12 Best Budget Software for Small Business in 2025

Share

Keeping a tight grip on finances is non-negotiable for any small business aiming for growth and stability. Manual spreadsheets and guesswork can quickly lead to cash flow crises and missed opportunities. The right budget software for small business isn't just about tracking expenses; it's a strategic tool that provides clarity, empowers informed decision-making, and lays the foundation for sustainable success. This guide moves beyond basic feature lists to deliver a comprehensive resource for finding the ideal financial platform.

We will dive deep into the top solutions, evaluating everything from invoicing and payroll to advanced forecasting and reporting. Our goal is to help you select a tool that aligns with your specific operational needs, whether you're a solo freelancer, a growing service-based company, or a retail startup.

Inside, you will find detailed reviews of 12 leading platforms, complete with screenshots, direct links, and an honest assessment of their strengths and limitations. We analyze practical use cases and implementation considerations to ensure you can confidently choose the best software to streamline your finances and drive your business forward. Let’s explore the options that will transform your financial management from a chore into a strategic advantage.

1. AccountShare

AccountShare presents a unique and powerful approach for small businesses aiming to control their software-as-a-service (SaaS) expenditures. Instead of direct accounting or expense tracking, it leverages a collective buying model, allowing businesses to access premium software subscriptions through secure, shared groups. This model drastically cuts the per-user cost for essential tools, making it an innovative piece of budget software for small business teams.

The platform is particularly effective for accessing high-demand applications like generative AI tools, project management software, and design platforms that might otherwise be prohibitively expensive for a growing team. Its standout feature is the combination of significant cost reduction with robust security, including customizable permissions and secure password management.

Key Strengths and Use Cases

AccountShare excels by providing priority access and stable performance, even for services known for high traffic. This ensures your team’s productivity isn’t hampered by service interruptions or slow response times. For example, a small marketing agency can provide its entire team with shared access to a premium AI copywriting tool for a fraction of the cost of individual licenses.

Practical Implementation:

- Cost Reduction: Pool resources with other users to access tools like ChatGPT Plus, typically reducing the cost to around $10 USD per seat.

- Enhanced Collaboration: Securely share access to collaborative software without compromising primary account credentials.

- Simplified Management: The user interface is praised for being intuitive, streamlining the process of joining or managing a subscription group.

While the shared nature means it may not be ideal for services requiring strict individual data privacy, its security protocols make it a viable and strategic choice for many collaborative tools.

Learn more at AccountShare

2. QuickBooks Online

QuickBooks Online is a powerhouse in the accounting world, making it a go-to choice for small businesses seeking comprehensive budget software for small business needs. It excels by bundling robust accounting features with user-friendly budgeting tools. Beyond just tracking numbers, you can create detailed budgets, compare them against actual performance, and generate insightful financial reports to guide your business decisions. Its standout feature is the vast integration ecosystem, connecting with over 750 third-party apps, allowing you to build a customized financial tech stack.

While its user-friendly interface is perfect for non-accountants, its scalability supports growing businesses that need more advanced features over time. This makes it ideal for a service-based business that needs to track project profitability or an e-commerce store managing inventory and multi-currency sales.

Key Details & Pricing

- Best For: Businesses needing an all-in-one accounting and budgeting solution that can scale.

- Unique Feature: Unmatched integration with over 750 third-party apps for ultimate customization.

- Pricing: Plans start at $30/month, with more advanced tiers offering additional features and users.

Pros:

- Intuitive interface simplifies complex accounting tasks.

- Extensive support resources, including a large user community.

- Scalable plans that grow with your business.

Cons:

- Higher starting price point than simpler budgeting tools.

- User limits on lower-tier plans can be restrictive.

Website: https://quickbooks.intuit.com/online/

3. Xero

Xero stands out in the crowded accounting software space with its beautiful, intuitive design and powerful features, making it an excellent choice for those seeking budget software for small business with a focus on simplicity. It provides robust tools for creating and managing budgets, tracking cash flow in real-time, and generating detailed financial reports. Its unique selling point is offering unlimited users on all plans, which fosters collaboration without driving up costs as your team grows.

