8 Proven Ways to Improve Cash Flow in 2025

Share

Cash flow is the lifeblood of any business, yet managing it effectively can feel like a constant battle. A healthy cash flow doesn't just keep the lights on; it fuels growth, enables strategic investment, and provides a crucial buffer against unexpected challenges. Many businesses with profitable products fail simply because they run out of cash. The key isn't just to make more sales, but to optimize the entire cycle of money moving in and out of your company.

This article cuts through the noise to provide eight specific, actionable ways to improve cash flow. We will explore proven strategies, from optimizing how you bill customers to leveraging tax advantages and diversifying revenue, that you can implement immediately to build a more resilient and financially robust business. Whether you are a small business owner, a student entrepreneur, or a digital nomad managing freelance income, these tactics are designed to provide clear, practical steps.

We'll cover critical topics like invoice factoring, inventory optimization, and working capital management. Each point is designed to offer a fresh perspective on common financial challenges, providing you with the tools necessary for immediate implementation. For a comprehensive guide and further expert tips on enhancing financial stability, read more about how to improve cash flow and discover even more strategies for success. Let's dive into the methods that will empower you to take control of your financial future.

1. Invoice Factoring

Waiting 30, 60, or even 90 days for customer payments can strain your operations, creating a significant gap between earning revenue and having cash on hand. Invoice factoring is a powerful financial tool that bridges this gap, offering one of the most direct ways to improve cash flow. It allows you to sell your outstanding accounts receivable to a third-party factoring company at a discount, providing immediate access to capital.

