The 12 Best Budget Apps for Students in 2025

Share

Navigating college life comes with a unique set of financial challenges, from managing tuition and textbook costs to balancing a social life with part-time job earnings. Establishing smart money habits now is one of the most powerful investments you can make in your future. But where do you start? The answer is right in your pocket. The right budgeting app can transform financial chaos into clarity, helping you track every dollar, identify savings opportunities, and stay on top of your goals.

In this comprehensive guide, we'll dive deep into the best budget apps for students, moving beyond simple feature lists to give you practical, real-world insights. We’ll explore which tools are genuinely free, which offer the best student discounts, and how to choose the one that fits your specific financial situation. Each review includes direct links and screenshots to simplify your decision-making process.

Whether you're sharing expenses with roommates or just trying to make your coffee budget last the semester, the right tool is here. Beyond just budgeting, staying informed about broader financial aid, such as current news on student loan relief program extensions, is crucial for comprehensive financial planning. Let's find the perfect app to help you master your money.

1. AccountShare: Slash Subscription Costs for Essential Student Tools

Recurring subscriptions for streaming, software, and AI tools can quickly deplete a student's budget. AccountShare tackles this issue directly by facilitating legal and secure group purchasing. Instead of bearing the full cost of multiple services, you can join a group to share the expense, drastically cutting your monthly outlay. This makes it one of the most practical budget apps for students who rely on premium digital tools that often lack educational discounts.

The platform stands out by guaranteeing service availability even during peak demand and providing secure account management. This ensures you get uninterrupted access to essential software or can unwind with your favorite streaming service after a long study session.

Core Features & Use Case

AccountShare isn’t a traditional budgeting app; it's a cost-slashing tool. For a student, this means gaining access to a professional video editor for a class project or a premium AI writing assistant for research, all for a fraction of the standard price.

- Best For: Students needing premium software (like Adobe or coding tools) or entertainment subscriptions without paying the full retail price.

- Pricing: Costs vary by service, but shared plans can start as low as $0.01.

- Pro Tip: Popular services sell out fast. Turn on notifications for desired subscriptions to grab a spot as soon as it becomes available.

Pros & Cons

| Pros | Cons |

|---|---|

| Significant cost savings on popular subscriptions | High-demand services can sell out quickly |

| Guaranteed access during peak usage times | Requires coordination within a shared group |

| Secure account management and password sharing | Not ideal for users who prefer private, individual accounts |

Learn more at AccountShare.io

2. Apple App Store (iOS/iPadOS)

For students in the Apple ecosystem, the App Store is the essential starting point for finding the right financial tool. Instead of being a single app, it acts as a secure, curated marketplace hosting nearly all major budget apps for students. This platform simplifies the discovery process with editorial lists like "11 of the Best Budgeting Apps," allowing you to compare options side-by-side.

The App Store stands out by providing transparent information upfront, including pricing, in-app purchase costs, user reviews, and detailed privacy labels. This lets you vet an app's true cost and data handling practices before downloading, which is crucial for managing your finances securely.

Core Features & Use Case

The App Store isn't a budgeting app itself, but a trusted gateway to find one. For a student, this means easily discovering an app that syncs with your bank, tracks spending across categories, and helps manage subscription costs, all from a single, reliable source.

- Best For: iOS users who want a secure and straightforward way to discover, compare, and manage various budgeting apps.

- Pricing: Free to browse; app prices vary from free to paid, with many offering in-app subscriptions.

- Pro Tip: Use the "Family Sharing" feature to share a subscription for a paid budgeting app with family members, splitting the cost.

Pros & Cons

| Pros | Cons |

|---|---|

| Trusted, secure distribution with easy installation | Exclusively for iOS/iPadOS devices |

| Strong app quality control and transparent privacy details | Subscriptions can sometimes be pricier through the App Store |

| Centralized subscription management in Settings | App availability and pricing can vary by region |

Learn more at apps.apple.com

3. Google Play Store (Android)

For Android users, the Google Play Store is the essential starting point for discovering a massive ecosystem of financial tools. It's not a single app but a vast marketplace where students can find everything from simple expense trackers to complex investment platforms. The store’s curated collections and powerful search filters make it easy to sift through options and find the perfect budget apps for students based on features, ratings, and user reviews.

