Financial Planning for Students A Realistic Guide

Share

Let's be real—managing your money in college is a juggling act. Between tuition, books, rent, and trying to have some kind of social life, it's easy to feel like your bank account is constantly running on empty. This is where financial planning comes in, and it’s not as scary or restrictive as it sounds.

Think of it less as a chore and more as a roadmap. It’s about learning how to manage your cash so you can cover your essentials, handle surprises, and still say "yes" to the things that make college memorable.

Why Financial Planning Is Your Most Important Subject

Most of us think of financial planning as a set of rules meant to suck all the fun out of life. But that’s a huge misconception. Good money management isn't about deprivation; it's about giving yourself freedom and options.

This guide is designed to give you that roadmap. It's the difference between panicking when your car needs a new tire and knowing you've got it covered. It's the confidence to join your friends on that spring break trip instead of just watching their stories on Instagram. You're in the driver's seat.

Building a Foundation for Life

Learning to handle your money now is one of the single most valuable skills you’ll ever acquire. The habits you form in college—tracking your spending, putting a little aside each month, being smart about debt—don't just vanish when you get your diploma. They stick with you, forming the bedrock of your financial health for decades.

The scary part? Most people are thrown into the deep end without a life jacket. A staggering gap in financial literacy means that roughly 9 out of 10 adults finish their education feeling completely unprepared to manage their own finances. That stat alone shows why you have to take charge of this yourself. If you're curious, you can explore more financial literacy statistics to see just how widespread the problem is.

The Core Components of Your Financial Plan

So, where do you start? A solid financial plan isn’t overly complicated. It really comes down to mastering four key areas that all work together to keep you on track.

I like to think of these as the four essential pillars of financial wellness for any student. Getting a handle on these will put you miles ahead of your peers.

The Four Pillars of Student Financial Wellness

| Pillar | What It Means | Why It Matters for Students |

|---|---|---|

| Budgeting | Your game plan for your money. You're telling every dollar where to go, instead of wondering where it went. | It ensures your rent gets paid, you have food in the fridge, and you know exactly how much you have left for fun. No more guesswork. |

| Saving | Setting money aside for emergencies and future goals. This is your financial safety net and your goal-achieving fund. | An unexpected expense won't derail your entire semester. It’s also how you’ll save for a new laptop, a car, or your first apartment deposit. |

| Debt Management | Understanding your loans and credit cards and having a smart strategy to pay them off. | This helps you minimize interest, build a strong credit score, and avoid the crushing weight of debt after graduation. |

| Smart Spending | Actively looking for ways to cut costs without downgrading your life. Think student discounts, shared subscriptions, and thrifting. | It frees up cash that you can put toward savings or paying down debt faster, accelerating your financial progress. |

Getting these four pillars in place is the goal. Thankfully, you don't have to figure it all out alone. The Consumer Finance Protection Bureau offers excellent resources designed specifically to help students and young adults build these exact skills.

Resources like this are invaluable. They take the abstract concepts of finance and turn them into concrete, practical steps you can start taking today. By digging into them, you’re not just learning—you’re actively building a more secure future for yourself.

Mastering Your Money with a Flexible Student Budget

Let's be honest, most budgeting advice feels like it was written for someone with a stable 9-to-5 job, not a student juggling classes, a part-time gig with unpredictable hours, and an actual social life. Rigid spreadsheets and complicated apps often just don't work. The real key to successful financial planning for students isn't about cramming your life into a strict budget; it’s about building a budget that actually flexes with your life.

Think of it this way: you're building a sustainable habit, a tool that gives you financial freedom, not a restrictive chore. A good budget should empower you to make guilt-free choices, whether that's ordering pizza during a late-night study session or knowing you can actually afford that surprise textbook your professor just assigned.

Adapting Classic Budgeting for Student Life

You don't need to invent a whole new system from scratch. The best approach is to take proven methods and simply adapt them to the realities of being a student.

A popular framework you've probably heard of is the 50/30/20 rule. The classic breakdown of your after-tax income looks like this:

- 50% for Needs: The absolute essentials. Think rent, utilities, groceries, and transportation.

- 30% for Wants: Everything that makes life fun but isn't strictly necessary—streaming services, going out with friends, new clothes, or concert tickets.