How Invoice Factoring Works

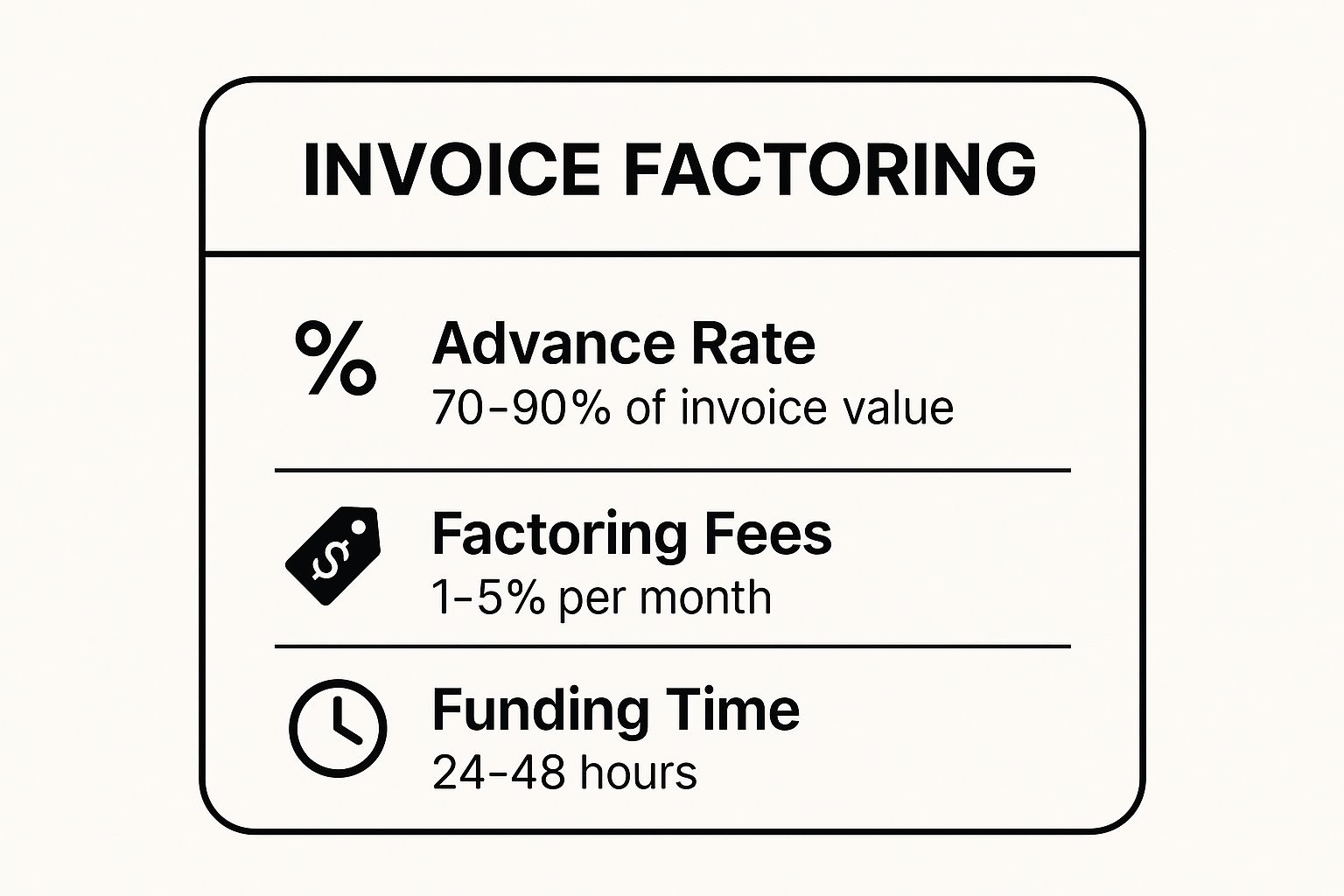

Instead of waiting for your customers to pay, a factoring company advances you a large portion of the invoice's value, typically 70-90%, within 24 to 48 hours. The factoring company then collects the payment directly from your customer. Once the full invoice is paid, the factor releases the remaining balance to you, minus their fee, which usually ranges from 1-5% of the invoice value.

This method is particularly effective for B2B businesses with long payment cycles. For example, a trucking company can factor its freight bills to immediately cover fuel and driver payroll, or a staffing agency can use it to meet weekly payroll obligations while waiting on client payments.

This quick reference box summarizes the key metrics involved in a typical factoring arrangement.

The data highlights how factoring provides rapid access to the majority of your earned revenue, making it a highly effective solution for immediate cash flow needs. To further understand this financing option, you can debunk common myths about invoice factoring and see if it’s the right fit for your business.

Actionable Tips for Implementation

- Compare Factoring Companies: Don't settle for the first offer. Compare rates, advance percentages, and contract terms from providers like BlueVine, Fundbox, or RTS Financial.

- Negotiate the Terms: Understand the difference between recourse (you are liable for non-payment) and non-recourse (the factor assumes the risk) factoring. Non-recourse offers more protection but comes with higher fees.

- Maintain Customer Relations: Inform your customers about the change in payment processing to ensure a smooth transition. A professional factoring partner will handle collections with care, but your relationship remains paramount.

2. Inventory Optimization

Holding excess inventory is like having cash locked in a warehouse; it's an asset on paper but can't pay your bills. Inventory optimization is a strategic approach to managing stock levels to free up this trapped capital. This powerful method improves cash flow by balancing the costs of holding inventory against the risk of stockouts, ensuring you have enough product to meet demand without tying up unnecessary funds.

How Inventory Optimization Works

This process involves using data and forecasting techniques to determine the ideal quantity of each item to keep in stock. By reducing overstock, you lower carrying costs like storage, insurance, and potential obsolescence. At the same time, you prevent stockouts that lead to lost sales and dissatisfied customers. This balance directly converts slow-moving goods back into cash.

Legendary examples include Toyota's Just-In-Time (JIT) system, which minimizes inventory by receiving goods only as needed for production. Similarly, Dell’s build-to-order model eliminates finished goods inventory entirely, building computers only after a customer places an order. These strategies are cornerstones of efficient capital management and are key ways to improve cash flow in product-based businesses.

Actionable Tips for Implementation

- Implement ABC Analysis: Categorize your inventory into A, B, and C groups. Focus your management efforts on the high-value "A" items that represent the bulk of your inventory costs.

- Use Inventory Management Software: Adopt tools like Oracle NetSuite or Fishbowl Inventory for real-time tracking, demand forecasting, and automated reorder point calculations.