What sets it apart is the transparency it offers. You can see how often an app is updated, read detailed reviews from other students, and check for in-app purchases before you download. This allows you to vet an app’s quality and avoid hidden costs, ensuring you choose a tool that genuinely helps your financial management.

Core Features & Use Case

The Play Store serves as a comprehensive discovery engine for financial wellness tools. For a student, this means easily comparing dozens of free and premium apps, reading editorial roundups on money-saving picks, and installing a chosen app with a single tap, streamlining the process of finding the right financial companion.

- Best For: Android users who want the widest possible selection of budgeting apps and the ability to compare them using extensive community reviews.

- Pricing: Varies by app, from completely free to subscription-based premium services.

- Pro Tip: Use specific search filters like "4.5+ stars" to quickly find high-quality, well-regarded budgeting apps and avoid poorly maintained ones.

Pros & Cons

| Pros | Cons |

|---|---|

| Broadest variety of apps, from free to premium | App quality can be inconsistent, especially with new or lesser-known apps |

| Powerful filters and clear rating systems | Some apps may have regional availability restrictions |

| Editorial picks help highlight top-tier apps | In-app purchase models can sometimes be unclear |

Learn more at Google Play Store

4. YNAB (You Need A Budget): Master Your Money with a Proven Method

YNAB (You Need A Budget) is more than just a tracking app; it’s a full-blown financial philosophy designed to help you gain total control over your money. It uses the zero-based budgeting method, where every dollar is assigned a specific job, preventing overspending and building a strong financial foundation. This structured approach makes it one of the most effective budget apps for students who want to develop lasting money management skills.

The platform's standout offer is its free year for verified college students, providing access to its premium features without any cost. YNAB also provides extensive educational resources, including live workshops and detailed guides, to help you master its powerful system and make your budget work for you.

Core Features & Use Case

YNAB’s strict methodology forces you to be intentional with your spending. For a student, this means consciously allocating funds for textbooks, groceries, and social activities, ensuring you don’t accidentally spend your rent money. The debt planner is also invaluable for managing student loans.

- Best For: Students who want a hands-on, structured system to build powerful budgeting habits and plan for long-term financial goals.

- Pricing: Free for one full year for verified college students; a paid subscription is required afterward.

- Pro Tip: Take advantage of the live workshops included with your free student membership. They provide practical guidance on applying the YNAB method to real-life student financial scenarios.

Pros & Cons

| Pros | Cons |

|---|---|

| One full year free for verified college students | Subscription required after the free year ends |

| Highly structured approach promotes lasting financial habits | Steeper learning curve for users new to zero-based budgeting |

| Extensive educational resources and live workshops | Requires more active management than passive tracking apps |

Learn more at YNAB for College

5. Quicken Simplifi: Automated Budgeting for Busy Schedules

For students who need a powerful yet straightforward budgeting tool, Quicken Simplifi offers an elegant solution. It streamlines financial management by automatically syncing with your bank accounts to track spending, identify recurring bills, and project your cash flow. Its focus on creating a simple, personalized spending plan makes it one of the best ad-free budget apps for students who want automation without a steep learning curve.

The app's clean interface and guided setup help you get a clear picture of your finances in minutes. By providing real-time insights and alerts, Simplifi empowers you to make informed decisions, whether you're saving for textbooks or managing daily expenses.

Core Features & Use Case

Simplifi is designed for proactive financial oversight. For a student, this means easily setting spending targets for categories like food and entertainment, creating custom watchlists to monitor specific expenses, and getting a clear forecast of their account balance to avoid overdrafts. It's a great tool for building healthy financial habits. Managing finances is a key part of student life, similar to finding great student software deals, which can further stretch your budget.

- Best For: Students new to budgeting who want an automated, set-it-and-forget-it system to monitor cash flow and spending habits.

- Pricing: Requires a subscription, typically starting around $3.99/month, with frequent promotions and a 30-day money-back guarantee.