This platform is particularly well-suited for service-based businesses, startups, and digital nomads who value a clean interface and strong mobile capabilities. With over 1,000 app integrations and automated bank feeds, Xero streamlines financial management, allowing you to focus more on business operations and less on bookkeeping. The customizable dashboard provides a personalized, at-a-glance view of your company's financial health.

Key Details & Pricing

- Best For: Small businesses and startups that need collaborative, user-friendly accounting without per-user fees.

- Unique Feature: Unlimited users included on all pricing plans, promoting team-wide financial access.

- Pricing: Plans start at $15/month, with promotional discounts often available for new users.

Pros:

- Affordable starting price with significant introductory discounts.

- Highly customizable dashboard for a personalized user experience.

- Strong security measures and reliable uptime.

Cons:

- Entry-level plan has restrictive limits on sending invoices and entering bills.

- Lacks direct phone support, relying on email and online resources.

Website: https://www.xero.com/

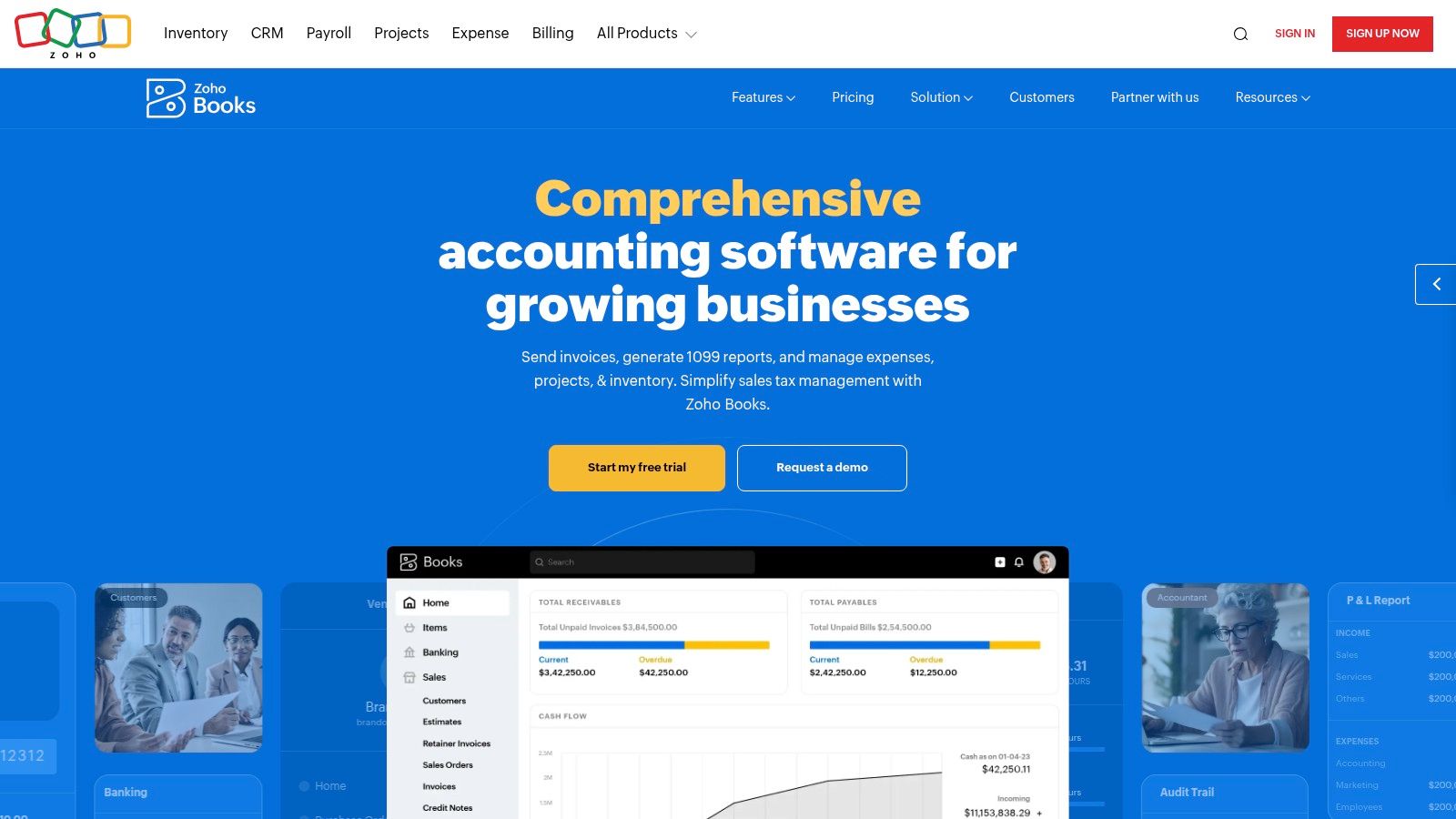

4. Zoho Books

Zoho Books is an incredibly powerful and affordable platform, making it a standout choice for anyone seeking budget software for small business without the enterprise-level price tag. It shines by offering a comprehensive accounting solution that is deeply integrated into the wider Zoho ecosystem of business apps. Users can create budgets, track actual spending against them, automate invoicing workflows, and manage expenses on the go with a robust mobile app. Its unique selling point is the value it provides, especially for businesses already using or planning to use other Zoho products like Zoho CRM or Zoho Projects.

The platform is designed for user-friendliness, with clean dashboards and automated features that reduce manual data entry. This makes it ideal for a small consultancy managing international clients with its multi-currency support, or a startup that needs a free, full-featured accounting tool to manage finances until revenue grows.

Key Details & Pricing

- Best For: Small businesses looking for a cost-effective, all-in-one accounting solution, especially those in the Zoho ecosystem.

- Unique Feature: A completely free plan for businesses with annual revenue under $50,000.

- Pricing: Paid plans are highly affordable, starting from a very competitive price point with advanced features.

Pros:

- Generous free plan offers significant value for startups.

- Strong integration with other Zoho business applications.

- Excellent customer support available via phone, chat, and email.

Cons:

- Fewer third-party integrations compared to competitors like QuickBooks.

- User limits on plans can lead to extra fees for growing teams.

