with the most obvious accounts: social media platforms like Facebook, email providers such as Gmail, and online banking portals. Then, delve deeper into less frequently used accounts. This might include shopping websites like Amazon, online forums, gaming platforms, and professional networking sites like LinkedIn. Don't forget about older accounts you may have created and forgotten.

Choosing the Right Inventory System

Various methods exist for building your digital inventory, each suited to different organizational preferences. A simple spreadsheet works well for those who prefer a minimalist approach, listing account names, usernames, passwords, and URLs. For visual thinkers, mind-mapping tools offer a non-linear approach to categorizing accounts. More information can be found here: How to master...

- Spreadsheets: Ideal for basic organization, offering a clear, structured overview of your accounts.

- Mind Maps: Useful for visualizing the connections between different accounts and categories.

- Password Managers: Password managers often include built-in inventory features, along with secure password storage.

- Dedicated Account Management Tools: These provide advanced features such as security audits and automated updates.

Categorizing for Clarity and Control

After compiling your list, categorize your accounts. This adds a crucial layer of organization, simplifying management and security. Consider categorizing by:

- Purpose: (e.g., Social, Financial, Shopping, Entertainment)

- Sensitivity: (e.g., High - containing financial data, Medium, Low)

- Frequency of Use: (e.g., Daily, Weekly, Monthly, Rarely)

This structured approach transforms your inventory from a basic list into a dynamic control center. It also helps identify dormant accounts that could pose security risks.

The Future of Account Management

Account management is constantly evolving. Advances in artificial intelligence (AI) and the changing nature of social media will influence how we manage our online presence. This includes the potential for AI-powered personalized financial services and more integrated digital experiences. Consequently, users will likely rely more on smart tools to manage their digital activities. The global digital banking platform revenue is projected to reach $13.4 billion by 2026, highlighting the growing importance of digital platforms for managing financial and personal information. Learn more: Digital 2025 Global Overview Report. This emphasizes the importance of building a robust digital inventory now to prepare for future advancements. A well-organized inventory becomes the foundation for effectively using these emerging tools and maintaining control of your expanding digital footprint.

Password Mastery: Beyond the Sticky Note

Having a well-organized inventory of online accounts is a great first step. But true digital security begins with a robust password strategy. This means moving beyond common, yet risky, password habits.

The Perils of Weak Passwords

Many underestimate the dangers of weak or reused passwords. Cybersecurity professionals often compare this to using the same key for your house, car, and office. If a thief gets one key, they have access to everything. One compromised password can unlock multiple accounts, exposing sensitive information.

Understanding Password Managers

Password managers are designed to solve this problem. They act as secure digital vaults for your passwords. These tools generate and store complex, unique passwords for every account. You only need to remember one master password to unlock the vault. This eliminates the need to memorize dozens of passwords, reducing the temptation to reuse weak ones. LastPass is one example of a popular password manager.

Creating Strong, Memorable Passwords

Even without a password manager, you can create strong, memorable passwords. One effective method is using a passphrase: a string of random words, numbers, and symbols. For example, "purple elephant 27! singing" is much stronger and more memorable than "P@$$wOrd1".

Implementing Multi-Factor Authentication

Multi-factor authentication (MFA) adds another layer of security. MFA requires a second verification factor, like a code sent to your phone, in addition to your password. It's like adding a deadbolt to your door. Even with the key (password), entry is blocked without the second factor.

Account Recovery Strategies

Even with strong security, problems can arise. A well-defined account recovery plan is crucial. This includes setting up recovery email addresses and phone numbers. Document your security questions and answers in a safe place, ideally offline or in a secure password manager. This ensures you can regain access if you're locked out.