- Pro Tip: Use the "Watchlists" feature to track spending on variable categories like "coffee runs" or "ride-sharing" to see exactly where your money is going.

Pros & Cons

| Pros | Cons |

|---|---|

| Clean interface and straightforward setup for beginners | No permanent free tier; subscription required after trial |

| Personalized spending plans and cash flow projections | Limited to U.S. financial institution connectivity |

| Ad-free experience with real-time mobile and web alerts | Lacks advanced investment tracking features |

Learn more at Quicken.com

6. EveryDollar (Ramsey Solutions): Master Zero-Based Budgeting

EveryDollar champions the zero-based budgeting method, where every dollar of income is assigned a specific job, leaving no money unaccounted for. This approach is powerful for students learning to manage a variable or limited income, as it forces intentional spending and saving decisions. The app’s straightforward design makes it easy to create your first budget in minutes, tracking expenses manually in the free version.

It stands out as one of the best budget apps for students new to financial planning due to its simplicity and focus on foundational habits. Instead of overwhelming users with complex features, EveryDollar prioritizes the core discipline of assigning income to expenses, savings, and debt repayment before the month begins.

Core Features & Use Case

EveryDollar is built for proactive, hands-on budgeting. For a student, this means you can easily plan for upcoming tuition payments, set aside funds for textbooks, and track daily spending on food or transport. The manual entry in the free version reinforces spending awareness.

- Best For: Students who want to build strong budgeting habits from the ground up using a proven, simple system.

- Pricing: Free with manual transaction entry. Premium (with bank sync) is available with a 14-day free trial, then various subscription plans.

- Pro Tip: Ask for a Premium subscription as a gift. EveryDollar offers gift codes, making it an easy and practical present for birthdays or holidays.

Pros & Cons

| Pros | Cons |

|---|---|

| Excellent free version for manual budgeting | Premium automatic bank sync is U.S.-only on mobile |

| Simple, intuitive interface is great for beginners | Lacks the advanced reporting features of competitors |

| Premium plan can be received as a gift | The zero-based method requires consistent input |

Learn more at everydollar.com

7. Goodbudget: Master the Envelope System Digitally

Goodbudget brings the classic envelope budgeting method into the digital age, making it one of the most effective budget apps for students learning to allocate funds. Instead of using physical cash, you assign income to digital "envelopes" for categories like groceries, rent, or entertainment. This hands-on approach forces you to plan your spending deliberately and visually track where every dollar goes, preventing overspending before it happens.

The platform excels for students managing finances with roommates or a partner, as its syncing feature keeps everyone on the same page. It’s also incredibly useful for students studying abroad. To ensure you're always getting the most out of your money, even when abroad, consider comparing foreign currency exchange rates before filling your "travel" envelope.

Core Features & Use Case

Goodbudget is a tool for proactive, planned spending rather than retroactive expense tracking. For a student, this means creating a realistic budget you can stick to, paying off debt systematically, and building solid financial habits that will last a lifetime.

- Best For: Students who want a simple, visual way to manage their spending categories and those sharing expenses with others.

- Pricing: A generous free plan includes 10 regular envelopes. The Plus plan ($8/mo or $70/yr) offers unlimited envelopes and automatic bank syncing.

- Pro Tip: Use the "Annual Envelopes" feature on the free plan for irregular but predictable expenses like textbooks or yearly subscription renewals.

Pros & Cons

| Pros | Cons |

|---|---|

| Simple and intuitive envelope method promotes discipline | Automatic bank syncing is a premium-only feature |

| Generous free tier is sufficient for most students | Bank connectivity is limited primarily to U.S. institutions |

| Excellent for couples or roommates sharing a budget | Requires manual entry of transactions on the free plan |

