Recurring Payment Management With AccountShare

Share

When you run a subscription business, managing recurring payments effectively is everything. It's the lifeblood of your operation—the system that automatically handles billing cycles, secures your revenue stream, and keeps administrative headaches to a minimum. For any company built on subscriptions, getting this right isn't just a nice-to-have; it's fundamental to your survival and growth.

Why Recurring Payment Management Is So Critical

The business world has steadily moved away from one-off sales. Today, the real prize is predictable, recurring revenue. Hitting that goal comes down to one thing: how well you handle your customers' ongoing payments.

This is much more than just firing off an invoice each month. A solid recurring payment system is a strategic tool that directly impacts your company's financial health. It touches everything from your cash flow stability to customer retention rates. If you neglect it, you're opening the door to lost revenue from failed payments and a clunky customer experience that drives people away.

The Hidden Costs of Getting It Wrong

Inefficient payment management creates problems that can quietly cripple a business. Take involuntary churn, for example. This happens when a customer's subscription ends unintentionally because of a payment failure, like an expired credit card. It’s a silent revenue killer that can account for a huge chunk of your churn rate, but it's completely preventable with the right setup.

Then there's the operational drag. Manually tracking who has paid, chasing down failed transactions, and fielding billing questions from customers eats up an incredible amount of time. That administrative quicksand pulls your team away from what they should be doing: making your product better and growing the business.

Key Takeaway: Excellent recurring payment management isn't just back-office admin work. It's a core business strategy that protects your revenue, boosts customer lifetime value, and delivers the predictable cash flow you need to scale.

Riding the Wave of the Subscription Economy

The explosive growth of the subscription economy makes this even more important. The global market for automated recurring billing was valued at around $15 billion in 2025. With a projected compound annual growth rate of 15%, it could hit $45 billion by 2033.

That's not just a statistic; it's a clear signal. The businesses that automate and sharpen their billing processes are the ones that will win a bigger piece of this expanding pie.

This is exactly where AccountShare comes in. It's not just another payment tool; it's designed to help you master the entire subscription lifecycle. By giving you the tools to automate billing, control access, and fight churn, it positions your business to thrive. To get a better sense of this, check out our guide on how to revamp your subscription management workflow. It’s packed with practical steps for building a stronger, more efficient system from the ground up.

Core Pillars of Recurring Payment Management

To truly succeed, you need to address several key challenges head-on. A robust platform should provide clear solutions for each one. Here’s a breakdown of the core pillars and how AccountShare helps you build a solid foundation.

| Core Pillar | Business Challenge | AccountShare Solution |

|---|---|---|

| Automation | Manually invoicing and collecting payments is time-consuming and prone to human error. | Automates the entire billing cycle, from invoicing to payment collection, freeing up your team. |

| Revenue Protection | Failed payments from expired cards or insufficient funds lead to involuntary churn and lost revenue. | Proactively notifies users about payment issues and provides easy ways to update details, reducing churn by up to 30%. |

| Secure Access | Ensuring only paying customers can access services without creating security risks or administrative burdens. | Manages user access automatically based on payment status, revoking access upon cancellation and restoring it upon renewal. |

| Operational Efficiency | Handling billing inquiries, managing subscriptions, and tracking payments manually drains resources. | Provides a centralized dashboard for a clear overview of all subscription activity, simplifying management. |

Ultimately, a strong recurring payment strategy isn't just about collecting money. It’s about creating a seamless experience for your customers and a stable, predictable foundation for your business.

Building Your First Recurring Payment Workflow

Alright, let's move from theory to action and build your first recurring payment workflow in AccountShare. The best way to learn is by doing, so instead of a boring checklist, we'll walk through a real-world example.

Let's imagine a fictional SaaS company called "Pixel Perfect." They sell design software and want to set up a simple two-tier pricing model: a "Basic" plan at $15/month and a "Pro" plan at $45/month.

The very first thing Pixel Perfect needs to do inside AccountShare is define these plans. This means giving each one a name, setting the price, and choosing the billing interval (monthly, in this case). Getting this foundation right is the key to solid recurring payment management.