- 20% for Savings & Debt Repayment: This is for building an emergency fund, saving for a goal, or paying down student loans and credit cards.

But here’s the problem: a student’s income can swing wildly from one month to the next. The fix is simple. Instead of thinking in fixed dollar amounts, think in percentages. If you earn $800 one month and $1,200 the next, your spending targets adjust automatically. This keeps your financial priorities straight even when your paycheck isn't consistent.

Key Takeaway: Flexibility is your greatest asset. A budget that can't handle a slow week at work or an unexpected expense is a budget that's destined to fail. The goal is progress, not perfection.

Finding the Right Tools to Track Spending

A budget is only as good as the information you feed it. To really get a grip on where your money is going, you have to track it. This doesn't mean you need to hoard every paper receipt in a shoebox.

Modern tools make this almost painless. There are simple apps that link directly to your bank account and categorize your spending for you, giving you a clear picture of your habits at a glance. For an even deeper look, an AI Bank Statement Analyzer can help automate the analysis and pull out key insights.

When you see that you spent $150 on coffee last month, you’re empowered to make a conscious decision. Maybe that's totally worth it for you. Or maybe you'd rather see that cash go toward a weekend trip. Our guide on how to https://accountshare.ai/blogs/new/track-spending offers some great tips and app recommendations to get you started.

Putting Your Flexible Budget into Action

Let’s look at a real-world example. Meet Alex, a student working about 15 hours a week at the campus coffee shop.

- The Situation: Alex’s friends text about a last-minute concert this weekend. Tickets are $75.

- The Old Way (No Budget): Alex feels a jolt of stress. They check their bank account, see the balance is low, and either say no with a pang of regret or say yes and spend the next week worrying about rent.

- The New Way (Flexible Budget): Alex opens their budgeting app. They see they have $100 left in their "Wants" category for the month. They confidently buy the ticket, knowing their essentials are covered and their savings goal is still on track.

This is the real power of a budget that works for you. It takes the anxiety and guesswork out of financial decisions, giving you the confidence to live your life. You're building a system that puts you in control of every dollar you earn.

Building Your Savings for Future Freedom

Let's be real: saving money as a student can feel like a total myth. Between tuition, rent, and just trying to have a social life, the idea of stashing cash away can seem impossible. But saving isn't just about hoarding money—it’s about creating options for your future and building a buffer for when life inevitably throws you a curveball.

That savings account is your key to unlocking future goals. Think of it less as a number on a screen and more as the security deposit on your first apartment, the emergency fund for a flat tire, or simply the peace of mind knowing you have a financial cushion.

Why Your Savings Account Matters

First things first: you need a dedicated place for your savings, completely separate from the checking account you use for daily spending. But not all savings accounts are created equal. A lot of traditional bank accounts offer an interest rate so low, it might as well be zero.

This is where a high-yield savings account (HYSA) changes the game. These accounts, mostly offered by online banks, can give you an interest rate that's dramatically higher than what you’d get at a big-name brick-and-mortar bank. This means your money isn't just sitting there; it's actively growing and working for you, even while you sleep. It’s like getting free money on the money you've already worked hard to save.

Key Insight: The real magic behind a high-yield account is compounding. Over time, even a seemingly small difference in the annual percentage yield (APY) can add up to a serious amount of cash, getting you to your goals faster without any extra effort.

It's also surprising how many people miss out on powerful, tax-advantaged savings options. For example, in the United States, only about 37% of families use 529 education plans. This leaves a staggering $1.5 trillion sitting in accounts that aren't growing nearly as effectively as they could be.

Making Savings Effortless and Automatic

The secret to actually saving money consistently? Make it automatic. If you rely on willpower alone, you’re setting yourself up to fail. You need to build a system that does the saving for you.

Here are a few strategies that genuinely work:

- Pay Yourself First: This is the golden rule for a reason. Before you pay a single bill or buy a coffee, set up an automatic transfer from your checking to your savings account for the day you get paid. Even $20 per paycheck will add up faster than you think.

- Use Round-Up Apps: There are a bunch of apps that connect to your bank account and automatically round up your purchases to the nearest dollar. That coffee you bought for $3.50? The app will move that extra 50 cents into your savings or investment account. It's painless.