Learn more at Goodbudget.com

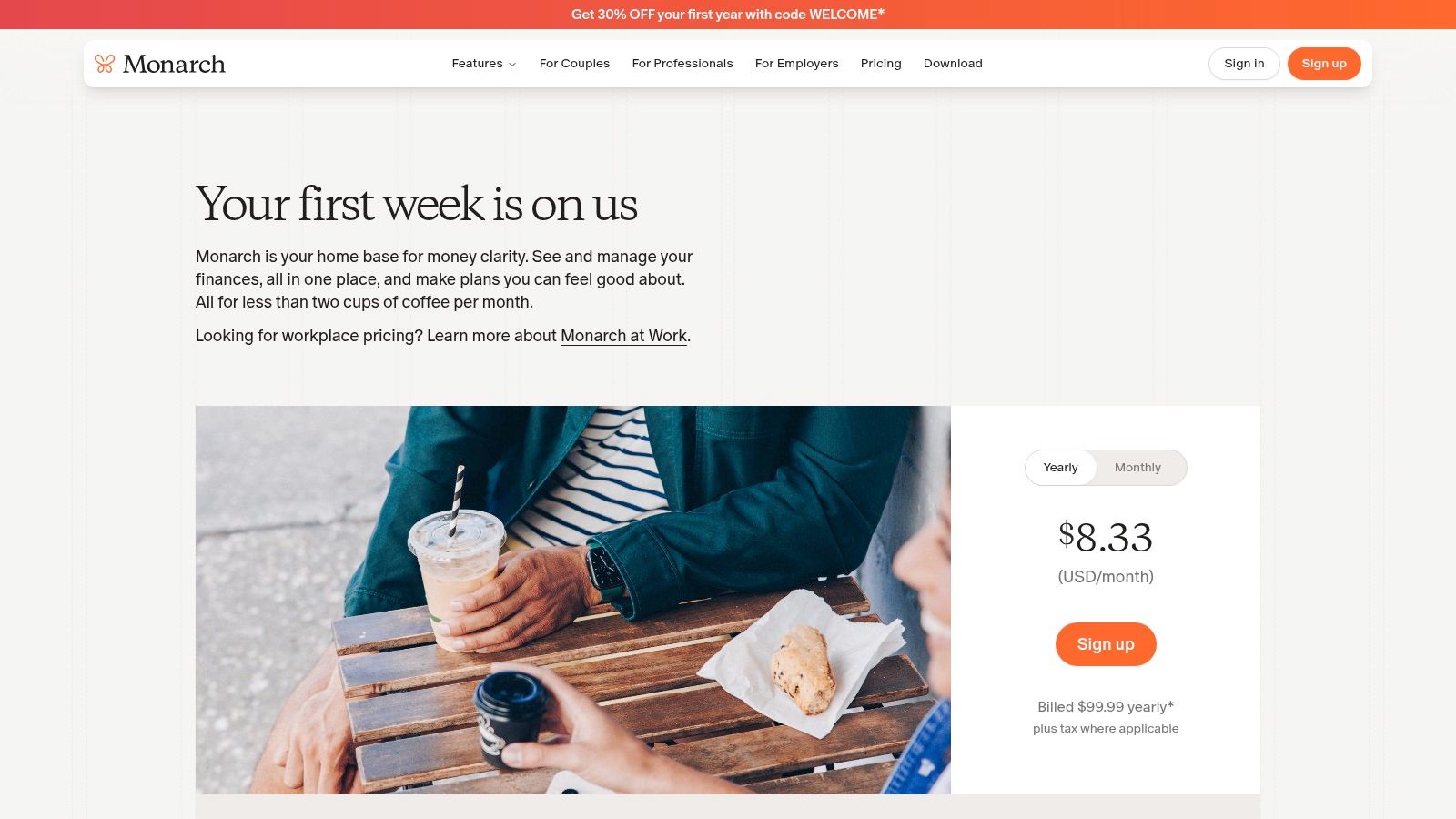

8. Monarch Money: A Modern Finance Hub for Students with Partners

For students managing finances with a partner or who want a comprehensive, ad-free overview of their money, Monarch Money offers a sophisticated solution. It goes beyond simple expense tracking by integrating budgeting, goal setting, and even investment monitoring into one clean interface. This makes it an excellent choice among budget apps for students who are planning for the long term, not just managing weekly pizza funds.

Its standout feature is the ability to invite unlimited collaborators at no extra cost, perfect for couples or roommates sharing financial responsibilities. Monarch also prioritizes data privacy and a premium user experience, avoiding the ads and data selling common in free apps.