Website: https://www.zoho.com/books/

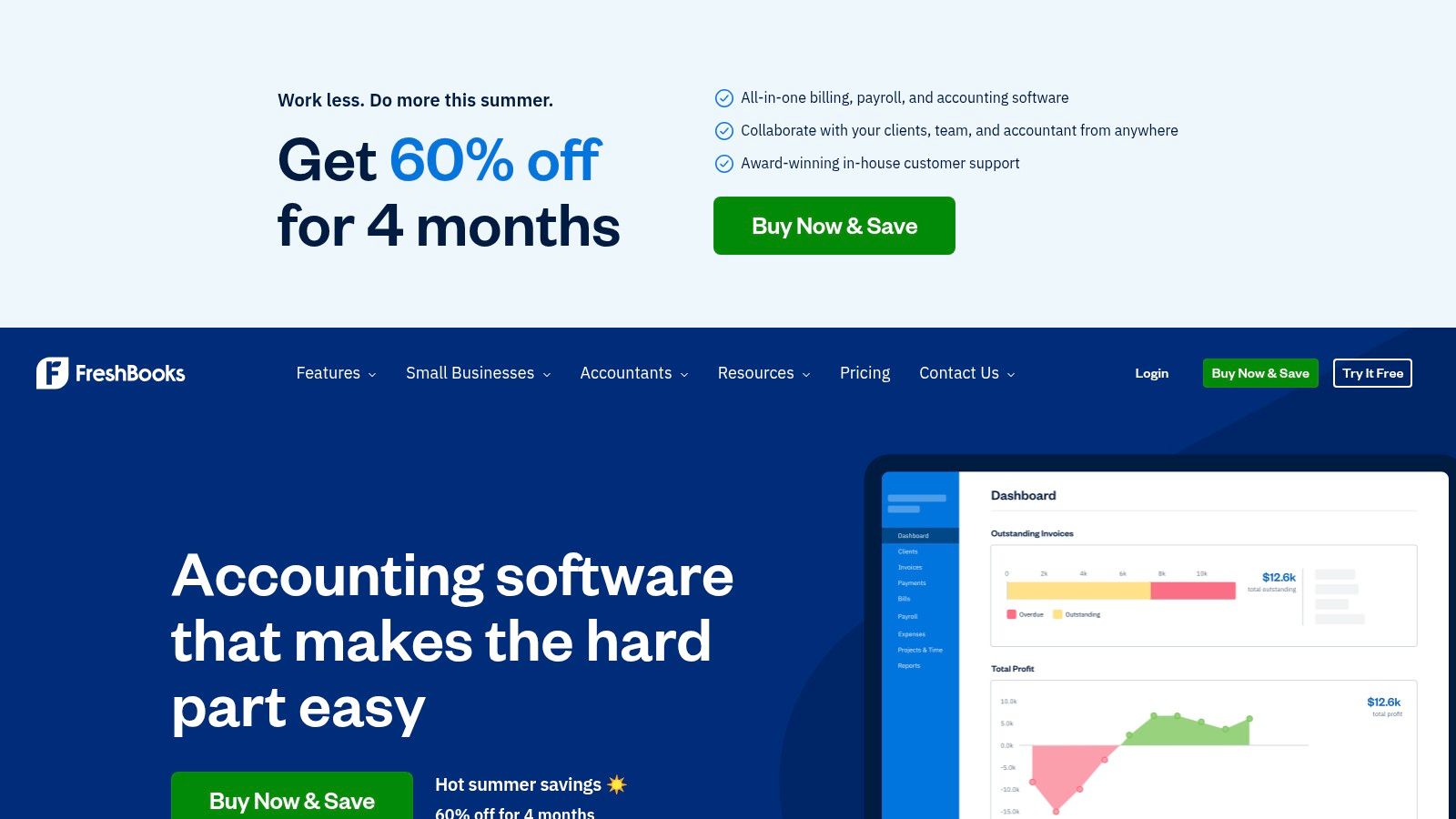

5. FreshBooks

FreshBooks shines as a top-tier choice for freelancers and service-based small businesses looking for intuitive budget software for small business. It masterfully combines robust invoicing and expense tracking with easy-to-use budgeting and project management tools. Its core strength lies in simplifying the financial workflow, allowing users to track billable hours, automate client invoices, and scan receipts effortlessly. The platform is designed from the ground up for non-accountants, making complex tasks feel straightforward and manageable.

This focus on simplicity makes it perfect for creative professionals, consultants, and contractors who need to manage project profitability without getting bogged down in complicated accounting software. By connecting project details directly to financial data, FreshBooks provides clear insights into which clients and services are most profitable, helping guide strategic business decisions. It also integrates with tools for managing recurring payments, making it a solid choice for businesses with subscription-based models. For more on this, you can learn about top subscription management tools for your business.

Key Details & Pricing

- Best For: Freelancers and service-based businesses focused on project profitability and invoicing.

- Unique Feature: An exceptionally user-friendly interface designed specifically for non-accountants.

- Pricing: Plans start around $19/month, with tiers that support growing teams and additional features.

Pros:

- Outstanding customer support with real-time phone and chat options.

- Powerful mobile app for managing finances on the go.

- Strong time tracking and project management capabilities.

Cons:

- Adding extra users comes with additional fees.

- May lack the deep accounting features required by more complex businesses.

Website: https://www.freshbooks.com/

6. Wave

Wave stands out in the crowded financial software space by offering a completely free solution, making it an exceptional choice for startups, freelancers, and small businesses operating on the tightest of budgets. It provides core accounting tools without a monthly subscription, covering essential needs like income and expense tracking, unlimited invoicing, and receipt scanning. This makes it an invaluable piece of budget software for small business owners who need professional-grade tools without the associated costs. Its primary appeal is its simplicity and accessibility, removing financial barriers for new entrepreneurs.

While its budgeting features are not as deep or customizable as paid competitors, it provides the fundamental financial reports needed to monitor cash flow and business health. For a service-based business or sole proprietor just starting, Wave delivers incredible value by covering all the basics needed to manage finances effectively and professionally from day one, without any upfront investment.

Key Details & Pricing

- Best For: Freelancers, consultants, and very small businesses needing free, no-frills accounting and invoicing.

- Unique Feature: Completely free accounting, invoicing, and receipt scanning software with no limits.

- Pricing: Core software is free. Fees apply only for optional services like payment processing (starting at 2.9% + 60¢ per transaction) and payroll.

Pros:

- No monthly fees for the main accounting and invoicing features.

- Extremely user-friendly interface ideal for non-accountants.

- Unlimited bank connections, invoices, and collaborators.