Comparing Password Management Solutions

Choosing the right password manager depends on your needs. The following table, "Password Manager Comparison", evaluates top solutions:

To help you choose the best password manager for your needs, we've compiled a comparison of several popular options, evaluating their features, security measures, and pricing.

| Password Manager | Free Features | Premium Features | Security Measures | Cross-Platform Support | Monthly Cost |

|---|---|---|---|---|---|

| LastPass | Password storage, password generator | Family sharing, dark web monitoring | AES-256 encryption, two-factor authentication | Yes | $3 |

| 1Password | Password storage, one-time passwords | Travel mode, document storage | End-to-end encryption, two-factor authentication | Yes | $3.99 |

| Dashlane | Password storage, autofill | VPN protection, identity theft monitoring | Zero-knowledge architecture, two-factor authentication | Yes | $5.99 |

| Bitwarden | Password storage, password generator | Priority support, self-hosting | Open-source, two-factor authentication | Yes | $10 |

This table provides a quick overview of some key features and pricing differences among these popular password managers. Be sure to research each option further to determine which one best meets your individual security needs and budget.

By mastering these password strategies, you transform your online accounts from a potential vulnerability into a well-defended digital fortress.

Taking Control of Your Financial Digital Footprint

Your financial accounts deserve special attention within your overall digital organization plan. This section offers a structured approach for managing banking, investments, credit cards, and online payment platforms, promoting both financial clarity and stronger security.

Organizing Your Financial Accounts

Effective financial management begins with a comprehensive overview. Much like a business maintains meticulous records, you should develop a system for keeping track of your financial accounts. This includes documenting account details, login information, and security details securely.

Consider using a password manager or a secure spreadsheet. However, always prioritize offline storage for your most sensitive data.

This organized approach allows for easy access to important information. It also simplifies tax preparation and provides a clear picture of your overall financial standing. Plus, it streamlines account access for trusted individuals in emergencies. You might find this helpful: How to master...

Navigating Account Aggregation Services

Account aggregation services provide a handy way to view all your financial accounts in a single location. However, while offering convenience, they also present potential security concerns.

Carefully evaluate the security practices of any aggregation service you consider. Choose providers with strong encryption and multi-factor authentication.

These services can streamline financial tracking, but they should be used cautiously. Finding a balance between convenience and security is paramount in effectively managing your financial digital footprint.

Taming Subscription Services and Payment Methods

Recurring subscriptions can subtly impact your finances. Regularly review your subscriptions, canceling any unused or unnecessary services.

Consolidating payment methods onto a small number of secure cards simplifies tracking. This also reduces the number of accounts you need to actively manage.

This minimizes financial complexity and improves security by limiting potential vulnerabilities. For additional security measures, consider reviewing this guide on effective Password Management.

Planning For Your Digital Estate

Digital estate planning is a critical yet frequently overlooked aspect of financial management. Make sure a trusted person can access your financial accounts in case of an emergency or death.

This involves clearly documenting account information, login credentials, and instructions for handling your digital assets.

This aspect of financial planning offers peace of mind and ensures responsible management of your digital legacy. Just like creating a will for physical assets, planning for your digital estate is an essential part of responsible financial management.

Taming Your Social Media and Content Universe

In our increasingly digital lives, we often accumulate a vast collection of online accounts, spanning social media profiles and content subscriptions. It's easy to lose track of these digital fragments, leading to a disorganized and potentially vulnerable online presence. This section offers a practical approach to organizing these accounts, bringing order to your social media and content consumption, and ultimately, taming your digital universe.

Conducting a Social Media Audit

A social media audit is the crucial first step in organizing your online presence. This involves identifying all your social media profiles, analyzing their activity, and assessing their security. Consider it a much-needed spring cleaning for your digital life.

- Identify: Create a comprehensive list of every social media platform you've ever joined, including those you may have forgotten.

- Analyze: Log into each account and review your activity, connections, and the information you've shared.

- Assess: Check your privacy settings, connected apps, and the strength of your passwords.

This audit frequently reveals dormant accounts, which can present security risks. Much like an unmaintained property, inactive online accounts are vulnerable to breaches.

Streamlining Active Platforms With Unified Dashboards

After identifying your active accounts, streamline their management to save time and reduce cognitive overload. Unified dashboard tools, such as Hootsuite or Buffer, allow you to manage multiple social media platforms from a single interface. This centralized approach simplifies scheduling posts, monitoring engagement, and responding to messages. It's like having a central control panel for all your social media activities.