- Establish Strong Supplier Relationships: Work with reliable suppliers who can offer shorter lead times and smaller, more frequent deliveries. This reduces the need to hold large amounts of safety stock.

- Consider Consignment Arrangements: Negotiate with suppliers to hold their inventory in your store or warehouse, only paying for it once it sells. This transfers the carrying cost back to the supplier and dramatically improves your cash position.

3. Accelerated Depreciation

Instead of spreading the cost of an asset evenly over its useful life, accelerated depreciation allows you to take larger tax deductions in the early years of ownership. This accounting method is one of the most strategic ways to improve cash flow by significantly lowering your immediate tax liability. By reducing your taxable income now, you keep more cash in the business for operations, investment, or debt reduction.

How Accelerated Depreciation Works

This strategy front-loads the depreciation expense of a fixed asset. For instance, under Section 179 of the IRS tax code, businesses can often deduct the full purchase price of qualifying equipment and software in the year it is placed into service. Similarly, bonus depreciation allows for an additional first-year deduction. This differs from straight-line depreciation, where the deduction is the same each year.

The primary benefit is a direct, immediate cash flow boost from tax savings. A manufacturing company purchasing $500,000 in new machinery could potentially deduct the entire amount in the first year, drastically cutting its tax bill. This frees up capital that would have otherwise been paid in taxes, allowing it to be reinvested into the business right away.

Actionable Tips for Implementation

- Consult a Tax Professional: Tax laws surrounding depreciation are complex. Work with a CPA to ensure you are maximizing deductions under provisions like Section 179 and bonus depreciation while maintaining full compliance.

- Time Your Asset Purchases: Strategically plan major equipment or vehicle purchases toward the end of your fiscal year. Placing an asset in service before the year closes allows you to claim the deduction for that entire tax year.

- Keep Meticulous Records: The IRS requires detailed records for all depreciated assets. Document the purchase date, cost, date placed in service, and the depreciation method used for each asset to substantiate your deductions.

- Analyze Long-Term Impact: While it boosts short-term cash flow, accelerated depreciation results in smaller deductions in later years. Model the multi-year impact to ensure the strategy aligns with your long-term financial forecasts.

4. Payment Terms Optimization

Optimizing your payment terms is one of the most fundamental ways to improve cash flow, as it directly manipulates the timing of money entering and leaving your business. This strategy involves shortening your accounts receivable cycle while extending your accounts payable cycle, creating a positive gap that keeps more cash in your company for longer. It's about getting paid faster by customers and paying suppliers slower, all within the bounds of good business relationships.

How Payment Terms Optimization Works

The core goal is to reduce your cash conversion cycle. You achieve this by setting customer payment terms that encourage prompt payment (e.g., Net 15 or Net 30) while negotiating longer terms with your vendors (e.g., Net 60 or Net 90). This deliberate timing difference ensures your customer payments arrive well before your own bills are due, freeing up capital for operations, growth, and unexpected expenses.

For instance, a consulting firm might require a 50% upfront deposit before starting a project, immediately covering initial labor costs. Similarly, a SaaS company can offer a 10-15% discount for annual subscriptions, securing a full year's revenue upfront and dramatically improving its cash position. This proactive management of payment schedules is a powerful, low-cost lever for financial stability.

Actionable Tips for Implementation

- Offer Early Payment Discounts: Incentivize customers to pay sooner by offering a small discount, such as a "2/10, net 30" term, which gives a 2% discount if paid in 10 days.

- Implement Late Payment Penalties: Clearly state in your contracts that late payments will incur a fee, typically 1.5% per month. This discourages delays and compensates you for carrying the debt.

- Negotiate with Suppliers: Regularly review terms with your vendors. As your business grows and your order volume increases, you gain leverage to ask for extended payment periods like Net 60 or Net 90.

- Automate Your Invoicing: Use accounting software to send automated payment reminders before, on, and after the due date. This reduces manual effort and minimizes the chance of invoices being overlooked.