Cons:

- Lacks advanced budgeting and forecasting tools.

- Reporting capabilities are basic compared to paid platforms.

Website: https://www.waveapps.com/

7. PlanGuru

PlanGuru carves out its niche by moving beyond simple expense tracking to offer sophisticated financial forecasting and analysis. This platform is an excellent choice for businesses that require more than just a basic overview, making it a powerful budget software for small business that prioritizes future planning. It empowers users to build detailed financial projections for up to 10 years, using over 20 different forecasting methods and custom financial drivers. Its standout capability is the robust "what-if" scenario analysis, allowing you to model various business outcomes.

While its advanced tools come with a steeper learning curve, PlanGuru is ideal for businesses that are serious about strategic growth and need to present detailed financial models to investors or lenders. It integrates directly with QuickBooks and Xero to pull in actuals, creating a seamless workflow between accounting and forecasting.

Key Details & Pricing

- Best For: Strategic planners and businesses needing in-depth, long-range financial forecasting.

- Unique Feature: Over 20 advanced forecasting methods and powerful 'what-if' scenario analysis.

- Pricing: Pricing starts around $99/month, with a 14-day free trial available to test its features.

Pros:

- Advanced forecasting tools for highly detailed financial planning.

- Integrates with popular accounting software like QuickBooks and Xero.

- Suitable for creating comprehensive financial models for investors.

Cons:

- Steeper learning curve compared to simpler budgeting tools.

- Higher price point may not be suitable for very small businesses.