- Set Specific, Achievable Goals: Vague goals like "save more money" don't work. Get specific. Aim to save $500 for an emergency fund or $1,000 for a new laptop. Having a real target in mind makes it much easier to stay motivated.

These small, steady actions are what build real financial stability over time. If you want to dive deeper into more specific tactics, check out our guide on https://accountshare.ai/blogs/new/how-to-save-money-each-month. The idea is to make saving a background habit, not a monthly chore.

Once you’ve got a handle on saving, the next step is learning how to make your money grow. For anyone ready to move beyond just saving, here’s a complete guide on how to start investing. Building these solid saving habits now will make that transition so much smoother. Your future self will thank you.

Navigating Student Loans and Credit Cards

Let's be honest: for most students, "debt" is a scary word. But it doesn't have to be. Think of things like student loans and credit cards as tools. Used correctly, they can help you build the future you want. Used carelessly, they can dig a hole that’s tough to climb out of. The whole point of financial planning for students is to learn how to use these tools to your advantage.

This isn’t about trying to avoid debt at all costs—for most of us, that's just not realistic. It’s about being strategic. A student loan makes your degree possible, and a credit card can be your best friend for building a strong credit score early on.

Understanding Your Student Loans

Not all loans are the same, and the differences are huge. You'll generally run into two types: federal and private.

- Federal Loans: These come straight from the government. They’re the good guys, offering borrower protections like fixed interest rates, repayment plans tied to your income, and even loan forgiveness programs. Plus, they usually don't require a credit check.

- Private Loans: These are offered by banks, credit unions, and other lenders. They're a different beast entirely. Interest rates can be variable (meaning they can go up), you'll need a solid credit history (or a cosigner), and you won't get the same flexible repayment options.

My advice? Always max out your federal loan options first. They're your safest bet. And remember to borrow only what you truly need for tuition, books, and essential living costs. It’s tempting to accept the full amount offered, but that extra cash isn't free money.

Pro Tip: If you have subsidized federal loans, the government covers the interest while you're in school. With unsubsidized loans, that interest starts piling up from day one. If you can swing it, try making small payments just to cover the interest while you're studying. You'd be amazed how much that can save you down the road.

This isn't just a personal issue; it's a global one. Projections show that in 2025, a staggering 9 million borrowers worldwide could default on their loans. This "student debt tsunami" has massive implications for individual lives and the economy as a whole.

Using Credit Cards to Build Your Future

It’s easy to see credit cards as a trap waiting to spring. But when you know how to use them, they are one of the most powerful tools for building a solid credit history. A good credit score is like a golden ticket—it unlocks better interest rates on car loans, mortgages, and more. It’s the number that tells lenders you're a responsible borrower.

Here’s the game plan: get a student credit card, use it for small, predictable purchases (like your Netflix subscription or a tank of gas), and then—this is the most important part—pay the entire balance off every single month.

Never, ever carry a balance if you can help it. Credit card interest rates are notoriously high, and they can turn a tiny purchase into a huge, lingering debt. Your credit card is for building credit, not for buying things you can’t actually afford.

Common Mistakes to Avoid

Managing debt is just as much about dodging pitfalls as it is about making smart moves. I’ve seen these three mistakes trip up students time and time again:

- Ignoring Your Grace Period: After you graduate, federal loans usually give you a six-month grace period before payments kick in. This isn't a vacation. Use this time to figure out your budget and choose the best repayment plan for your situation. Don't wait until the bill is due.

- Missing Payments: Even one late payment can ding your credit score. The easiest fix is to set up automatic payments for at least the minimum amount due. This ensures you’re never late on either your credit card or your loans.

- Maxing Out Your Credit Card: Lenders look at your "credit utilization ratio"—how much of your available credit you're using. If you're constantly close to your limit, it's a major red flag. A good rule of thumb is to keep your balance below 30% of your total credit limit.

Getting a handle on your loans and credit is a core part of your financial education. If you're already feeling the weight of educational debt, look into specific resources designed to help, like exploring grants to pay off student loans. The habits you build now will set the foundation for the rest of your financial life.

Creative Ways to Reduce Student Expenses

A solid budget and savings plan are your financial foundation, but aggressively cutting expenses is what will really move the needle. Good financial planning for students isn't just about spreadsheets and tracking where your money went—it's about making every dollar you have work harder for you.