5. Revenue Diversification

Relying on a single product or customer segment can expose your business to significant cash flow volatility. Revenue diversification is a strategic approach to building resilience by creating multiple income streams. This proactive measure reduces dependency on any one source, smoothing out revenue fluctuations and establishing a more predictable, stable cash flow that can weather market shifts or seasonal downturns.

How Revenue Diversification Works

Diversification involves expanding your offerings or entering new markets to generate additional income. This can range from adding complementary services to your core product to developing entirely new lines of business. A key goal is often to create recurring revenue models, which provide consistent, predictable monthly cash flow and are one of the most effective ways to improve cash flow.

A powerful example is Adobe's transition from selling one-time software licenses to its subscription-based Creative Cloud. This move created a steady, recurring revenue stream, transforming its cash flow predictability. Similarly, a local gym can diversify by adding personal training packages, nutrition counseling, and supplement sales to its core membership offering. Exploring collaborative growth strategies can also unlock new avenues; you can learn more about how group buying can boost business growth and open up new revenue opportunities.

Actionable Tips for Implementation

- Start with Complementary Services: Identify products or services that naturally fit your existing customer base. This is a low-risk way to test the waters and leverage your current market position.

- Focus on Recurring Revenue: Prioritize subscription models, retainers, or membership programs. Predictable income makes financial forecasting far more accurate and reliable.

- Test with a Minimal Viable Product (MVP): Before investing heavily, launch a basic version of your new offering to gauge customer interest and validate the market.

- Leverage Existing Assets: Use your current skills, technology, and customer relationships as a foundation for new income streams to minimize initial investment and maximize your return.

6. Expense Management and Cost Reduction

While increasing sales is often the primary focus, one of the most powerful ways to improve cash flow is by managing what you spend. Systematic expense management involves analyzing, controlling, and strategically reducing business costs. By optimizing your outflows, you free up capital that can be reinvested into growth, used to build a cash reserve, or allocated to other critical business needs.

How Expense Management Works

This approach goes beyond simple budget cuts; it's about making your spending more efficient and intentional. You start by thoroughly auditing all business expenses to identify non-essential costs, areas of overspending, and opportunities for negotiation. The goal is to retain more of your revenue by eliminating waste and optimizing operational efficiency, directly boosting your net cash flow without needing to generate new sales.

This strategy is universally applicable. For instance, a small tech company might switch from expensive on-premise servers to a scalable cloud-based solution, reducing IT overhead by 40%. Similarly, a large corporation like General Motors implemented a major restructuring that focused on cost efficiency, saving an estimated $6 billion annually and dramatically improving its financial health.

By plugging financial leaks and optimizing every dollar spent, you ensure that your business operates leanly and profitably. To dive deeper into this topic, you can explore these smart tips to reduce business costs and find opportunities within your own operations.

Actionable Tips for Implementation

- Conduct Regular Expense Audits: Perform a quarterly review of all expenses. Apply the 80/20 principle to identify the top 20% of expenses that account for 80% of your costs and focus your optimization efforts there.

- Negotiate with Suppliers: Don't accept initial pricing as final. Proactively negotiate with vendors for better terms, especially during contract renewals. Inquire about bulk purchasing discounts or longer-term payment schedules.

- Implement Spending Controls: Use software to create expense approval workflows that require manager sign-off for purchases over a certain limit. This prevents unauthorized or unnecessary spending before it happens.

- Outsource Non-Core Functions: Consider outsourcing tasks like IT management, bookkeeping, or human resources. This often converts a fixed cost (like an employee's salary) into a variable cost that is more manageable and scalable.

7. Working Capital Management

Effective working capital management is less of a single tactic and more of a comprehensive strategy to optimize your short-term financial health. It involves the careful administration of current assets (like cash, accounts receivable, and inventory) and current liabilities (like accounts payable) to ensure your business runs efficiently. By fine-tuning these components, you can shorten your cash conversion cycle and unlock one of the most sustainable ways to improve cash flow.