Website: https://www.planguru.com/

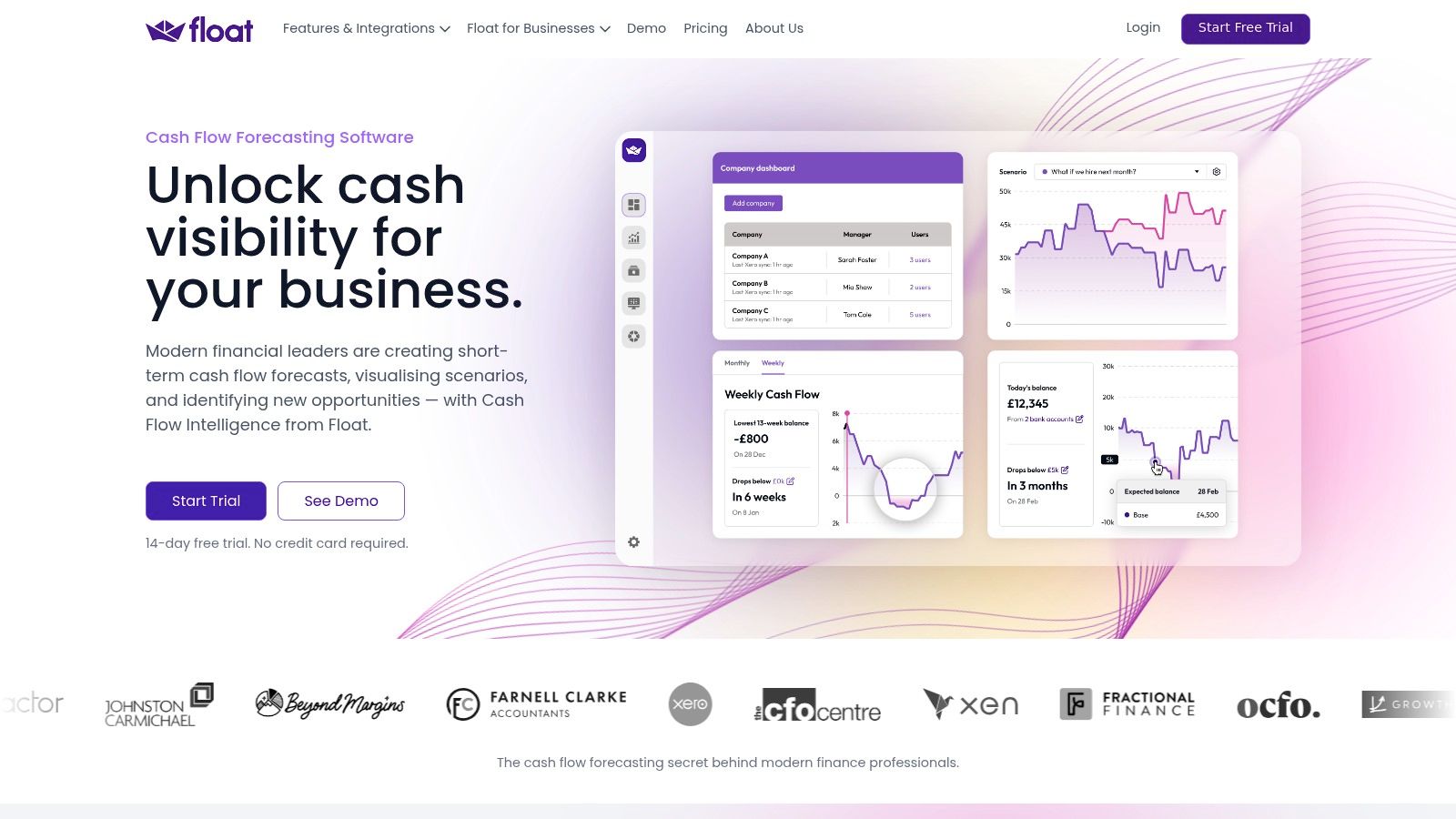

8. Float

Float distinguishes itself by moving beyond traditional budgeting to focus intently on cash flow forecasting. It is an excellent piece of budget software for small business owners who need to know precisely where their cash stands not just today, but weeks or months into the future. By integrating directly with accounting platforms like Xero and QuickBooks, it pulls in real-time data on bills and invoices to provide an accurate, visual projection of your cash runway. This operational focus helps you proactively manage funds and make strategic decisions to avoid shortfalls.

Its strength lies in scenario planning, allowing you to model the impact of potential business decisions, like hiring a new employee or purchasing equipment. While not a full accounting suite, its specialization makes it a powerful collaborative tool for financial planning. You can learn more about how Float's features fit into a wider strategy by exploring small business collaboration tools.

Key Details & Pricing

- Best For: Service-based businesses and startups that need precise, real-time cash flow forecasting.

- Unique Feature: Powerful scenario planning to model the financial impact of future business decisions.

- Pricing: Plans start at $59/month (billed annually) with a 14-day free trial.

Pros:

- Highly visual and intuitive interface makes cash flow easy to understand.

- Direct integration with major accounting software keeps data accurate.

- Helps businesses proactively identify and address potential cash gaps.

Cons:

- Strictly a cash flow tool, not a complete accounting or budgeting solution.

- Pricing can be a bit high for businesses with very simple cash flow needs.

Website: https://floatapp.com/

9. LivePlan