Core Features & Use Case

Monarch Money acts as a central dashboard for your entire financial life, connecting everything from bank accounts to student loans and investment portfolios. Students can use it to set savings goals for a spring break trip, track shared apartment bills with a roommate, and get a clear picture of their net worth.

- Best For: Students, especially those with partners, who want an all-in-one, ad-free platform to manage budgeting, goals, and investments collaboratively.

- Pricing: A premium subscription is required after a free trial, starting at $14.99/month or $99.99/year.

- Pro Tip: Use the custom dashboard to create a "Student View" that prioritizes tracking your tuition savings, part-time income, and textbook expenses all in one place.

Pros & Cons

| Pros | Cons |

|---|---|

| Ad-free experience with a strong focus on data privacy | No permanent free tier; requires a paid subscription |

| Invite unlimited collaborators for shared financial management | Primarily available for users in the U.S. and Canada |

| Polished, modern interface on both web and mobile | Can be more complex than needed for very simple budgeting |

Learn more at monarchmoney.com

9. Copilot Money (Apple platforms)

For students deeply invested in the Apple ecosystem, Copilot Money offers a premium and visually polished experience that goes beyond simple expense tracking. It consolidates your bank accounts, credit cards, investments, and subscriptions into a single, intuitive dashboard. This holistic view helps you understand your complete financial picture, from daily spending to long-term net worth, making it a powerful financial management tool.

The app stands out with its intelligent alerts and beautifully designed interface, which transforms the often tedious task of budgeting into an engaging activity. Unlike many free budget apps for students, Copilot is privacy-focused, ad-free, and continuously updated with new features based on user feedback.

Core Features & Use Case

Copilot acts as a smart financial assistant, automatically categorizing transactions and highlighting upcoming bills or unusual spending. A student can use it to monitor subscription costs, track investment growth from a part-time job, and ensure they stay within their monthly budget, all from their iPhone, iPad, or Mac.

- Best For: Apple-centric students who want a comprehensive, design-forward app to manage budgeting, investments, and net worth in one place.

- Pricing: Subscription-based with a free trial. Check the App Store for current pricing.

- Pro Tip: Look for community referral codes online before signing up. They can often extend your free trial period, giving you more time to evaluate the app.

Pros & Cons

| Pros | Cons |

|---|---|

| Highly polished, intuitive user interface | Primarily limited to the Apple ecosystem |

| Privacy-focused with no ads or data selling | Subscription cost can be higher than other student options |

| Combines budgeting, investments, and net worth | No finalized Android or web version available |

Learn more at copilot.money

10. Rocket Money: Automatically Cancel Unwanted Subscriptions

Managing recurring expenses is a major challenge for students, and forgotten free trials or unused subscriptions can silently drain your bank account. Rocket Money excels at finding and canceling these hidden costs, making it a powerful tool for automated savings. It syncs with your bank accounts to identify every recurring charge, letting you cancel unwanted services with a single tap.

The app's standout feature is its bill negotiation service, where its team attempts to lower your monthly bills like internet or phone services on your behalf. While it offers standard budget and spending tracking, its primary strength lies in actively cutting your expenses rather than just monitoring them. This hands-off approach makes it one of the best budget apps for students who want to save money without constant manual effort.

Core Features & Use Case

Rocket Money functions as a financial "autopilot" for finding savings. For a student, this means easily canceling that streaming service you forgot about after a free trial or potentially lowering a high internet bill, freeing up cash for essential expenses like textbooks.

- Best For: Students who want to automate savings by finding and eliminating "subscription creep" and lowering recurring bills.

- Pricing: Core features are free. Premium, which includes cancellation services and smart savings, has a flexible monthly fee (typically $3-$12). Bill negotiation takes a percentage of the savings.

- Pro Tip: Regularly review the recurring charges Rocket Money finds. You might be surprised by old subscriptions you've completely forgotten about. For more ideas on managing these costs, you can get additional subscription sharing tips to save even more.