Forget the tired advice to just "stop buying lattes." Let's get into some real, modern strategies that can free up significant cash without making you feel like you're missing out on the college experience. This is all about being smarter with your spending, not depriving yourself.

Master the Art of Shared Subscriptions

We live in a subscription world. From your favorite shows on Netflix to the music you stream on Spotify, those small monthly charges can sneak up on you and become a massive drain on your bank account.

The solution is surprisingly simple: team up.

Almost every major service—streaming, music, software, you name it—offers a "Family" or "Group" plan that crushes the per-person cost. For students, this is a total game-changer. Just grab a few trusted friends or roommates and get organized.

- Streaming Services: A standard Netflix plan might cost you $15-$20 a month. A family plan lets multiple people watch at once for just a few dollars more, easily cutting your personal cost in half.

- Music: Why pay $11 per month for an individual Spotify account? The family plan is around $17 a month and covers up to six people. Do the math—your share drops to less than $3.

- Software: Need expensive tools like Adobe Creative Cloud or Microsoft 365? Student discounts are great, but sometimes a shared family plan is an even better deal if you can get a group together.

The key is to keep it organized. Have one person manage the account and use a simple app like Splitwise to track payments. It keeps things fair and avoids those awkward "hey, you owe me money" conversations. If you're looking for the best deals out there, our guide on student discount streaming services is a great place to start.

Cost Savings Comparison Group vs Individual Subscriptions

Let's look at the real numbers. Teaming up on subscriptions isn't just about saving a few bucks here and there; the annual savings are genuinely significant when you add them all up.

| Service | Typical Individual Cost (Annual) | Typical Family/Group Cost (Per Person, Annual) | Potential Annual Savings |

|---|---|---|---|

| Netflix Premium | $276 | $69 (with 4 people) | $207 |

| Spotify Premium | $132 | $34 (with 6 people) | $98 |

| Microsoft 365 | $70 | $17 (with 6 people) | $53 |

| YouTube Premium | $168 | $46 (with 6 people) | $122 |

As you can see, making this one simple switch across a few common services can easily put hundreds of dollars back into your pocket each year. That's money that can go toward savings, paying down debt, or just giving you some much-needed breathing room in your budget.

Hunt Down Every Possible Discount

Your student ID is basically a financial superpower. You just have to learn how to use it.

So many businesses offer student discounts but don't shout it from the rooftops. You have to be proactive and ask. Beyond your local pizza place, check out platforms like UNiDAYS and Student Beans, which are treasure troves of deals on everything from new laptops to clothes and travel.

Make it a reflex. Before you buy anything online, get in the habit of opening a new tab and searching for "[Brand Name] + student discount."

My Takeaway: Never assume the sticker price is the final price. A five-second search before you hit "checkout" can often save you an instant 10-15%. That's free money for almost zero effort.

Rethink Your Textbook Strategy

Paying full price for brand-new textbooks should be your absolute last resort. Seriously. The cost of required course materials can be a shocking blow to any student budget, but you have so many better, cheaper options.

- Rent, Don't Buy: Why own a book you'll only use for four months? Services like Chegg and Amazon Textbook Rental let you rent for the semester at a fraction of the cost.

- Go Digital: E-books are almost always cheaper, lighter, and searchable. It's a win-win-win.

- Buy Used: Check your campus bookstore, online marketplaces, or even ask upperclassmen in your major. Just double-check that you're getting the right edition.

- Hit the Library: Your university library probably has copies of required textbooks on reserve. It’s completely free!

This matters more than you think. The amount of debt students take on is staggering, and every dollar you save on things like overpriced textbooks is a dollar you won't have to pay back later with interest.