LivePlan excels as a strategic planning tool that integrates powerful financial forecasting, making it a unique form of budget software for small business, especially for startups and those seeking funding. It guides users through creating a professional business plan, complete with detailed financial projections, cash flow statements, and sales forecasts. Its standout capability is translating your strategic goals into a tangible, actionable financial roadmap that can be presented to investors or used for internal management.

By connecting with QuickBooks or Xero, LivePlan pulls in your actual financial data, allowing you to compare performance against your initial budget and forecasts. This makes it a dynamic tool not just for planning but for ongoing performance tracking, helping you stay on course as your business grows.

Key Details & Pricing

- Best For: Startups and businesses creating formal business plans or seeking investment.

- Unique Feature: Step-by-step guidance for business plan creation combined with robust financial forecasting.

- Pricing: Starts at $20/month, with a Premium plan required for full dashboard and forecasting features. A 35-day money-back guarantee is offered.

Pros:

- Excellent for building investor-ready financial documents.

- Industry benchmarks help create realistic forecasts.

- Integrates with accounting software for real-time tracking.

Cons:

- May be overly complex for businesses only needing simple budgeting.

- Core budgeting and dashboard features require the more expensive Premium plan.

Website: https://www.liveplan.com/

10. Budgeto

Budgeto carves out a niche by focusing purely on creating dynamic and user-friendly financial projections, making it a sharp tool for any entrepreneur needing powerful budget software for small business use cases. It excels at simplifying the complex process of forecasting, allowing users to build a complete budget in under 20 minutes. Its key strength lies in scenario planning, where you can easily model different financial outcomes to see how hiring a new employee or a change in sales might impact your bottom line. This makes it an invaluable strategic planning tool, not just a historical tracker.