Pros & Cons

| Pros | Cons |

|---|---|

| Excellent at identifying and canceling unwanted subscriptions | Key features require a paid Premium subscription |

| Optional bill negotiation can lead to significant savings | Bill negotiation service charges a fee based on annual savings |

| User-friendly interface simplifies financial management | Linking all financial accounts is necessary for full functionality |

Learn more at RocketMoney.com

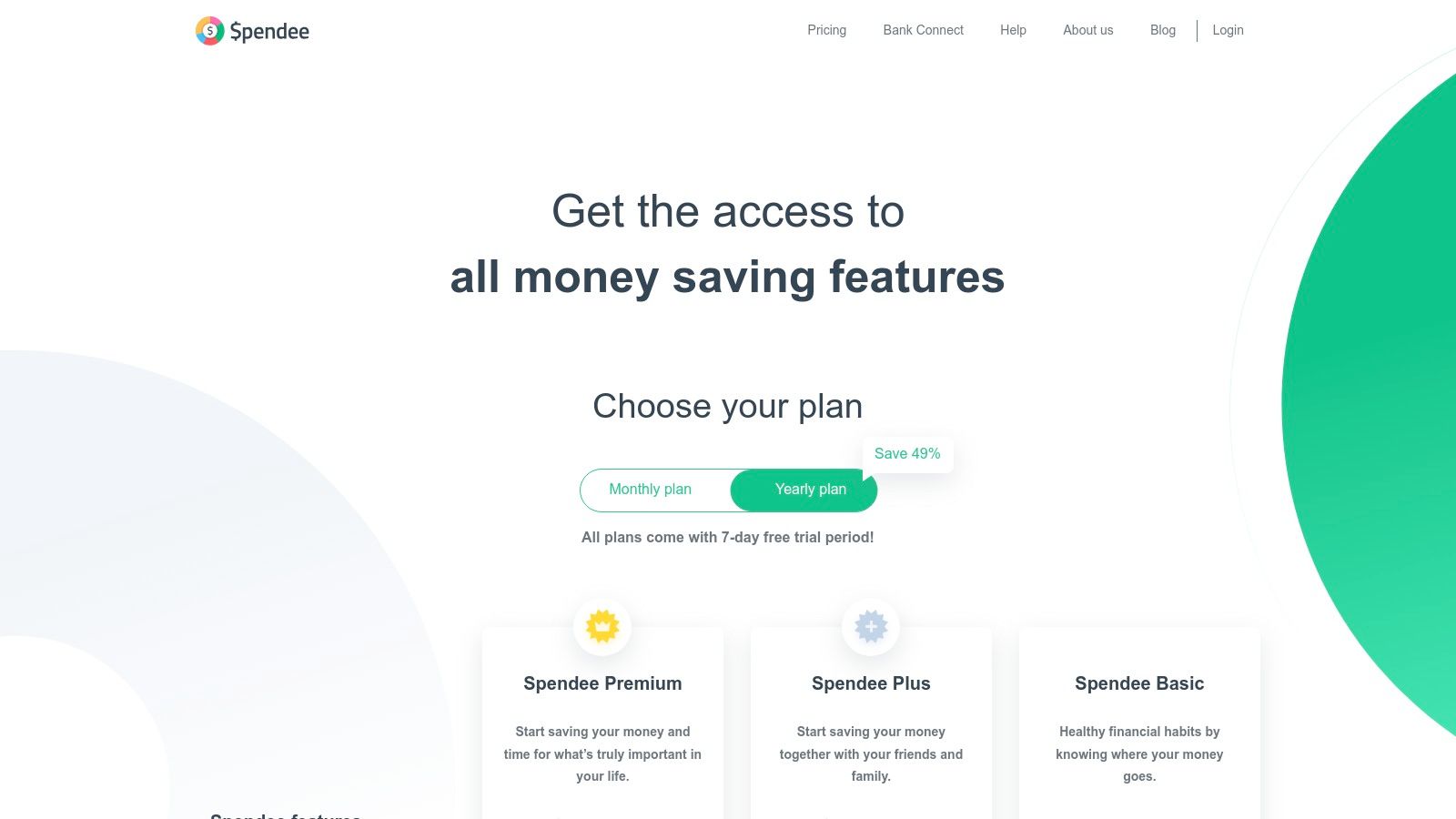

11. Spendee: Master Shared Expenses with Roommates

Managing shared expenses for rent, utilities, or groceries is a classic student challenge. Spendee is designed to solve this by offering shared wallets, making it an excellent budget app for students living with roommates or collaborating on group projects. It allows you to create a joint budget, track who paid for what, and settle balances without confusion.