Organizing Content Subscriptions for Maximum Value

Content subscriptions, from streaming services like Netflix to online publications, can quickly become overwhelming and costly. Organizing them strategically maximizes their value while minimizing cost and clutter.

- Inventory: Compile a list of all your content subscriptions, noting their cost and how often you use them.

- Evaluate: Assess the value each subscription provides. Are you truly utilizing that premium streaming service?

- Consolidate: Explore bundling services or sharing subscriptions with family or friends. You might be interested in: How to master...

- Automate: Utilize tools to track renewal dates and manage payments, preventing unwanted charges and ensuring you only pay for what you use. Consider using services like Truebill or Mint.

Effective Digital Footprint Management and Privacy Protection

Managing your digital footprint also requires awareness of data privacy regulations, like India's Digital Personal Data Protection Bill, 2023. Controlling your online presence extends beyond social media and content subscriptions. Actively manage the information available about you online and implement privacy protection measures. This includes reviewing privacy settings, limiting data sharing, and being mindful of your online activities. Just as you protect your physical possessions, safeguarding your digital identity is crucial. By taking control of your social media, content universe, and overall digital footprint, you create a more organized, secure, and ultimately, more enjoyable online experience.

Building Maintenance Habits That Actually Stick

Organizing your online accounts is a big win. But maintaining that organization is essential for long-term success. This section explores how to turn good intentions into lasting habits, preventing digital clutter from creeping back in.

Designing Minimal-Effort Maintenance Routines

The key to sustainable organization is minimizing effort. Imagine tidying up your kitchen after every meal instead of letting dishes pile up. Small, regular actions prevent things from becoming overwhelming. This principle also applies to your digital life.

-

Regular Password Updates: Schedule routine password changes, maybe quarterly. Use a password manager to streamline the process.

-

Account Reviews: Dedicate a few minutes each week to review recently used accounts, making sure all information is current.

-

Unsubscribe from Unwanted Emails: Regularly unsubscribe from marketing emails and newsletters you no longer read to prevent inbox overload.

These small habits add up, preventing the return of digital chaos.

Automating the Heavy Lifting

Many digital maintenance tasks can be automated, just like bill payments. For example, set up automatic security updates for your software and apps. Many password managers even offer automatic password updates, further simplifying your security routine. Consider using a service like IFTTT or Zapier to automate tasks such as saving receipts to a digital inventory or backing up your password manager data.

Strategic Defaults and Decision Frameworks

Effective digital organizers simplify decision-making with strategic defaults. Set a default action for new account creation, like automatically adding them to your password manager and inventory spreadsheet. Develop a clear process for deciding whether to keep, delete, or archive old accounts for consistent management of your digital footprint.

Seasonal Account Reviews: A Streamlined Approach

Regular reviews are key, but they don’t have to be a burden. Implement a seasonal review system. Like spring cleaning your home, set aside time each season to review all online accounts.

-

Spring: Focus on financial accounts. Review budgets, investments, and subscriptions.

-

Summer: Review social media and entertainment accounts. Adjust privacy settings and connections.

-

Fall: Prioritize security. Update passwords and check security settings across all accounts.

-

Winter: Review and update your digital inventory and account recovery information.

This structured approach makes account maintenance manageable and less daunting.

Handling New Account Requirements

New accounts are part of our digital lives. Create a simple onboarding process for new accounts, ensuring they’re immediately integrated into your organized system. This includes adding them to your password manager, updating your inventory, and categorizing them correctly. Think of it like adding a new book to your library – it has a designated place and is immediately cataloged.

By adopting these maintenance habits, you can transform your digital life from a source of stress to a well-oiled machine. This ongoing effort ensures your organized online accounts remain a valuable asset, boosting both productivity and peace of mind.

Ready to take control and simplify your online accounts? AccountShare offers a platform for shared access to premium services and subscriptions, streamlining your digital experience and saving you money. Learn more and start sharing securely today: Discover AccountShare