By integrating directly with accounting software like QuickBooks and Xero, Budgeto pulls your actuals to compare against your forecasts, providing a clear view of your financial health. This focused approach is ideal for startups and small businesses that already have an accounting system but need more robust, forward-looking budgeting capabilities. By visualizing potential financial futures, you can proactively reduce business costs and make smarter decisions.

Key Details & Pricing

- Best For: Startups and businesses needing a dedicated, easy-to-use tool for financial forecasting and scenario analysis.

- Unique Feature: Rapid, intuitive scenario planning to model the financial impact of business decisions.

- Pricing: Offers a free plan for basic use. Paid plans start at $29/month, with a 14-day free trial on premium features.

Pros:

- Extremely user-friendly and designed for non-accountants.

- Seamless integration with QuickBooks and Xero for data syncing.

- No-contract, flexible monthly plans are ideal for small businesses.

Cons:

- Not a full accounting solution; limited to budgeting and forecasting.

- More advanced features are locked behind higher-tier plans.

Website: https://www.budgeto.com/

11. FreeAgent

FreeAgent is an online accounting platform specifically designed for the needs of freelancers and very small businesses, making it a strong contender for accessible budget software for small business. It streamlines financial management by integrating invoicing, expense tracking, and project management into one central hub. The platform’s standout feature is its tax forecasting and filing support, which helps sole proprietors and limited companies stay on top of their obligations with real-time estimates.

With its clean interface and automated bank feeds, FreeAgent simplifies the day-to-day bookkeeping that often overwhelms entrepreneurs. This makes it ideal for consultants or creative professionals who need to manage project budgets and track time against specific jobs, ensuring profitability on every engagement. Its robust mobile app further empowers business owners to manage finances on the go.

Key Details & Pricing

- Best For: Freelancers and micro-businesses needing simple accounting with strong tax support.

- Unique Feature: Real-time tax forecasting and direct self-assessment filing for UK-based users.

- Pricing: A single plan is offered at approximately $24/month, with promotional pricing often available for the first six months.

Pros:

- Extremely user-friendly interface designed for non-accountants.

- Excellent customer support and a wealth of online resources.

- Includes time tracking and project management tools.

Cons:

- Pricing can be higher than some simpler alternatives.

- Reporting and customization options are somewhat limited.

Website: https://www.freeagent.com/

12. Kashoo

Kashoo offers a refreshingly simple approach to accounting, making it an excellent budget software for small business owners who are overwhelmed by overly complex platforms. It focuses on core functionalities like income and expense tracking, invoicing, and reporting without the steep learning curve. The platform automates tedious tasks, such as importing bank transactions and reconciling accounts, allowing you to spend more time on strategic planning rather than data entry. Its standout feature is its machine learning capability, which intelligently categorizes transactions to save you time.

While it may lack the advanced bells and whistles of larger competitors, Kashoo's strength lies in its simplicity and affordability. It is particularly well-suited for freelancers, consultants, and very small businesses that need reliable, no-fuss accounting tools to manage their finances and stay on top of their budgets.

Key Details & Pricing

- Best For: Freelancers and small business owners who prioritize simplicity and ease of use.

- Unique Feature: Machine learning that automatically categorizes bank transactions to streamline bookkeeping.

- Pricing: Offers a straightforward plan at $30/month or an annual plan that reduces the cost. A free plan is also available for very basic needs.

Pros:

- Extremely simple and intuitive interface, ideal for non-accountants.

- Strong, responsive customer support via live chat, phone, and email.

- Multi-currency support is a major plus for businesses with international clients.

Cons:

- Limited integrations with third-party applications.

- No mobile app available for Android users.