The platform simplifies expense tracking by syncing with your bank account and automatically categorizing transactions. This gives you a clear, real-time overview of your spending habits, helping you identify where your money is going and where you can cut back.

Core Features & Use Case

Spendee shines in collaborative financial management. For a student, this means easily splitting a grocery bill, tracking contributions for a shared textbook, or managing household utilities with roommates directly within the app. Its multi-wallet support keeps your personal and shared finances neatly separated.

- Best For: Students living with roommates or anyone needing to manage shared finances for group activities.

- Pricing: A functional free plan is available. Paid plans (Plus & Premium) offer unlimited budgets and shared wallets, starting from $1.99/month.

- Pro Tip: Use the data export feature to create custom spreadsheets for a detailed financial review before the start of a new semester.

Pros & Cons

| Pros | Cons |

|---|---|

| Excellent for collaborative budgeting and shared expenses | Bank connectivity can be inconsistent depending on the country |

| Flexible pricing with a useful free version | Web platform features sometimes lag behind the mobile app |

| Automatic transaction categorization saves time | Advanced features require a paid subscription |

Learn more at Spendee.com

12. U.S. News — Best Budget Apps (editorial comparison)

Navigating the crowded market of financial tools can be overwhelming. Instead of downloading dozens of apps, U.S. News provides a curated editorial list of the best budget apps for students and other users. This resource helps you cut through the noise by offering side-by-side comparisons, expert analysis, and clear 'best for' recommendations, making it easier to find a tool that genuinely fits your financial situation.

It acts as a trusted advisor, breaking down complex features into simple, digestible explanations. For students just starting their financial journey, this independent context is invaluable for making an informed choice without the pressure of a direct sales pitch.

Core Features & Use Case

This isn't an app but a research hub. It’s the perfect starting point before committing to a platform, helping you compare top contenders like Mint, YNAB, and others based on criteria like ease of use for beginners or investment tracking capabilities. This research is a key first step in effective financial planning for students.

- Best For: Students who want to research and compare multiple budget apps before downloading one.

- Pricing: Free to access the editorial content.

- Pro Tip: Use their slideshow format to quickly scan key features and pricing callouts to create a shortlist of 2-3 apps to test drive.

Pros & Cons

| Pros | Cons |

|---|---|

| Independent editorial context complements app store listings | Not a direct app store or purchasing platform |

| Helpful for matching apps to user-specific needs | Lists and promotions may lag behind latest app changes |

| Compares top-tier apps in a clear, digestible format | Primarily focused on the U.S. market and apps |

Learn more at money.usnews.com

Top 12 Student Budget Apps Comparison

| Platform | Core Features/Characteristics | User Experience/Quality ★★★★☆ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 AccountShare | Group purchasing, secure password sharing, customizable perms | Fast response, reliable access even at peak demand | From $0.01 USD, excellent cost savings | Individuals, families, students, SMBs | Priority access, enhanced security, broad service range |

| Apple App Store (iOS/iPadOS) | Curated apps, family sharing, subscription management | Trusted, secure with transparent privacy | Pricing varies, sometimes higher | iPhone/iPad users | Strong quality control, curated editorial |

| Google Play Store (Android) | Large app catalog, one-tap install, family library | Extensive reviews, varied app quality | Wide range; free to premium | Android users | Powerful filters, extensive editorial content |

| YNAB (You Need A Budget) | Zero-based budgeting, goal tracking, live workshops | Structured, educational, ★★★★☆ | Free 1 year for students, then subscription | Students, budget-focused users | Student program, lasting budgeting habits |

| Quicken Simplifi | Sync multiple accounts, personalized plans, real-time insights | Clean interface, beginner-friendly | Subscription after trial, frequent promos | Beginners, students | Auto-detect bills, 30-day money-back |