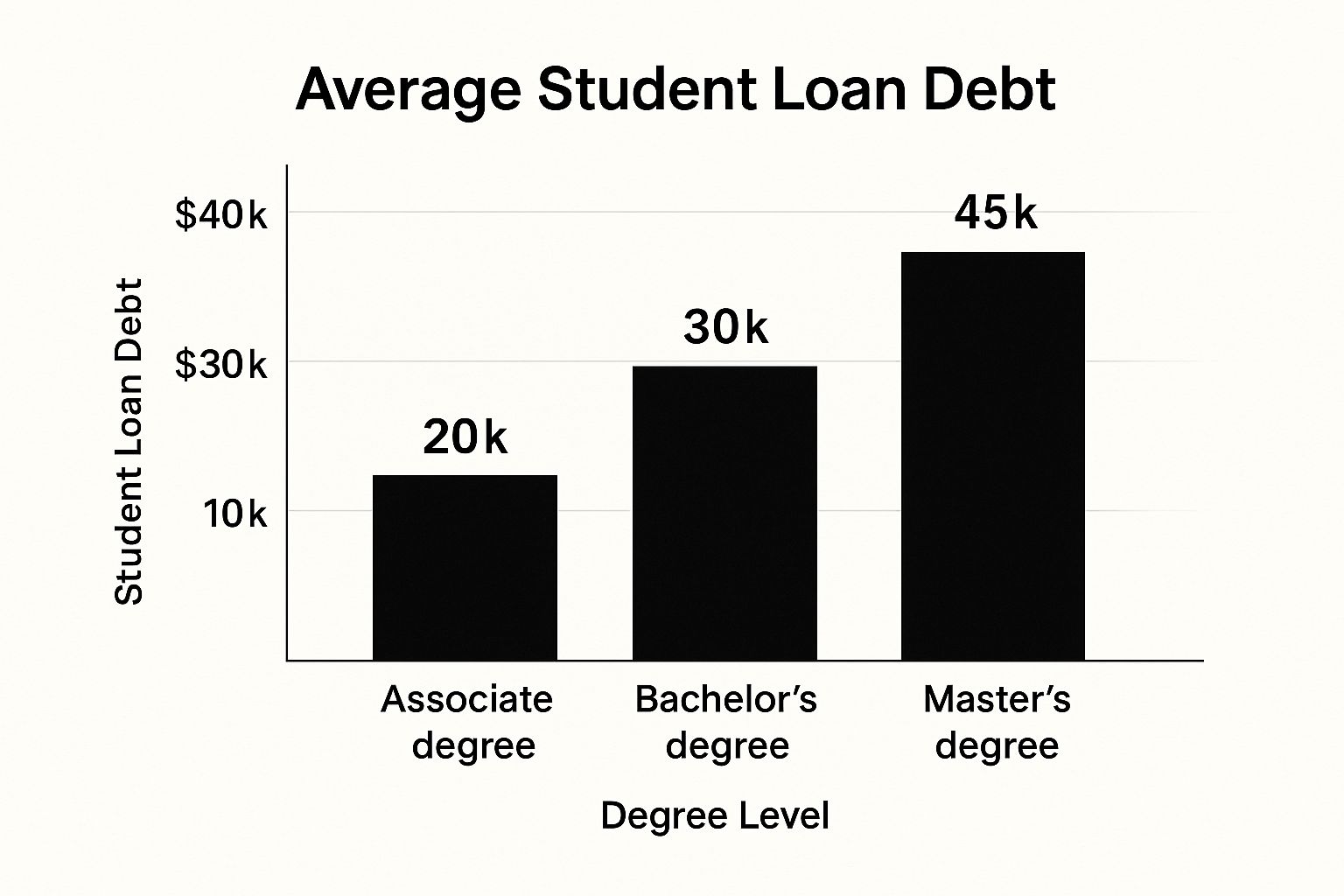

As you can see, the debt burden gets heavier with each degree. Building smart spending habits now is one of the best ways to keep that number as low as possible.

Embrace Strategic Meal Prep

Finally, let's talk about food. This is often the biggest budget-buster for students. Delivery apps, daily coffee runs, and eating out with friends add up incredibly fast.

The answer is meal prepping, but it doesn't have to mean eating boring chicken and broccoli all week.

Start small. Instead of trying to plan seven days of meals, just cook a big batch of something versatile on Sunday—think grilled chicken, roasted vegetables, or a pot of quinoa. You can use these as building blocks for quick and different meals all week, like salads, wraps, or grain bowls.

This simple habit saves a ton of money and, just as importantly, time. It makes it so much easier to resist the temptation to order expensive takeout after a long day of classes.