Website: https://www.kashoo.com/

Budget Software Feature & Pricing Comparison

| Product | Core Features / Highlights | User Experience / Quality ★★★★☆ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 AccountShare | Group purchasing for premium digital subscriptions | Stable, fast response, priority features | Cost-effective (~$10 avg.) | Tech-savvy, families, students, SMBs | Secure shared access, customizable permissions |

| QuickBooks Online | Multi-currency, invoicing, extensive integrations | User-friendly, regular updates | Higher price, pay per user | Small businesses, accountants | 750+ app integrations, customizable reports |

| Xero | Unlimited users, bank feeds, real-time reporting | Affordable, secure, customizable | Affordable, discounts available | Small businesses, startups | 1000+ integrations, unlimited users |

| Zoho Books | Automated workflows, multi-currency, reporting | Strong support, affordable | Free plan under $50k revenue | Small businesses | Integrates with Zoho suite |

| FreshBooks | Time tracking, invoicing, project management | Intuitive, strong support | Mid-range pricing | Freelancers, small businesses | Receipt scanning, easy invoicing |

| Wave | Unlimited invoicing & expenses, free | User-friendly, basic reporting | Completely free | Small businesses, freelancers | No fees, unlimited transactions |

| PlanGuru | Deep forecasting, scenario analysis | Advanced tools, learning curve | Higher cost | Businesses needing detailed forecasts | 20+ forecasting methods |

| Float | Cash flow management, real-time projections | Visual dashboards, user-friendly | Mid to high pricing | Small businesses focused on cash flow | Automated sync, scenario planning |

| LivePlan | Business plans, financial forecasts | Guided process, suitable for startups | Premium plan for full features | Startups, small businesses | Industry benchmarks, performance dashboards |

| Budgeto | Easy budgeting, scenario planning | Simple, flexible plans | Mid-range pricing | Small businesses | Collaboration features |

| FreeAgent | Bank feeds, time tracking, tax support | Comprehensive, strong support | Higher cost | Small businesses, freelancers | Tax filing support |

| Kashoo | Simple invoicing & tracking, multi-currency | Simple interface, affordable | Affordable, no hidden fees | Small businesses, non-accountants | Easy to use, good support |

Choosing the Right Financial Partner for Your Business Growth

Navigating the landscape of financial management tools can feel overwhelming, but making an informed choice is a foundational step toward sustainable success. We've explored a diverse range of platforms, from comprehensive accounting powerhouses like QuickBooks Online and Xero to innovative, free solutions like Wave. Each tool offers a distinct approach to managing your company's finances, underscoring that there is no single "best" option-only the best fit for your unique circumstances.

Your decision hinges on a clear understanding of your business's current needs and future aspirations. A solopreneur or freelancer might find the streamlined invoicing and expense tracking of FreshBooks perfectly sufficient. Conversely, a growing retail business with inventory management needs would benefit more from the robust, all-in-one ecosystem provided by Zoho Books. The key is to look beyond today's requirements and consider where you'll be in one, three, or even five years.

From Selection to Successful Implementation

Choosing the right budget software for small business is only half the battle; successful implementation is what truly unlocks its value. Before committing, take advantage of free trials to test the user interface and see how intuitively it handles your typical workflows. Don't just look at features on a pricing page-run a real invoice, connect your bank account, and generate a sample report. This hands-on experience is invaluable.

Once you’ve made a selection, dedicate time to proper setup and team training. Key factors for a smooth transition include:

- Data Migration: Can you easily import existing customer lists, vendor details, and historical financial data? A clumsy import process can create significant headaches and inaccuracies from the start.

- Integration Capabilities: Assess how well the software connects with your existing tools, such as your CRM, payment processor, or e-commerce platform. Seamless integration saves time and prevents manual data entry errors.

- Scalability: Consider the platform’s limitations. If you anticipate rapid growth, ensure your chosen software has higher-tier plans or advanced features like multi-currency support, advanced reporting, or payroll services that you can grow into without needing to switch platforms later.

Final Thoughts on Your Financial Future

Investing in the right software is more than just an operational expense; it's a strategic investment in your business's clarity, efficiency, and potential. Whether you need the powerful forecasting of PlanGuru to secure funding or the simplicity of Kashoo for straightforward bookkeeping, the right tool empowers you to move from reactive problem-solving to proactive, data-driven decision-making. By taking the time to carefully evaluate your options and select a true financial partner, you are laying the groundwork for a more stable, scalable, and profitable future.

As you optimize your business operations, remember that savings extend beyond just accounting software. Many essential digital tools for marketing, project management, and collaboration also come with subscription costs. To maximize your budget across the board, consider using AccountShare to securely and affordably share access to these vital services, ensuring your team has the tools it needs without breaking the bank. Learn more about smart subscription sharing at AccountShare.