Once the plans are in place, the next question is how to get people to sign up. Pixel Perfect decides to offer a free trial for their "Pro" plan to showcase its full value. Inside AccountShare, they can easily set up a 14-day trial period. This isn't just a feature; it's a strategic move to let users experience the best of the product, which dramatically increases the odds they'll stick around as paying customers.

Defining Billing Cycles and Payment Logic

Creating the plans is just step one. The real magic happens when you automate the billing logic that drives them. For Pixel Perfect, the "Basic" plan is simple—a straight monthly charge. But for the "Pro" plan, they want to reward customers who commit for a full year.

This is where AccountShare really shines. Pixel Perfect can create an annual billing cycle for the "Pro" plan and price it at $450. This simple tweak gives customers a nice discount (the equivalent of two months free) and provides a powerful incentive to sign up for the long haul. For the business, it means a healthier cash flow and a big boost to customer lifetime value.

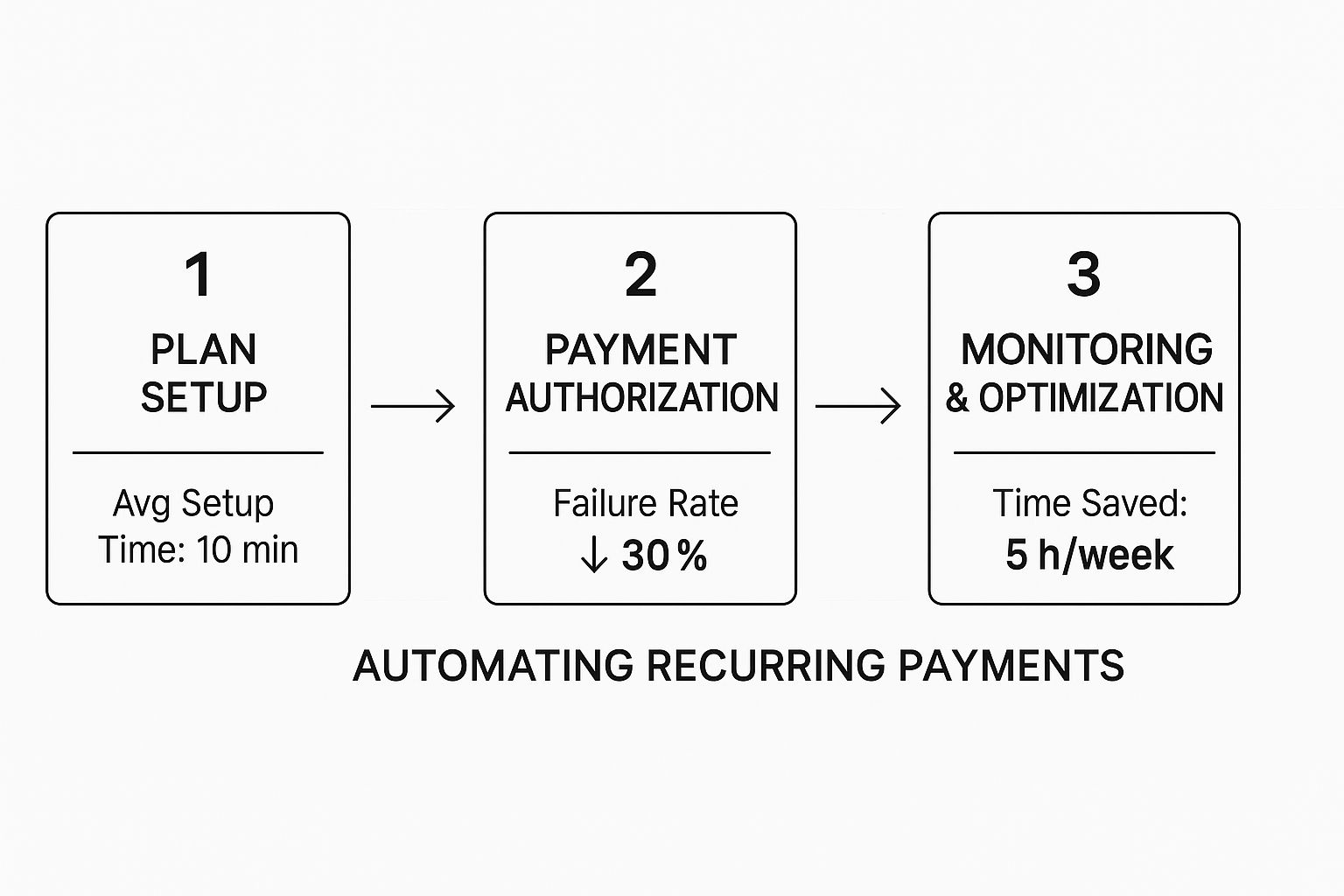

This isn't just about convenience; it's about efficiency. Automating these steps with a platform like AccountShare has a massive impact.

As you can see, automation does more than just cut down on admin hours. It directly impacts your bottom line by reducing the number of failed payments.

Putting It All Together: A Practical Example

So, what does this look like for a new customer? Let's say a designer signs up for the "Pro" trial. The moment they do, AccountShare logs the start date and automatically schedules the first potential payment for 14 days later.

From the customer's perspective, it's seamless. Here’s the automated sequence AccountShare will run behind the scenes:

- Day 12: An automated email goes out, giving the customer a friendly heads-up that their trial is about to end.

- Day 14: The trial expires. The system automatically charges the card on file for the first month of the "Pro" plan.

- Ongoing: The customer is billed on the same day each month, every month, with zero manual effort required from the Pixel Perfect team.

This hands-off approach is the core of what makes recurring payment management so effective. It creates a smooth experience for the customer while ensuring consistent, predictable revenue for your business.

This entire workflow, from the initial trial to the ongoing monthly billing, is completely automated. By thinking through your plans, trials, and billing cycles upfront, you build a revenue engine that runs itself. This frees you up to focus on what really matters—growing your business—knowing your payments are being handled perfectly in the background. With AccountShare, getting this done takes a few minutes, not a few weeks.

Securing Payments and Managing Team Permissions