How Working Capital Management Works

The goal is to maintain a smooth operational flow without tying up excess capital in unproductive assets. This means collecting from customers quickly, managing inventory levels to avoid overstocking, and strategically paying suppliers. A well-managed working capital system ensures you have enough liquidity for daily expenses, such as payroll and rent, while minimizing the costs associated with holding inventory or extending generous credit terms.

This strategic balance is a hallmark of highly efficient companies. For instance, Apple is famous for its negative cash conversion cycle, meaning it collects cash from customers before it has to pay its suppliers, effectively generating free cash flow to fund operations. Similarly, Procter & Gamble uses supplier financing programs to extend its payment terms, improving its own cash position while offering its suppliers early payment options through a third-party financer.

Actionable Tips for Implementation

- Monitor Your Cash Conversion Cycle (CCC): Calculate your CCC (Days Inventory Outstanding + Days Sales Outstanding - Days Payable Outstanding) monthly. A lower or negative number is ideal, indicating you are converting assets into cash quickly.

- Implement Strict Credit Policies: Establish clear credit terms and vetting processes for new customers to reduce the risk of late or non-payment. Consistently enforce late fees to encourage timely payments.

- Use Rolling Cash Flow Forecasts: Implement a 13-week rolling cash flow forecast to gain a clear, near-term view of your liquidity. This allows you to anticipate shortfalls and surpluses, enabling proactive financial decisions.

- Establish a Credit Line Proactively: Secure a business line of credit before you face a cash crunch. Having this safety net available provides flexibility to cover unexpected expenses or bridge short-term cash gaps without disrupting operations.

8. Cash Flow Forecasting and Planning

Operating a business without a clear view of future finances is like navigating without a map. Cash flow forecasting provides that map by projecting your future cash inflows and outflows. This proactive approach helps you anticipate liquidity needs, identify potential shortfalls before they become critical, and make informed strategic decisions to maintain healthy operations.

How Cash Flow Forecasting Works

Forecasting involves creating a detailed model of your expected cash movements over a specific period, often a rolling 13-week forecast updated weekly. You'll analyze historical data, sales pipelines, and anticipated expenses to estimate when cash will enter and leave your business. This process isn't just about avoiding deficits; it's a powerful tool for planning and one of the most fundamental ways to improve cash flow.

This method is crucial for businesses with fluctuating revenue or expenses. For instance, a seasonal retailer can use forecasting to plan for holiday inventory purchases while anticipating a cash dip in the spring. Likewise, a SaaS company can forecast the impact of customer churn on recurring revenue, allowing it to adjust spending or marketing efforts accordingly.

A robust forecast gives you the foresight to manage capital effectively. You can learn more about how forecasting and other cash flow improvement tips can build financial resilience for your business.

Actionable Tips for Implementation

- Implement a Rolling Forecast: Use a 13-week cash flow forecast that you update weekly. This short-term view is agile enough to catch immediate issues while providing a strategic outlook.

- Develop Multiple Scenarios: Don't rely on a single projection. Create optimistic, realistic, and pessimistic scenarios to understand potential outcomes and prepare contingency plans for each.

- Integrate Key Business Data: Your forecast should not exist in a vacuum. Integrate data from your sales pipeline, customer payment histories, and accounts payable schedules to create a more accurate and dynamic model.

- Track Accuracy and Refine: Regularly compare your forecasts against actual results. Analyzing the variances will help you identify flawed assumptions and refine your forecasting model for greater precision over time.

8 Key Cash Flow Improvement Strategies Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Invoice Factoring | Moderate - involves contractual setup and coordination with factoring company | Moderate - requires invoice management and fees | Immediate cash conversion of receivables; improved cash flow predictability | B2B businesses with NET 30-90 payment terms needing urgent cash | Fast access to working capital; reduces bad debt risk; no collateral aside from invoices |

| Inventory Optimization | High - needs forecasting, categorization, and automated systems | High - requires software, data analytics, supplier coordination | Reduced carrying costs and obsolescence; improved turnover | Businesses managing multiple SKUs and wanting to minimize stock and costs | Frees working capital; improves efficiency and cash flow predictability |