| EveryDollar (Ramsey Solutions) | Category budgets, bill tracking, manual free tier | Easy learning curve, web & mobile | Free basic, Premium for bank sync | Students starting budgeting | Premium gift cards, simple interface |

| Goodbudget | Digital envelopes, sync & shared budgets | Intuitive, generous free tier | Free & paid plans | Roommates, partners, students | Envelope method, device sync |

| Monarch Money | Budgeting, investments, unlimited collaborators | Polished apps, ad-free, privacy focused | Subscription after trial | Students, families, investors | Unlimited collaborators, broad financial tracking |

| Copilot Money (Apple platforms) | Bank sync, smart alerts, multi-view finance | Highly polished, privacy-focused | Premium subscription | Apple ecosystem users | Design excellence, active community |

| Rocket Money | Subscription detection/cancellation, bill negotiation | Large user base, actively maintained | Flexible fee for premium | Students cutting costs | Bill negotiation services |

| Spendee | Bank sync, shared wallets, data export | Functional free plan, collaborative budgeting | Multiple pricing tiers | Students, group projects | Shared wallets, flexible budgeting |

| U.S. News — Best Budget Apps | Editorial comparisons, pricing snapshots, direct links | Independent, helpful for user matching | N/A (comparison only) | Beginners, students, budget planners | Expert recommendations, user-specific guidance |

Choosing Your Financial Co-Pilot: The Final Decision

Navigating the world of personal finance as a student can feel like a daunting final exam, but selecting the right tool makes all the difference. We've explored a comprehensive suite of options, from the disciplined, philosophy-driven approach of YNAB to the automated, set-it-and-forget-it convenience of apps like Quicken Simplifi and Copilot Money. The key takeaway is that there is no single "best" app for everyone; the ideal choice is deeply personal and hinges on your unique financial habits, goals, and personality.

Your journey began by understanding the landscape, from the vast libraries of the Apple App Store and Google Play Store to curated editorial comparisons. From there, we dove into specific tools, each with a distinct approach to financial management. The decision you make now is about finding the most sustainable system for you.

Synthesizing Your Options

To simplify your choice, consider which of these core approaches resonates most with you:

- For the Hands-On Planner: If you thrive on structure and want to proactively assign every dollar a job, YNAB or the envelope-based Goodbudget are your strongest contenders. These apps require active participation but offer unparalleled control over your financial destiny.

- For the Automated Organizer: If you prefer a system that does the heavy lifting by tracking transactions automatically and providing insights with minimal effort, look towards Quicken Simplifi, Monarch Money, or Copilot Money. These are excellent budget apps for students who want oversight without daily manual entry.

- For the Goal-Oriented Saver: If your primary focus is hitting specific savings goals or aggressively paying down debt, the focused, zero-based method of EveryDollar provides a clear, motivating path forward. Similarly, Rocket Money excels at identifying and canceling unwanted subscriptions to free up cash.

- For the Data-Driven Analyst: If you love digging into a detailed analysis of your spending habits with advanced filtering and customizable categories, an app like Spendee offers the robust features needed to truly understand your financial data.

Your Action Plan for Financial Success

The most sophisticated app is useless if it gathers digital dust. Your next step isn't just to download an app but to commit to a process. Start by taking advantage of free trials. Dedicate one month to a manual entry system and the next to an automated one. This hands-on comparison is the most effective way to discover what truly clicks with your lifestyle.

Remember that implementation is key. Schedule a weekly 15-minute "money check-in" on your calendar to review transactions and adjust your budget. This simple, consistent habit is more powerful than a marathon session once every few months. The ultimate goal isn't just to track where your money went, but to gain the clarity and confidence to direct where it will go in the future. By embracing one of these powerful budget apps for students, you are not just managing money; you are building a foundational skill for a lifetime of financial well-being. Start today, stay consistent, and watch as you transform financial stress into financial strength.

Ready to cut your fixed costs and supercharge your new budget? Many premium apps and services offer family or group plans. AccountShare makes it easy and secure to share these subscription costs with friends or family, putting more money back into your pocket each month. Visit AccountShare to see how you can reduce your bills and make your budget go further.