When you're managing recurring payments, security isn't just another box to check—it's the very foundation of customer trust. You're handling sensitive data month after month, and even a minor slip-up can seriously damage your reputation. This is why the security features and permission controls of your payment platform are non-negotiable.

We built AccountShare with this reality front and center. The system is designed around robust security protocols that protect your business and, just as importantly, your customers. It all starts with strict adherence to Payment Card Industry Data Security Standard (PCI DSS) guidelines. By processing all payments in a PCI-compliant environment, you’re offloading a massive amount of risk and ensuring cardholder data is handled with the highest level of care.

Once you have that secure foundation, you can turn your attention to managing your team’s access. This is your next critical layer of defense.

Putting Role-Based Access Control to Work

In security, there's a golden rule: the principle of least privilege. Simply put, people should only have access to what they absolutely need to do their job, and nothing more. AccountShare brings this principle to life with its role-based access control (RBAC), allowing you to get incredibly specific with permissions for every person on your team.

Forget giving everyone the admin password. You can tailor access to each role's real-world needs. For instance, your marketing specialist might need to view subscription analytics, while your accountant needs to pull financial reports without being able to edit the underlying subscription plans. This separation prevents costly mistakes and limits the potential fallout if a user's account is ever compromised. We cover more on this in our guide to secure shared subscription management.

Here’s a real-world example: Let's say you have a customer support agent named Alex. Alex’s job is to help customers with their billing questions, so he needs to see their subscription history and payment status. But should he be able to issue refunds or change subscription prices? Absolutely not. That’s a risk you don’t need to take.

With AccountShare’s RBAC, you can build a custom "Support Agent" role with permissions set just right:

- View Subscription History: Enabled

- See Payment Status: Enabled

- Issue Refunds: Disabled

- Modify Subscription Plans: Disabled

- Access Company-Wide Financials: Disabled

This setup gives Alex exactly what he needs to be great at his job, all without exposing your business to financial vulnerabilities or data privacy breaches. At the end of the day, smart recurring payment management is all about striking that perfect balance between letting your team work efficiently and maintaining airtight security. By defining clear roles and permissions, you create a more resilient system that protects your revenue, safeguards customer trust, and lets you focus on growth.