| Accelerated Depreciation | Moderate - requires tax knowledge and precise record keeping | Low to Moderate - mostly accounting and tax professional resources | Immediate tax savings; improved cash flow early in asset life | Businesses investing in capital assets seeking tax deferral | Larger early tax deductions; better cash flow timing; beneficial for growth phase |

| Payment Terms Optimization | Moderate - policy updates and customer/supplier negotiation | Low to Moderate - requires system updates and communication | Improved working capital without external financing; better cash flow timing | Businesses with established customer and supplier relationships | Strengthens supplier ties; reduces collection costs; increases forecasting accuracy |

| Revenue Diversification | High - involves new product/service development and market expansion | High - significant investment in R&D, marketing, and management | Reduced revenue volatility; more stable and predictable cash flow | Businesses seeking growth through multiple income streams | Decreases business risk; increases valuation; buffers economic downturns |

| Expense Management and Cost Reduction | Moderate - needs ongoing audits and policy enforcement | Moderate - requires tools and management oversight | Immediate cash flow improvement; reduced costs and risks | Businesses aiming to improve profitability and reduce financial risk | Operational efficiency; competitive advantage; improved budget control |

| Working Capital Management | High - requires integrated financial systems and monitoring | Moderate to High - finance and operational coordination | Enhanced liquidity and operational flexibility | Companies optimizing cash conversion cycle; managing receivables, payables, inventory | Reduces external financing need; improves financial health and crisis readiness |

| Cash Flow Forecasting and Planning | High - needs detailed data, scenario modeling, and regular updates | Moderate - forecasting tools and dedicated team | Reduces cash crises; enables strategic financial decisions | Businesses with fluctuating cash flows and seasonal patterns | Early warning system; improves investor confidence; reduces emergency costs |

From Strategy to Action: Building a Cash-Positive Future

Navigating the complexities of business finance ultimately comes down to one core principle: maintaining a healthy cash flow. Throughout this guide, we've explored eight powerful, actionable strategies designed to move your business from a state of financial reactivity to one of proactive control. From leveraging invoice factoring for immediate liquidity to optimizing inventory and accelerating depreciation, each tactic offers a distinct lever you can pull to enhance your financial stability.

The journey to a cash-positive future is not about implementing every single strategy at once. Instead, it’s about a deliberate, phased approach. The true power lies in understanding that these methods are not isolated fixes but interconnected components of a comprehensive financial ecosystem. Optimizing your payment terms, for instance, directly complements a robust cash flow forecasting plan, while disciplined expense management amplifies the benefits of revenue diversification. The key is to start small, identify the one or two areas that will yield the most significant impact for your specific business model, and build from there.

Your Blueprint for Lasting Financial Health

Mastering these concepts transforms cash flow management from a daunting task into a strategic advantage. It empowers you to seize growth opportunities, weather economic downturns, and make decisions from a position of strength, not desperation. Here are your immediate next steps:

- Conduct a Financial Self-Audit: Review your current processes. Where are the most significant cash leaks or bottlenecks? Is it slow-paying clients, excess inventory, or unmanaged operational costs?

- Prioritize and Implement: Select one strategy from this list that directly addresses your biggest challenge. If slow payments are an issue, focus on optimizing your invoicing and payment terms first. If high overhead is a concern, dive deep into expense management.

- Measure and Adapt: Track your key metrics before and after implementation. Monitor your cash conversion cycle, days sales outstanding (DSO), and operating cash flow. Use this data to refine your approach and inform your next move.

Ultimately, finding effective ways to improve cash flow is an ongoing discipline, not a one-time project. As you implement these foundational changes, you can also explore innovative tools to further reduce costs. For a deeper dive into actionable steps and to build a cash-positive future, discover these 7 proven strategies to improve cash flow for SMEs to gain even more perspective. By consistently applying these principles, you are not just managing money; you are building a resilient, agile, and enduring enterprise poised for sustainable growth.

Ready to tackle your expense management and reduce software costs immediately? With AccountShare, you can securely share access to over 300 essential SaaS tools, from marketing to productivity, at a fraction of the subscription price. Start saving and boost your cash flow today by visiting AccountShare.