Your Financial Future Starts Now

Look, nobody expects you to become a financial wizard overnight. Getting your money in order isn't about some dramatic, life-altering overhaul. Honestly, that approach usually fails. The real goal is much simpler and way more achievable: just start. Think of it as a journey, not a race. It's all about making small, smart moves consistently.

We've covered a lot of ground here. You've got a solid roadmap for creating a budget that actually works for a student's unpredictable life, a game plan for making saving feel effortless, and a strategy for handling debt without the stress. We even looked at how to cut your costs by being clever with your spending, not by giving up everything you enjoy.

The Power of Taking That First Step

The most critical thing you can do is to pick one—just one—small thing and do it this week. Don't let yourself get overwhelmed by trying to fix everything at once. That's a recipe for burnout.

Instead, try one of these:

- Hop into your banking app and set up a recurring transfer. Even $10 from your checking to your savings is a massive win.

- Download a budgeting app like YNAB and just connect your accounts. Don't even analyze the numbers yet. The goal is just to get it running.

- Shoot a text to a friend and ask, "Hey, want to split the cost of Netflix?"

It's these tiny actions that build momentum. They're proof that you're in control, and that confidence is what fuels you to take on the bigger stuff later.

The secret to getting ahead is getting started. Don't wait for the "perfect" time, because it doesn't exist. The best time to start taking control of your financial future was yesterday. The second-best time is right now.

And please, celebrate your wins. Stuck to your budget for a whole week? That’s awesome. Actually set up that automatic savings transfer? Give yourself a pat on the back. Acknowledging these small victories helps lock in the good habits that will serve you long after you've graduated. You have the tools and a clear path for solid financial planning for students. Now it's your turn to take the wheel and build the future you want, one smart decision at a time.

Burning Questions About Student Finances

It's one thing to have a financial plan, but it's another to handle the weird money situations that pop up in real life. Let's be honest, standard financial advice doesn't always work when you're a student.

This is your go-to spot for those specific questions. I’ll give you straight, no-fluff answers to help you navigate those tricky financial moments you’re probably facing right now.

What's a Realistic Emergency Fund for a Student?

Forget the old "three to six months of expenses" rule. For most students, that’s just not happening, and thinking about it can feel defeating. Instead, aim for a much more achievable goal: a $500 to $1,000 "mini" emergency fund.

This isn't meant to cover a job loss, but it's the perfect amount to stop a small hiccup from turning into a full-blown crisis. Think of what it could cover:

- That surprise car repair you didn't see coming.

- A last-minute textbook that costs a fortune.

- An unexpected medical bill or co-pay.

- Replacing your laptop right before finals week.

Focus on hitting this smaller target first. It gives you a crucial buffer and a huge sense of relief. Once you have that safety net in place, you can always aim higher as your income grows.

Should I Get a Credit Card in College?

Absolutely, as long as you treat it like a tool for your future, not a source of free money. Using a student credit card responsibly is one of the smartest things you can do to build a solid credit history. A good credit score will be your best friend later when you're applying for an apartment or a car loan.

Here’s the simple game plan to make it work for you:

- Pick a small, regular purchase you already budget for—like your Spotify or Netflix subscription—and put it on the card.

- Set up automatic payments to pay the entire balance off every single month.

- That's it. Never, ever carry a balance.

Here's the key: The whole point is to show you're reliable. Paying on time, every time, proves you can handle credit responsibly. That’s literally what your credit score measures.

How Can I Possibly Budget With an Irregular Income?

Budgeting with a fluctuating income from side gigs or a part-time job feels chaotic, but there’s a way to manage it. Ditch the traditional fixed budget and create a "bare-bones" budget instead. This budget only includes your absolute must-pays: rent, basic groceries, utilities, and transportation to class or work.

Figure out that essential number. Then, any money you make on top of that gets a specific job. A great approach is to first send any extra cash to your emergency fund. After that, put some toward your other savings goals. Whatever is left over is for your "wants."

This method ensures your core needs are always covered, bringing a sense of stability even when your income is all over the place. It's a flexible system built for the reality of student life.

Ready to slash your monthly bills without giving up the services you love? At AccountShare, we help you team up on group subscriptions, saving you hundreds every year. Stop overpaying and check out how to start saving at AccountShare.