How to Stop Failed Payments From Bleeding Your Revenue

Involuntary churn is the silent killer of subscription revenue. These aren't customers who want to leave; they're the ones you lose because a credit card expired or a payment simply didn't go through. It's a frustrating and completely preventable problem, but the good news is you can get ahead of it with the right recurring payment management approach.

AccountShare is built to tackle this head-on. It’s not just another billing system. It uses a smart mix of proactive communication and automated recovery tools to rescue failed payments and keep your customers, well, customers. It all happens in the background, making things seamless for your subscribers and keeping your revenue predictable.

Smart Dunning That Actually Gets a Response

Your first line of defense is dunning management. That’s just a fancy term for how you contact customers about payments. A generic "Your payment failed" email is practically invisible in a crowded inbox. With AccountShare, you can build an automated email sequence that feels personal and helpful, not like a demand from a robot.

Think about it this way: you can set up a workflow to send a friendly heads-up a few days before a customer's card is set to expire. If a payment does fail, the system doesn’t just throw its hands up. It can automatically send a series of messages over several days, each with a simple, one-click link for the customer to update their payment details.

This multi-touch approach makes a huge difference. You're giving the customer multiple, low-friction chances to solve the problem, all without your team having to lift a finger.

Get Ahead with Proactive Card Updates and Intelligent Retries

So many payment failures come from predictable issues, like cards expiring or being replaced. This kind of payment method churn is a constant headache for subscription companies. The best recurring billing platforms fight this with automatic card updates, personalized reminders, and smart retry logic. We're seeing a big shift in how modern systems handle this, adapting to customer behavior to slash churn rates. You can actually discover how modern billing systems adapt to consumer behavior on Rapidcents.com.

AccountShare’s card updater service is a perfect example. It talks directly to card networks like Visa and Mastercard to pull in new card details before the old ones even fail. This one feature can stop a huge chunk of failed payments before they even happen.

But what if a payment fails for another reason, like insufficient funds? That’s where smart retries come in. The system doesn’t just blindly try the charge again and again. It looks at why it failed and retries at the most strategic time.

- Soft Declines (e.g., Insufficient Funds): The system might wait a few days to try again. This gives your customer time to top up their account.

- Hard Declines (e.g., Stolen Card): It stops immediately. This prevents more failed attempts that could get your account flagged for fraud.

Real-World Journey: Let's say a customer's card expires on the 30th. AccountShare’s card updater grabs the new details on the 25th. When their subscription renews on the 1st, the payment sails through on the new card. The customer notices nothing, and you don't miss out on that revenue.

This combination of automated tools is the secret to getting a grip on involuntary churn. It turns what feels like an unavoidable cost of business into a problem you can actively solve, protecting both your customer relationships and your bottom line.

Integrating Diverse Payment Methods For Global Reach

If you want your subscription business to truly grow, you have to think beyond the usual credit card payments. Your customers have their own preferred ways to pay, and if you don't offer them, you're practically turning away business. Effective recurring payment management is all about meeting your audience where they are, using the payment tools they already know and trust.

This isn’t just about slapping a few more logos on your checkout page. It’s a calculated strategy to boost your conversion rates, slash transaction costs, and build a real connection with customers around the world. The good news is, with a platform like AccountShare, weaving these different options into your system is surprisingly straightforward.

The global payment scene is shifting fast. Recurring payments are a massive economic engine, with transaction volumes hitting $13.2 trillion in 2023. That figure is projected to surge past $15.4 trillion by 2027. The real story, though, is how people are paying. Digital wallets and new open banking methods are growing much faster than cards, a trend fueled by both customer convenience and businesses like yours hunting for lower fees. You can see the full research on recurring payment growth on JuniperResearch.com.

Expanding Beyond Credit Cards

Credit cards are still a cornerstone, no doubt. But they come with higher transaction fees and aren't always the go-to payment method in many international markets. That’s where Alternative Payment Methods (APMs) become your secret weapon.

-

Digital Wallets: Think PayPal, Apple Pay, and Google Pay. These offer a lightning-fast, secure checkout that removes the friction of manually typing in card numbers. That one small change can have a huge impact on your conversion rates.

-

Direct Debit: For ongoing subscriptions, direct debit (like ACH in the U.S.) is a game-changer. It boasts much lower transaction fees than cards and, crucially, has a lower failure rate. Bank accounts don't expire or get lost like credit cards do.

Getting these up and running in AccountShare is incredibly simple. From your dashboard, you can just toggle on different payment gateways with a few clicks, instantly broadening the payment choices for your customers.

The Strategic Value Of Alternative Payments

Giving customers more ways to pay does more than just make them happy—it directly pads your bottom line. Those lower transaction fees from methods like direct debit mean more of every dollar earned stays in your pocket.

Key Insight: Adopting a wider range of payment options isn't just a customer convenience—it's a direct cost-saving measure. Over time, shifting even a fraction of your recurring revenue away from high-fee credit cards can lead to substantial savings.

This is especially true if you’re selling internationally. In many parts of Europe and Asia, local payment methods are far more common than Visa or Mastercard. By offering them, you’re no longer just some foreign company; you’re a business that gets it, one that respects local preferences.

Managing Multiple Methods Seamlessly

The obvious challenge with offering more payment options is the headache of managing them all. This is where having a unified platform like AccountShare becomes indispensable. Instead of wrestling with multiple dashboards and trying to reconcile different reports, all your subscription data—no matter the payment source—is centralized in one clean interface.

This unified view lets you:

- Track revenue from all sources in a single dashboard.

- Apply consistent dunning and retry logic across different payment types.

- Give your support team one place to look, so they can help customers no matter how they pay.

By bringing everything under one roof, AccountShare strips away the operational chaos of a multi-payment strategy. And if you're hunting for more ways to trim costs, check out our guide on 10 hacks to save money on subscriptions in 2025.

Answering Your Top Questions About Recurring Payments

Switching to a new system for managing recurring payments always brings up a few key questions. It's about more than just automating billing cycles—you're touching on customer relationships, data security, and how everything connects back to your financial tools. Let's tackle some of the most common concerns we hear from businesses just like yours.

How Do I Handle Chargebacks and Disputes?

Chargebacks are a frustrating reality, but the right system can turn a chaotic scramble into a straightforward process. When a customer files a dispute, you need immediate alerts and a central dashboard to manage your response.

With AccountShare, every dispute is automatically logged right inside the customer's subscription history. This means you instantly have the full picture—every transaction, every communication, and all their usage data—in one place. You can then use this evidence to challenge the dispute directly with the processor, which dramatically improves your win rate. It’s the difference between a frantic search for old emails and having everything you need at your fingertips.

Key Takeaway: A clear, unified record of a customer's payment and service history is your best defense against chargebacks. A platform like AccountShare builds this record for you automatically, so you're always prepared.

Can We Migrate Our Existing Subscribers to AccountShare?

Absolutely. We know how critical it is to move your existing customer base without causing any service disruptions or billing nightmares. The last thing you want is to lose loyal subscribers during a transition.

Our team has this process down to a science. We start by helping you securely export your subscriber data from your old system—focusing on payment tokens, never raw credit card details. From there, we work hand-in-hand with you to import that data, map it to your new subscription plans, and double-check that all future billing dates are set correctly. Our goal is a seamless cutover with zero downtime for your customers.

How Does This Integrate with Our Accounting Software?

Your payment system should make life easier for your finance team, not harder. That’s why a smooth connection to your accounting software, whether it's QuickBooks, Xero, or another platform, is non-negotiable.

AccountShare is built to sync directly with these tools, putting your financial data on autopilot. Here’s what that looks like in practice:

- Automated Reconciliation: Every single payment, refund, and fee is logged in your accounting ledger automatically. This can save your team hours of tedious manual data entry each month.

- Accurate Reporting: Revenue is recognized correctly according to accounting standards, giving you a true picture of your financial health without any gaps or mismatched numbers between systems.

This kind of integration turns your payment platform into a vital part of your financial tech stack, ensuring everything stays consistent and accurate.

Ready to take control of your subscription revenue and get rid of the administrative headaches for good? With AccountShare, you can automate billing, reduce churn, and securely manage customer payments all in one place. Discover how AccountShare can streamline your business today.